Ali_PSND

Silver is trading in its ascending channel on the 4-hour timeframe, between the EMA200 and EMA50. If silver reaches the supply zone, it can be sold. A downward correction will also provide us with a buying opportunity with a good risk-reward ratio. U.S. President Donald Trump has implemented tariff policies with the aim of revitalizing domestic manufacturing....

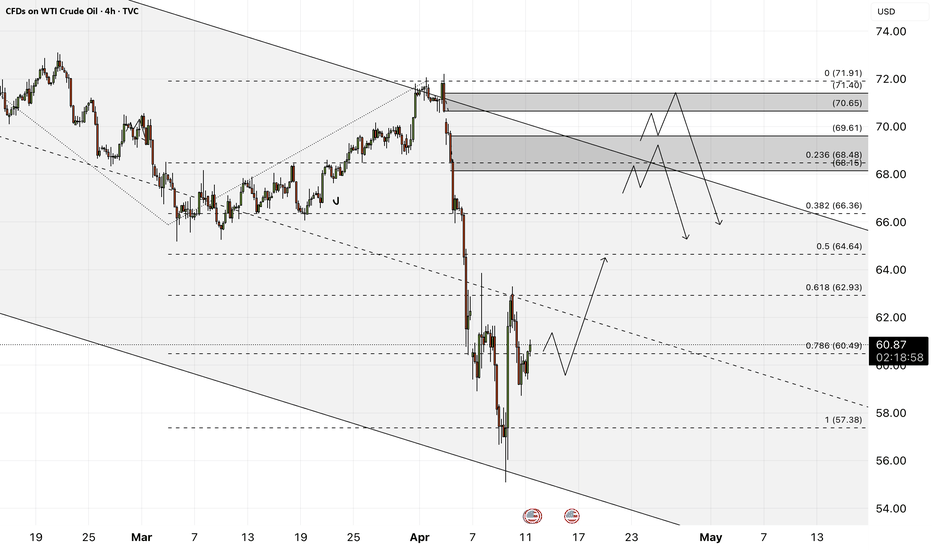

WTI oil is below the EMA200 and EMA50 on the 4-hour timeframe and is moving in its medium-term descending channel. If the correction towards the supply zone continues, the next oil selling opportunity with a suitable reward for risk will be provided for us. In this direction, with confirmation, we can look for oil buying transactions. The U.S. Energy Information...

Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. The continuation of Bitcoin’s downward trend and its placement in the demand zone will provide us with the opportunity to buy it again. The continued rise of Bitcoin will also lead to testing of selling transactions from the supply zone. It should be...

The index is trading below the EMA200 and EMA50 on the 4-hour timeframe and is trading in its descending channel. If the index moves down, it will be clear that it is heading for further moves. At the channel ceiling, I could be close to the next sell-off. As the new US tariffs are set to take effect on April 2, new evidence suggests that they may be less than...

The index is trading below the EMA200 and EMA50 on the four-hour timeframe and is trading in its descending channel. If the index moves down towards the specified demand zone, we can look for further buying opportunities in Nasdaq. A break of the channel ceiling will also continue the short-term upward trend in Nasdaq. According to EPFR data reported by Bank of...

Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. The continuation of Bitcoin’s downward trend and its placement in the demand zone will provide us with the opportunity to buy it again. As long as Bitcoin is above the drawn trend line, we can think about buying transactions. The continued rise of...

The index is trading below the EMA200 and EMA50 on the four-hour timeframe and is trading in its descending channel. If the index moves down towards the specified demand zone, we can look for further buying opportunities in Nasdaq. A break of the resistance range and the channel ceiling will also cause the Nasdaq to continue its short-term upward trend. In...

Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. Bitcoin’s continued downward trend and its inclusion in the zone may buy it again for us. A Bitcoin correction will also be offered to test the selling from the zone. It should be noted that there is a possibility of heavy fluctuations and shadows due...

Silver is above the EMA200 and EMA50 on the 4-hour timeframe and is moving within its medium-term descending channel. If a valid trendline break or bullish correction is observed, silver can be re-sold and followed to the specified support level. Looking ahead, analysts predict that rising economic uncertainty will drive stronger investment demand in Western...

The GBPUSD pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction, the pair can be sold to narrow it. Last week ended with an unexpected shock for economists: estimates pointed to a significant trade imbalance in the United States for January, primarily driven by a sharp surge in...

Bitcoin is located between the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. Bitcoin's downward correction and its placement in the demand zone will provide us with the opportunity to buy it again. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and...

The index is below the EMA200 and EMA50 on the four-hour timeframe and is trading in its medium-term ascending channel. If the index rises towards the suggested zones, we can look for the next Nasdaq sell-off. The composition of investors’ financial assets from 1990 to 2025 reveals shifts in the allocation of equities, bonds, and cash. Currently, the share of...

Gold is below the EMA200 and EMA50 on the 30-minute timeframe and is in its descending channel. An upward correction of gold towards the supply limits will provide us with the next selling position with a good risk-reward ratio. An economist believes that the massive influx of gold and silver into the United States, coupled with speculation about the liquidity of...

The GBPUSD pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction, the pair can be bought within the specified demand range. The Federal Reserve of the United States has embarked on a process that could have profound implications for the global economy: a reassessment of the framework...

WTI oil is below the EMA200 and EMA50 on the 4-hour timeframe and is moving within its medium-term descending channel. If the downward trend continues towards the demand range, the next opportunity to buy oil with a risk-reward ratio will be provided for us. An upward correction of oil towards the supply range will provide us with an opportunity to sell...

Gold is located in a 2 -hour timeframe, above EMA200 and EMA50 and is on its uptrend channel. Gold reform to the demand range will provide us with a good risk position for us. According to Tom Stevenson from Fidelity International, gold remains resilient despite challenges such as high interest rates and a strong dollar, continuing its march towards the $3,000...

Silver is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. If we see a correction, we can re-enter the silver purchase and accompany it to the ceiling of the ascending channel. Then we can sell within the specified supply zone with an appropriate reward for risk. In recent weeks, analysts have warned investors that gold...

WTI oil is located between EMA200 and EMA50 on the 4-hour timeframe and is moving in its medium-term descending channel. In case of a downward correction towards the support area, the next opportunity to buy oil with a reward at a reasonable risk will be provided to us. A valid break of the drawn downtrend line will pave the way for oil to reach the drawn...