Albert_8

Daily trend-line broken as looking at H4 will see more detail, second waive rally finish correction, looking for 3rd waive rally potential in trade waiting the engine restarting. 1,3 was higher high 2,4 was higher low RRR 3:1 was a good trade to participate for short term trading. For fundamental investor here also a good level to initiate position for...

Daily downtrend broken,and break last high at 21.245 as reach at weekly demand zone. looking forward to break last supply zone at 23.375-24.80 to next level, pre trade at 20 as waiting pull back correction for next waive rally.

break last supply zone, new demand zone form (22.13) can start accumulate. for aggressive trader can consider a tarde at TP 27.30 ,SL23.

break last high, and 2nd higher high been created, any pull back with no below 0.845 will be a change to add. if break last low (0.845) will not consider long bias.

break last high, higher low form, oil price recover higher trading volume, can chase for momentum if close lower then yesterday candle CUT.

Downtrend broken, break last high (1.080) follow by trying to break 1.405 level in next 3 day. trying to break 1.405 level at 31/3/2020 and 21/4/2020. high potentially to test in next few day, if success will try to test 1.505 level. SL will be 1.20 level and aggressive trader can try if tonight US market is good. else can accumulate at (1.350-1.265) level

Downtrend broken, new demand zone from ,demand in control (long bias) after-retrace break last high(0.955) , 2nd waive complete, looking for 3 waive rally entry point. SL 0.905, below 1.00 still can accumulate and initiate position.

Downtrend broken, new demand zone from ,demand in control (long bias) after-retrace break last high(0.955) , 2nd waive complete, looking for 3 waive rally entry point. SL 0.905, below 1.00 still can accumulate and initiate position.

break last high at 0.760,demand in control look at 1.020 RRR 1.48:1 moderate risk trade

downtrend broken,with no break last high (no strong long bias) after rally pull back with no new low (no strong short bias) ranging at 0.610-0.730 level. (yellow color box) 2 strategic may apply 1) Buy and hold as Sl at 0.560 for value investor 2) limit set up to wait breakout at 0.730

Daily trend line form with to latest various rally, looking for 3rd waive rally. should be pre-trade set up at 2.250 for pull back reentry by 17/4/2020 candle closing with bullish signal. aggressive investor can chaise for TP 2.9 level, moderate investor may waiting at 2.250.

daily trend line broken, and break last supply zone, lower level demand zone form.(long bias)- find opportunity or waiting retrace 1st April second supply zone taking in control with high volume buy rate (high probably washing stage). (short-term short bias)- waiting turning signal follow by 2 week flat price and low volume, 17/4 open high with 3.6X traded...

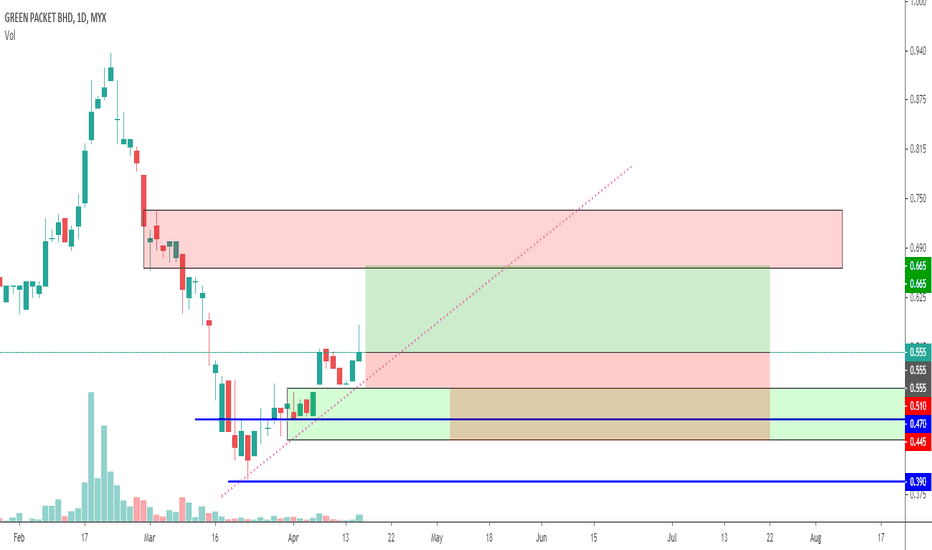

Daily trend line broken,share price traded above last (0.470). Daily demand form and 2 obvious peak was form a up trend-line, 2 trade set up High risk chase for intraday moderate risk can buy stages as no missing chance.

15/4/2020 look good to trade latest daily up trend-line form but last peak was 1.68 and 1.3 still far aware. high potential downside risk, lower base need yet to be build. searching for daily downtrend broken and traded above last peak.

Daily trend line broken,share price traded above last (3.485). Daily demand form and potential pre trade set up possible at 3.60 for swing investor. short-term trade may chase and set cut loss at last lose 3.71.

Daily trend line broken,share price traded at last peak (1.495). 2 obvious rally was form, potential 3rd waive riding opportunity. TP1 2.115 RRR 1.3:1 TP2 2.280 RRR 1.9:1 reasonable risk to take. For fundamental investor here also a good level to initiate position for long-term holding.

lowest had been form higher higher created as RRR 3:1. worth to take risk.