Alex-Whale

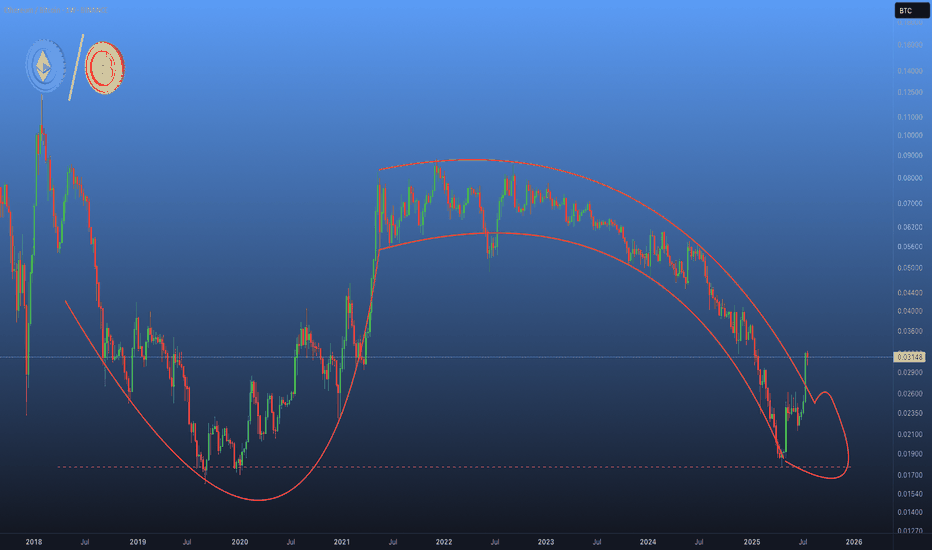

PremiumThe ETH/BTC chart looks like #Ethereum has been suffering from impotence for years… 🍆 But judging by the shape, this breakout isn’t just a Bullish signal — it’s the early sign of a massive altcoin erection. 🚀 ⚠️ Side effects may include: rapid growth and uncontrollable pumps. Keep children and weak hands away from the charts !

🤏 On #Bitcoin’s 3D chart, the Bollinger Bands have tightened to record levels — a signal that historically precedes massive moves. 🚀 📉 Volatility has also dropped to levels not seen since late 2024, right before #BTC launched from $26k to $70k. ✖️ Even John Bollinger himself, the creator of the indicator, hinted in his X post that a powerful impulse might be on...

As expected, after a small pullback from resistance, #Bitcoin is continuing its upward move. 📈 🇺🇸 And if nothing major happens in the next few hours, today we’ll get a very strong #BTC Daily close above the upper boundary of the Bullish Flag, confirming my bullish outlook for a continued rally in July. 🔥 Just a quick update to last Thursday’s post — get ready,...

It's July 1st – the first day of Q3! 🫡 Did you know that even #Bitcoin has seasonality? For example, the most profitable months of the year tend to be in winter. ❄️ 👀 Historically, the strongest rallies have happened in Q4, while Q3 is usually the slowest — it's vacation time, good weather, school holidays, etc. That said, July has historically been the most...

📣 "BiTcOrN dOmInAnCe Es Baut 2 cRaSh" 🤡 Crypto clowns are shouting across all social media platforms, pointing to two bearish signals that have appeared on the BTC.D chart. 😅 What’s funny is that, in their rush to write their “deeeep” analytical posts and copy one another, they don’t even notice that this exact same setup failed just a few months ago. 🔙 🤔 Yes,...

🥶 After a painfully long #altcoins winter, the #ETH/#BTC chart — having recently hit its lowest point in the past 5 years — has finally shown CRYPTOCAP:ETH outperforming CRYPTOCAP:BTC by the end of Q2 2025. We saw a similar scenario in 2021, when that same bottom was reached a bit earlier, followed by a massive altcoin rally in the second half of the year....

✅ M2 (Global Money Supply) – ATH ✅ NASDAQ – ATH ✅ Coinbase – ATH ❌ Bitcoin – still lagging behind 👀🔮 If you want a glimpse into the future — take a closer look at this chart, and you’ll gain more confidence in what’s likely ahead in the coming months. 🚀

After the close of yesterday’s 1D candle, we now have confirmed Bullish signals on the HTF: ✅ RSI breakout ; ✅ Bullish Crossover on the MACD ; ✅ Completed EW(abc) corrections with a sweep of the lows ; ✅ A Bullish Flag pattern has formed ; ✅ And overall, while there’s some easing of tensions in the Middle East, the market might gain some positive momentum after...

🗞 The news backdrop is finally starting to improve. 〰️ After a prolonged #Ethereum accumulation phase, the recent wave of bearish headlines triggered a textbook manipulation move — shaking out weak hands and fueling fear across the market. 🙌🧻 Now, with disbelief and panic dominating sentiment, all signs point to the final stage of the Power of Three framework:...

👀 So far, none of the #Bitcoin - #Gold fractals I’ve shared earlier have failed. 👌 Here’s another high-timeframe comparison that I genuinely believe in. 🐋 Yes, #XAU is gaining momentum as global tensions rise — but that #BTC scenario works just fine for me. 📈 After all, the ~$150K range has been my target for this cycle for the past few years.

Today’s chart compares Total Crypto Market Cap 🆚 USDT Dominance - two metrics with a clear inverse correlation.🪞 🧠 Simple logic: when USDT.D drops, people are buying crypto and moving out of stablecoins. When it rises — capital seeks safety. Since breaking its downtrend in early April, TOTAL shot up and is now consolidating in a bullish pennant — a classic...

🟠 #BTC is like Moses – it always goes first, and the rest simply follow. Due to its significance, Bitcoin attracts the largest investments from the biggest players. That’s why Bitcoin dominance keeps growing for extended periods. 📈 🔴 BTC.D reflects the overall market narrative – from the bottom to the top of Bitcoin’s cycle, its dominance surges. Yes, altcoins...

✋ On its fifth attempt, ETH finally breaks above the 200-day moving average (200SMA) — along with the upper boundary of a Bullish Pennant. 🚩 🔑 This is a key technical signal that could mark the beginning of a new upward move. 📈 In the /BTC pair, the picture is just as bullish: ETH breaks out of a symmetrical triangle, further strengthening its dominance among...

A massive Hidden Bullish Divergence has been spotted on Ethereum’s weekly chart, stretching for nearly two years! 😳 With ETH forming a new Higher High while RSI prints a new Lower Low in deep oversold territory, and ETH/BTC hitting its lowest level in over four years while BTC.D reaches its highest in the same period - this combination could be a highly rewarding...

✅ Looking at the 3D chart, the first positive sign is a slow but steady bounce after closing the CME gap. ✅ BTC is also holding strong above the 200EMA and the key trendline of this cycle. ✅ Oscillators are showing more bullish signs: - MACD is turning around (on the weekly TF, the histogram has shifted from dark to light); - RSI has already broken out, even...

🤡 Despite many laughing at my confidence in altcoins, I’m still holding my bags tightly. And honestly, there hasn’t even been a great opportunity to take profits yet… 😅 But here’s a scenario that I still see as possible and truly believe in. 👀 When Gold corrected for two months after its new ATH in early 2024, was there a single person shouting that it was over...

#Bitcoin 🆚 M2 💸 M2 is the total money supply, including cash, bank deposits, and liquid assets. When M2 rises, more liquidity enters the market, often flowing into risk assets like #BTC and stocks - but with a 2-3 month lag as you can see on the Weekly tf. 👀 🔙 At the end of January, M2 broke its downward structure for the fourth time in this cycle and is rapidly...

📈 Bullish Divergence on the Daily tf, combined with the expected cold CPI today, could give a good impulse (be careful with leverage today!), which I hope will give us a confirmed trend reversal (CHoCH) on Ethereum. 🟢 After that, we just need to wait for a good entry point in the discount zone area, and potentially a 5RR in our pocket. 👀 Plan the trade. Trade the plan.