My XBR/USD (Brent Crude) trade idea is solid, with a strong bearish confluence based on technical indicators. Let's refine it a bit: Trade Breakdown: Bearish Bias: Price rejected the upper trendline of an ascending channel. Indicators Confirming: CCI & %R exiting overbought → Bearish momentum starting. Imbalance below → Potential price correction...

My EUR/USD trade idea is well-structured based on the recent breakout and descending channel formation. Here’s a refined breakdown of the setup: Trade Plan: Entry: Sell only after price consolidates below 1.0834 (to avoid false breakouts). Target (TP): 1.06143 (next major support level). Stop-Loss: Consider placing it around 1.0865 - 1.0880 (above recent...

Here's an analysis of My Bitcoin trade setup: ### 1. *Risk-Reward Ratio* - *Risk: 85,400 - 82,400 = **3,600 points* (3.29% downside). - *Reward*: - Target 1: 91,500 - 86,000 = *5,500 points* (6.3% gain). - Target 2: 95,000 - 86,000 = *9,000 points* (10.42% gain). - *Risk-Reward Ratios*: - Target 1: *1.53:1* (5,500 / 3,600). - Target 2: *2.5:1*...

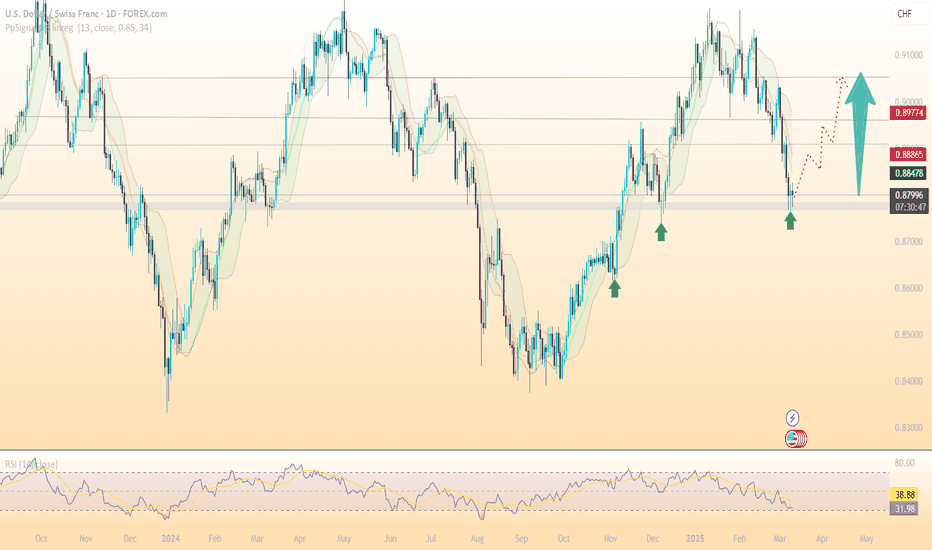

*USDCHF Trade Analysis & Evaluation* *1. Trade Setup Overview:* - *Entry Condition:* Buy signal triggered if USDCHF consolidates above *0.8815* and the 50-period Moving Average (MA50), suggesting a bullish breakout. - *Targets:* - *Target 1:* Likely typo; assumed corrected to *0.8860* (45 pips above entry). - *Target 2:* *0.9145* (330 pips above entry). ...

My GBP/JPY sell zone suggests a bearish outlook with downside targets at 192.480, 191.500, and 190.720, while maintaining a stop loss at 194.600. Key Levels & Analysis: Resistance (Stop Loss): 194.600 – If price breaks above this, the bearish setup is invalidated. Support Levels (Targets): 192.480: First support, minor retracement level. 191.500: Stronger...

My EUR/USD technical analysis suggests a bearish outlook with downside targets at 1.08400, 1.07888, and 1.07500, while maintaining a stop loss at 1.09500. Key Levels & Analysis: Resistance: 1.09500 (stop loss level) Support Levels: 1.08400: Minor support, potential retracement zone 1.07888: Stronger support, aligns with previous price action 1.07500: Major...

MY gold trade setup using the bullish flag pattern suggests: Entry: 3025 Target: 3028 Stop Loss: 3016 Risk-Reward Ratio Analysis Risk: 3025 - 3016 = 90 points Reward: 3048 - 3025 = 300points Risk-Reward Ratio (RRR): 1:0.33 Considerations: The risk-reward ratio is quite low (typically, traders aim for at least 1:2 or 1:3). Bullish flags usually indicate...

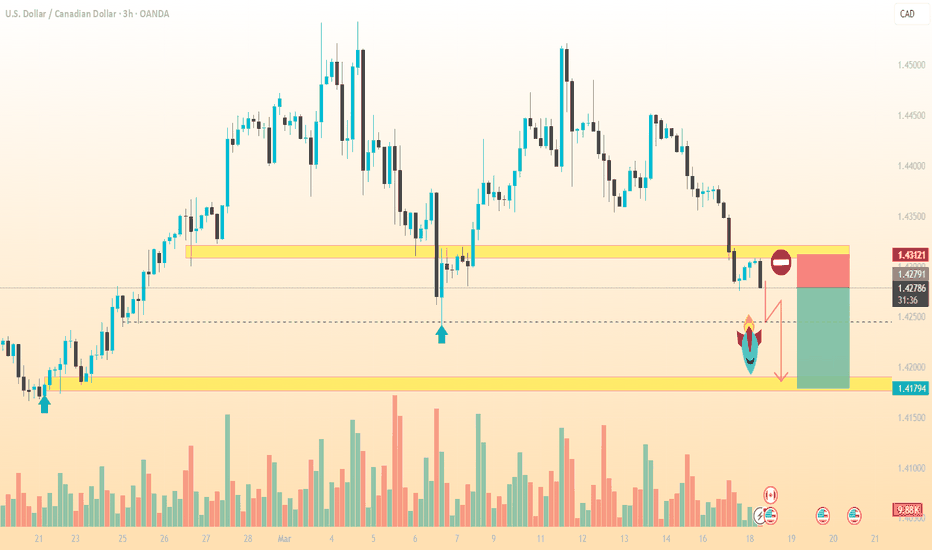

Here’s a structured analysis of the *USDCAD sell trade setup, assuming the entry is near current market levels (e.g., **1.4300–1.4310*). If the entry differs, adjust calculations accordingly: --- ### *Trade Summary* - *Entry: *Not specified (Assumed near *1.4300*) - *Stop Loss (SL): **1.43130* (13 pips risk if entry is 1.4300) - *Targets*: 1. *1.42400*...

Here's a structured analysis of the USD/JPY buy trade setup: ### *Trade Summary* - *Entry*: 149.70 - *Stop Loss (SL)*: 148.00 (170 pips risk) - *Targets*: 1. *151.00* (+130 pips) 2. *152.00* (+230 pips total) 3. *155.00* (+530 pips total) --- ### *Key Analysis* 1. *Risk-Reward Ratios*: - *1st Target*: 0.76:1 (Risk > Reward). - *2nd...

*Gold Trade Plan Analysis & Recommendations* *Entry Point:* 2912 *Stop Loss (SL):* 2894 (180 points risk) *Targets (TP):* 1. TP1: 2920 (+80 points) 2. TP2: 2930 (+180 points) 3. TP3: 2952 (+400 points) --- ### *Key Considerations & Adjustments* 1. *Risk-Reward Ratios:* - *TP1:* 8:18 = *1:2.25* (Low reward for risk). - *Overall Potential...

*Bitcoin (BTCUSD) Trading Signal Analysis & Strategy* *1. Technical Overview:* - *30-Minute Chart:* A potential bullish reversal pattern (e.g., inverse head and shoulders or double bottom) is forming, with price testing the *100-period Moving Average (MA)* resistance. A confirmed break above this MA could signal upward momentum. - *Daily Chart:* *Bullish...

The proposed USDCHF trade idea presents a logical technical setup, but several factors should be considered before confirmation: ### *Technical Rationale* 1. *Bollinger Bands*: The bounce from the lower band suggests potential oversold conditions, but confirmation above 0.8820 (likely a key resistance-turned-support) is critical to validate bullish momentum. 2....

The trade setup me provided contains a contradiction: selling gold at *2913* with a target at *2980* (higher than the entry) conflicts with the bearish (sell) direction. Let’s break this down: --- ### Key Issues to Address: 1. *Third Target (2980)*: This is *67 points above the entry price (2913), which is illogical for a sell trade. This is likely a...

MY analysis presents a well-structured bearish outlook for BTC/USDT. The descending wedge and lower highs signal weakening bullish momentum, and a break below the ascending trendline could lead to further downside pressure. A few key considerations: Support & Demand Zones: If BTC breaks below the trendline, the $80,000 - $81,000 zone could act as strong demand....

Official Trump (TRUMP) cryptocurrency is trading at approximately $11.90 USD. Your proposed trading strategy includes the following targets and stop-loss: Entry Point: $11.94 1st Target: $13.50 2nd Target: $15.50 3rd Target: $18.00 Stop-Loss: $11.00 Recent developments indicate that President Donald Trump is considering implementing zero capital gains tax...

XAUUSD ALERT IN NFP !!! 🥇XAUUSD formed a “cup and hand” pattern after long-term growth. CCI indicates the possibility of further growth with consolidation above the nearest fractal. 🔼 We consider buying XAUUSD ONLY❗️ on consolidation above 2920; 🎯 Target: 2940; 🎯 Target: 2955;

USDCAD 🐻 The price is in the decline, rebounding from the crucial 1.4320 resistance zone. Bearish crude oil prices and trade wars with the US are undermining the commodity-linked loonie and acting as a tailwind for the USDCAD pair's decline The Momentum oscillator crosses the 100-level down, confirms the increasing bearish sentiment. #TradeIdea 🔽 We consider...

*GBPUSD Sell Trade Analysis & Execution Plan* *Key Technical Rationale:* 1. *Fibonacci Retracement (61.8%):* Price reversed after testing the 61.8% Fib level, a classic reversal zone in downtrend corrections. This suggests a potential resumption of the broader downtrend. 2. *Bollinger Bands:* The breach of the upper band (20-period, 2σ) signals short-term...