Allenbrowser-3

Since the release of the trading strategy, I have been able to accurately predict market trends. I am also grateful to so many brothers for following me. My premium privileges are about to expire. I will put the subsequent trading content in the group. If any brothers are interested, they can find me through 🌐. As for how to deal with the future market, I have...

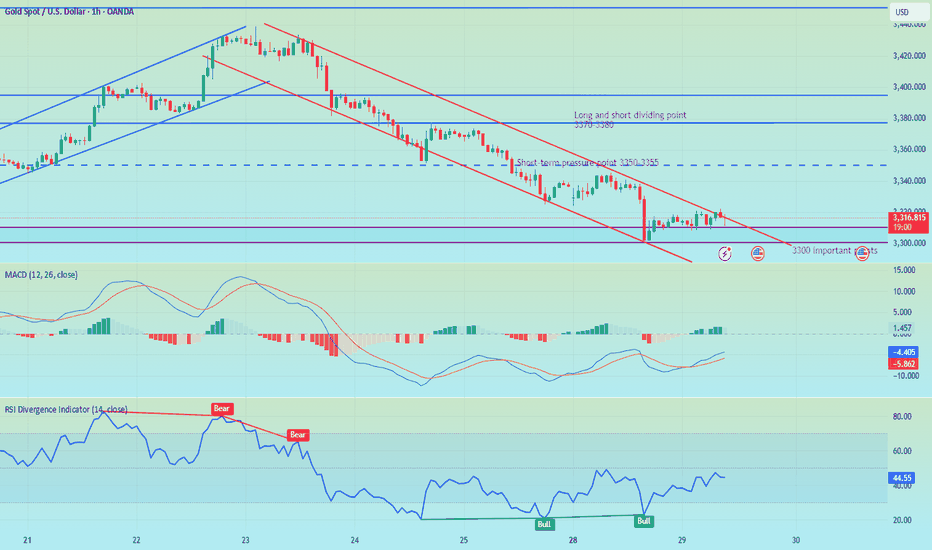

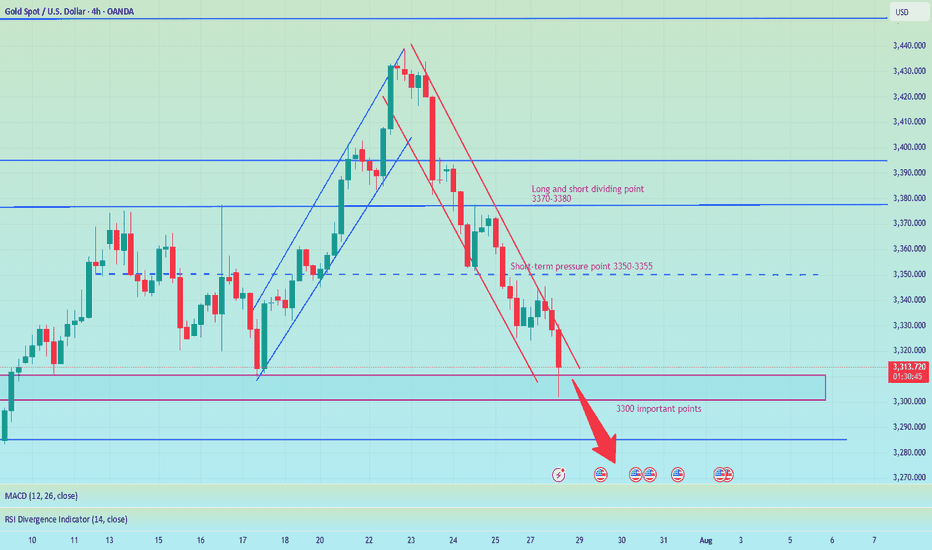

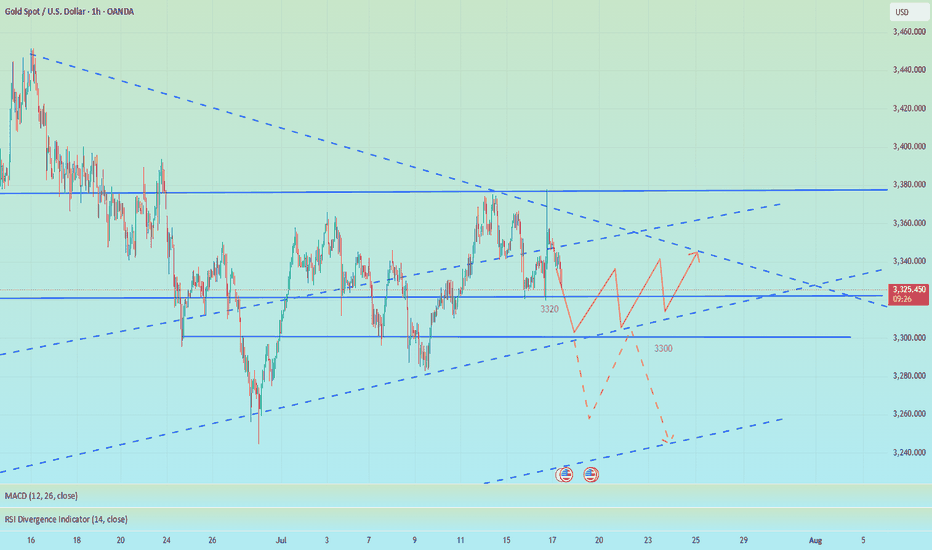

I reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in...

After the shorts took profits, gold consolidated in the 3310-3300 area. Judging from the daily chart, the decline in gold seems to have just begun, with the middle track of the Bollinger Band at around 3345 and the lower track at 3285. The possibility of falling below the 3300 mark cannot be ruled out in the evening. If gold falls below the 3300 mark, it may first...

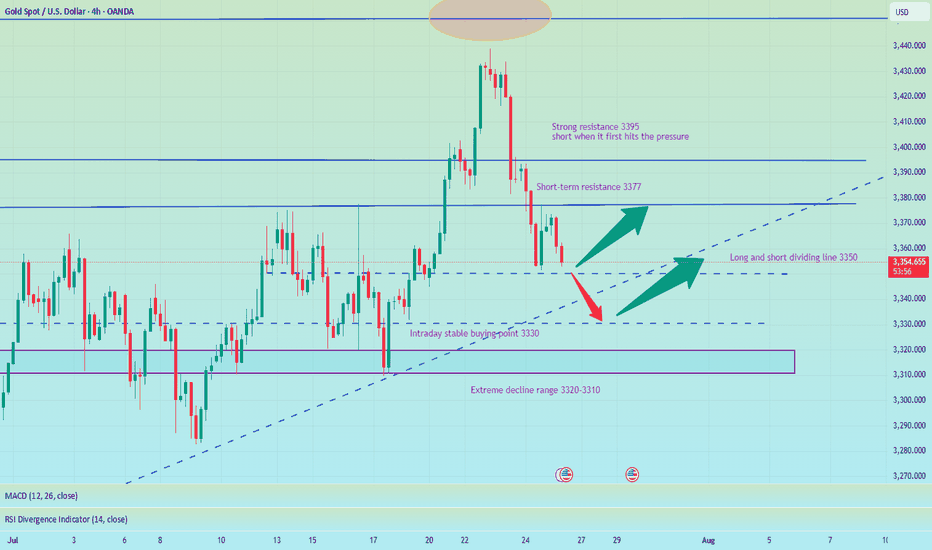

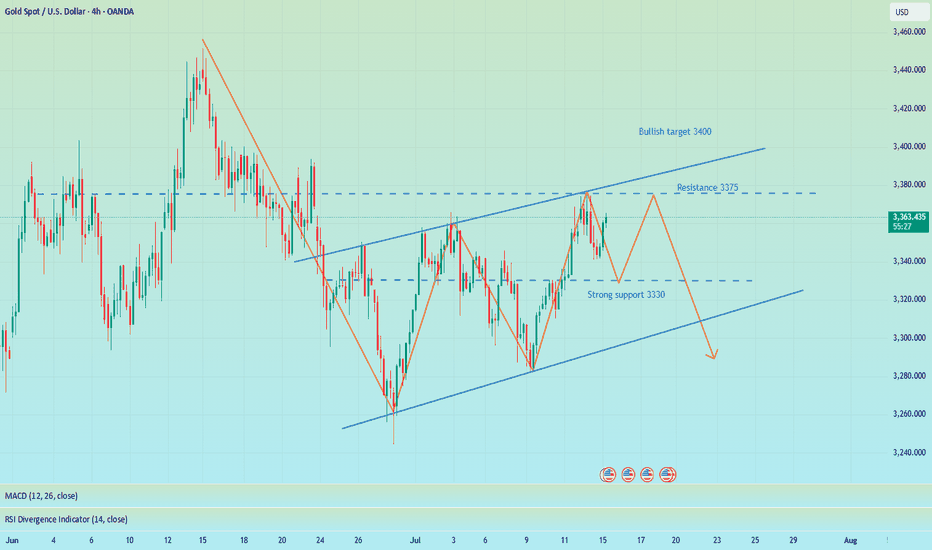

Good morning, bros. This morning gold again tested last week's low near 3325. From the chart, gold may continue to rise this week, with tariffs approaching, the Fed's interest rate cut, and NFP data imminent. The current strength and weakness are at 3350-3355. If it can effectively break through and stand above, it is expected to continue to test the previous high...

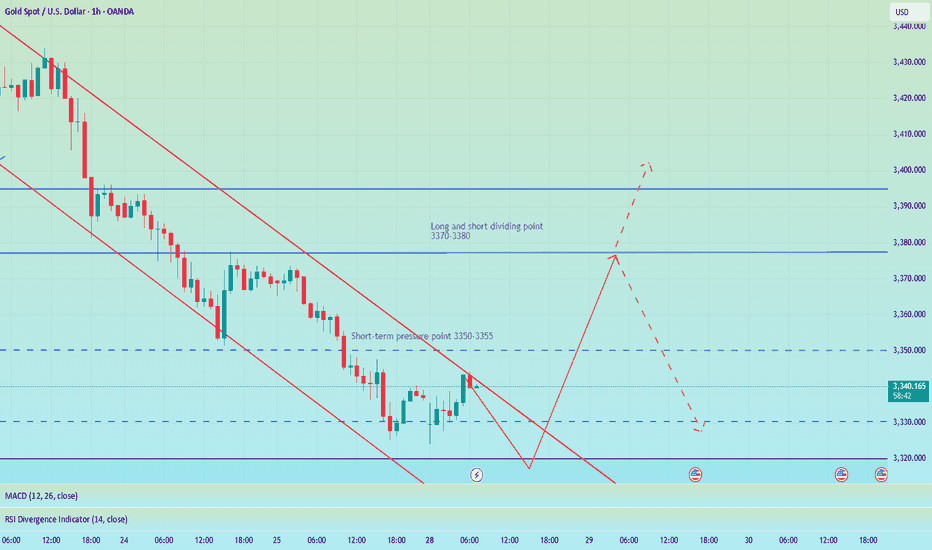

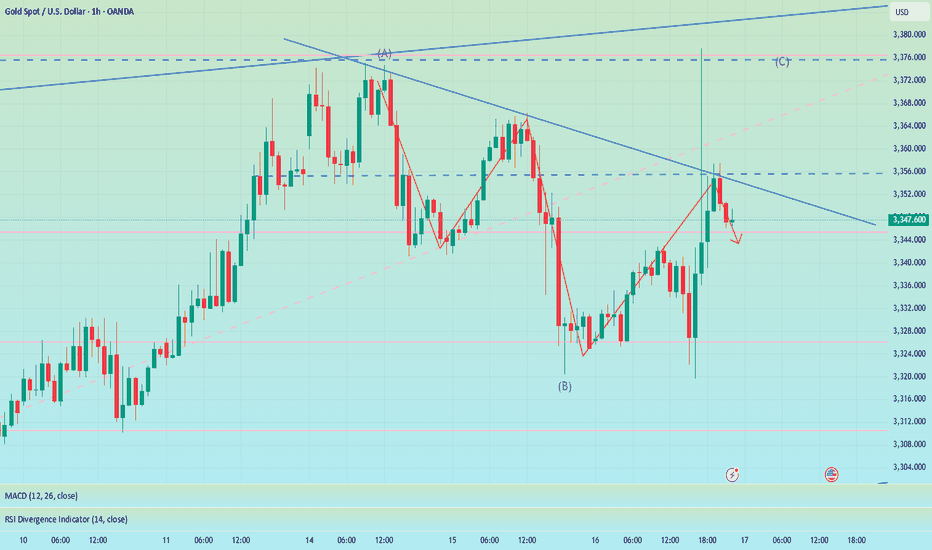

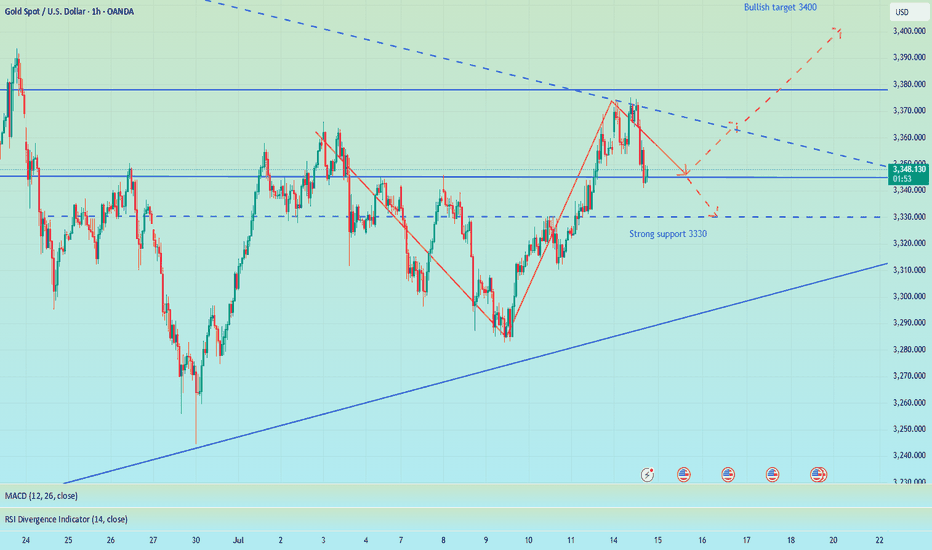

📰 News information: 1. Tariff issues 2. Next week's NFP data 📈 Technical Analysis: Last night, gold rebounded to only around 3377 before starting to fall back. Our judgment that the current rebound is weak is completely correct. 3350 is the support point of the bottoming out and rebounding to nearly $20 last night. Whether the European session can go down to...

📰 News information: 1. Initial unemployment claims data 📈 Technical Analysis: Gold has made a profit retracement correction as expected. The two-day rising market has led to an overly bullish sentiment in the market. Under this pattern, it is very easy to trigger an unexpected reversal trend, which is often a key opportunity to break the psychological defense...

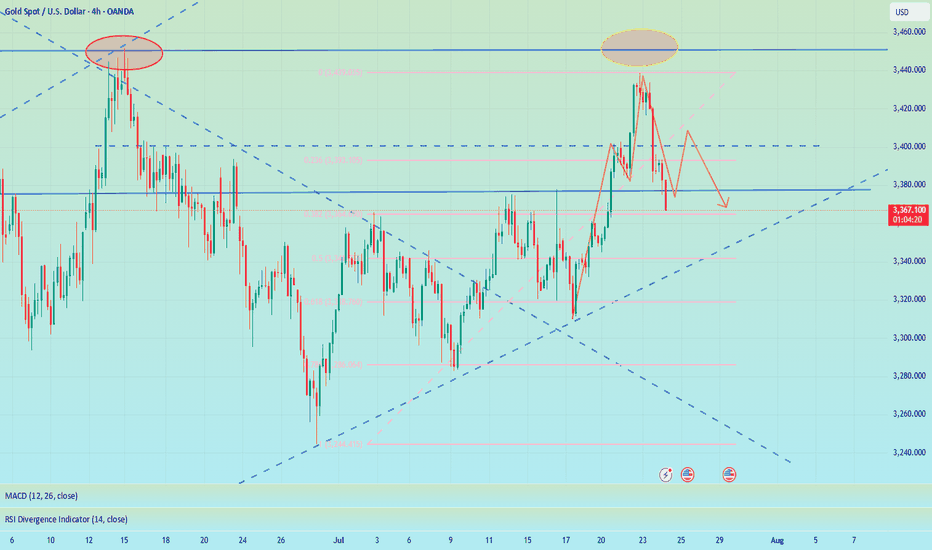

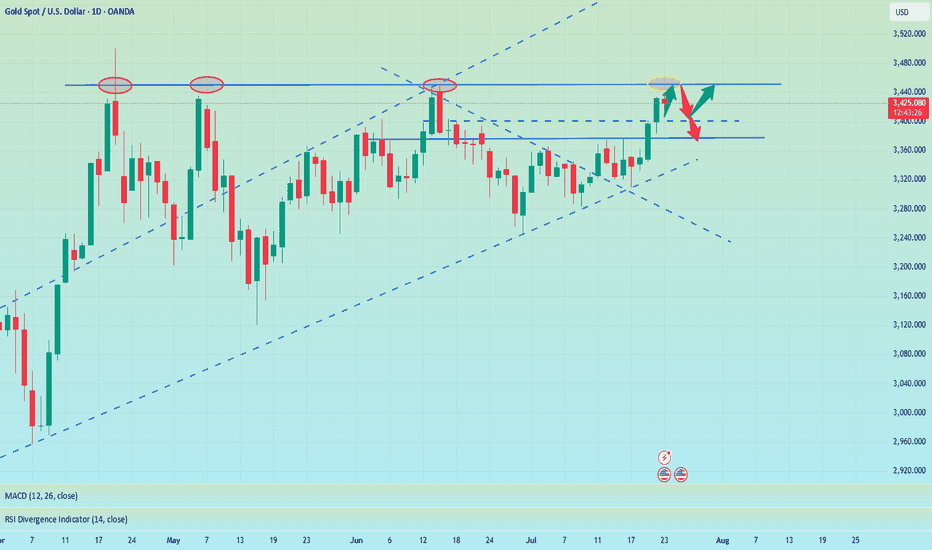

📰 News information: 1. Geopolitical situation 2. Tariff retaliation 📈 Technical Analysis: Trump continued to lash out at the Fed, but seemed to have backed off on whether to remove Fed Chairman Powell. The continuous rise of the gold index, once close to 3440, also ushered in a new high in more than a month. Next, we need to pay attention to whether gold can...

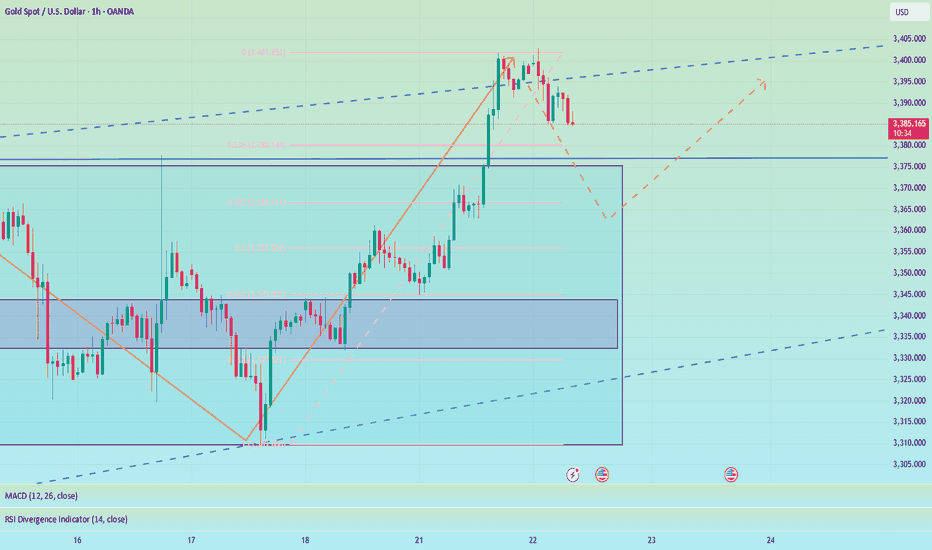

📰 News information: 1. Fed Chairman Powell delivers a welcome speech at a regulatory conference 2. The tariff deadline is approaching 📈 Technical Analysis: Today's opening high reached around 3402, and did not effectively break through the upper resistance of 3405-3415. As I said yesterday, a decline and return to the moving average is an inevitable result. The...

📰 News information: 1. The Trump administration puts pressure on the Federal Reserve to cut interest rates 2. The continued impact of tariffs and the responses of various countries 📈 Technical Analysis: Gold is currently rising rapidly, reaching a high near 3368, and the overall bullish trend has not changed yet. It is not recommended to continue chasing the...

📰 News information: 1. The Trump administration puts pressure on the Federal Reserve to cut interest rates 2. The continued impact of tariffs and the responses of various countries 📈 Technical Analysis: This week's basic judgment and forecast on the gold market trend were consistent, but on Friday, the overall gold fluctuations were not large. The overall trend...

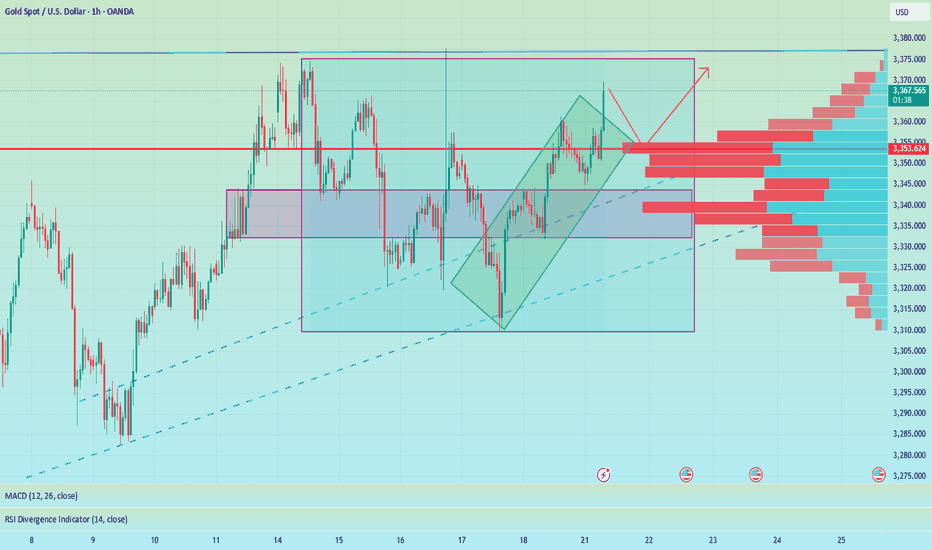

📰 News information: 1. Powell responds to White House issues 2. Will other countries impose reciprocal sanctions on tariffs? 📈 Technical Analysis: Although the MACD indicator of the gold hourly line formed a golden cross, the market reached a high of around 3361, and the RSI indicator was close to the overbought area, so we need to be cautious about...

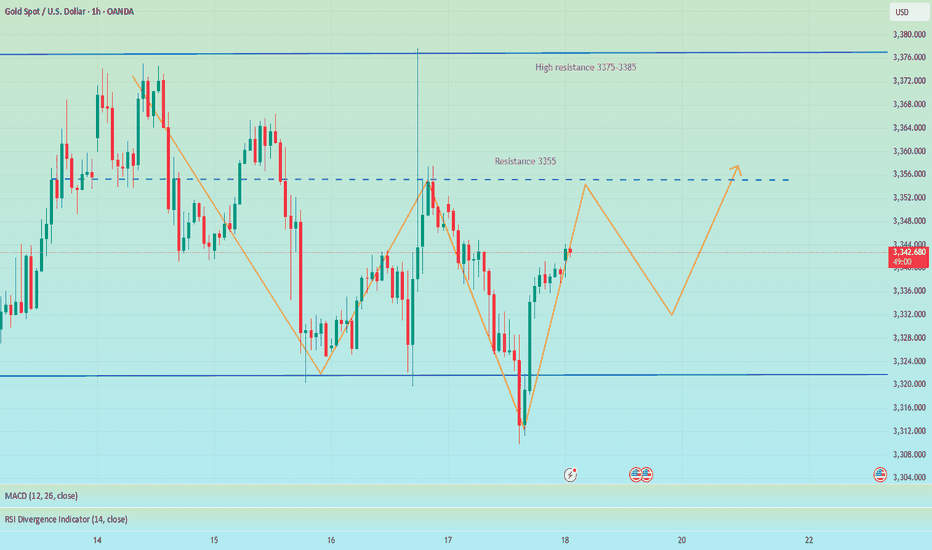

📰 News information: 1. Powell responds to White House issues 2. Will other countries impose reciprocal sanctions on tariffs? 📈 Technical Analysis: Gold closed with a long lower shadow on the daily line yesterday and closed with a doji on the hourly line. In the short term, gold may continue to rise and is expected to touch the 3355 line. If gold cannot break...

📰 News information: 1. Initial jobless claims data 2. June retail data 3. Beware of Trump's remarks about firing Powell 📈 Technical Analysis: Last night, the daily line closed at around 3347. The current short-term daily line range is 3355-3300. The short-term support below is still 3320. Once it falls below 3320, it will look to 3310-3300. Short-term trading...

📰 News information: 1. Beige Book of Federal Reserve's economic situation 2. European and American tariff trade negotiations 📈 Technical Analysis: Today, our overall trading can be said to have accurately grasped the trading points, and both long and short positions have earned us good profits.The gold market surged due to Trump's intention to fire Powell....

📰 News information: 1. Beige Book of Federal Reserve's economic situation 2. European and American tariff trade negotiations 📈 Technical Analysis: Currently, gold continues to consolidate around 3340, and the daily MACD indicator is stuck to the zero axis. Two consecutive days of negative bars also indicate that the overall trend of gold is weak and volatile....

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: The short-term trend flag pattern has been formed, and our short-selling strategy perfectly hits the TP. According to current news, Trump has once again urged the Federal...

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: The 1H chart shows that the gold price continued to pull back last night and then fluctuated at the bottom, and continued the rebound trend this morning. The key pressure...

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: Bros, I had some things to deal with just now so I went out for a while. Now I come back to share my ideas. When the market is blindly chasing longs, I chose to give a...