Allenbrowser-3

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: This week, the US CPI data, consumer index, tariff issues and geopolitical situation are all key points to pay attention to. In the morning, both our long and short positions...

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: The short-term bears have successfully hit the TP to realize profits, and the trading strategy is still valid. Continue to pay attention to the 3355-3345 support during the...

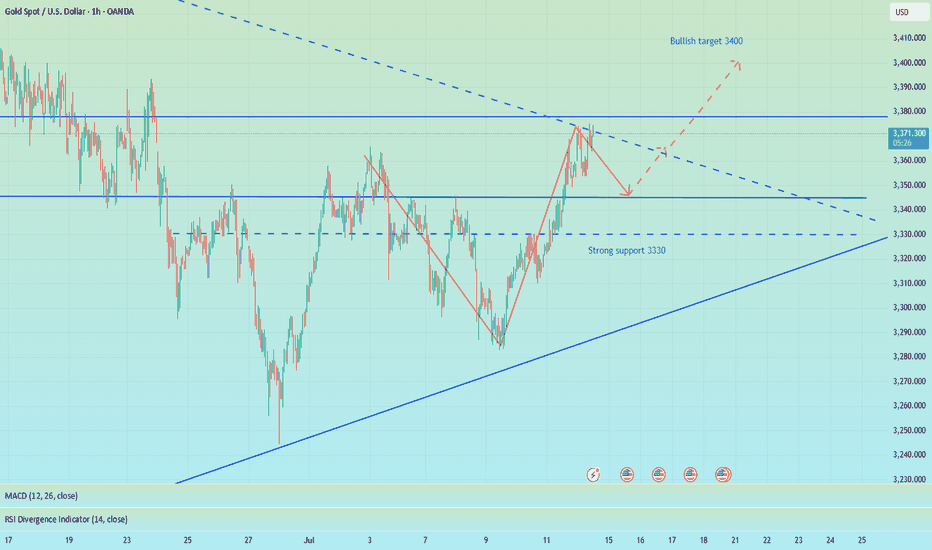

After the gold broke through on Friday, we started to turn long, and gold rose strongly. Gold finally rose as expected, and the gold bulls are still strong. If there is no major change in the news over the weekend, the decline next week will not be large, and we can continue to buy. The gold 1-hour moving average continues to cross upward and the bulls are...

📰 News information: 1. Focus on tomorrow's CPI data 2. Bowman's speech at the Federal Reserve 3. Tariff information outflows and countries' responses to tariff issues 📈 Technical Analysis: During the weekend, the Trump administration's tariff information continued to come out, causing a large amount of funds to flow into the safe-haven market, triggering an...

📰 News information: 1. Pay attention to the impact of Trump administration tariffs 📈 Technical Analysis: Possible interest rate cuts and tariffs in the fall continue to stimulate risk aversion. Currently, the 3300-3285-3310 points form a head and shoulders bottom pattern. The bullish momentum is relatively strong in the short term. Our short trade near 41 has...

📰 News information: 1. Pay attention to the impact of Trump administration tariffs 📈 Technical Analysis: Gold rose as expected and touched around 3344, which was in line with our judgment last night. However, from the market point of view, the K-line entity did not stand firmly above 3335. There are only two possible scenarios for the subsequent trend of gold....

📰 News information: 1. Waller meeting on interest rate cuts 2. Trump tariff issues 📈 Technical Analysis: Waller will participate in the meeting in more than two hours and pay attention to whether there is any news of interest rate cut. The key is to operate around the 3330-3310 range. Continue to pay attention to the support of 3310-3305 at night. If gold falls...

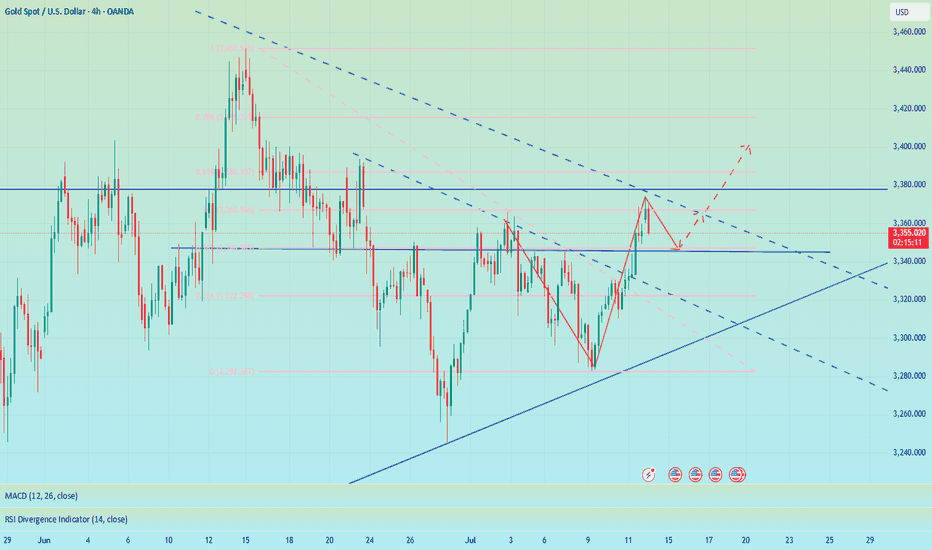

Trump extended the tariff agreement to August 1 and began to collect tariffs again. Although it eased market tensions, his remarks will not be extended after the expiration, and he issued a tariff threat, which increased global trade uncertainty and pushed up risk aversion. There was no clear direction coming out of the Fed's meeting minutes last night, but the...

📰 News information: 1. Federal Reserve meeting minutes 📈 Technical Analysis: Gold fell into a narrow range of fluctuations during the European trading session. As I said this morning, gold is expected to rebound in the short term and the bullish momentum needs to be released. From a technical perspective, the overall market is still in a volatile pattern. The...

📰 News information: 1. Federal Reserve meeting minutes 📈 Technical Analysis: Our decision to close our positions at 3305 yesterday was undoubtedly a very strategic one. After reaching a high of around 3310 last night, it began to fall. At the same time, I also gave VIP members the news that it might fall back to around 3300. Since the opening, the lowest point...

At present, the market has been fluctuating narrowly in the range of 3330-3320, and both bulls and bears are in a stalemate. However, gold has formed a double-layer head and shoulders bottom pattern, so the short-term bullish trend is definitely unchanged. In the previous post, I also mentioned that if the rebound in the European session is weak and gold continues...

📊 Gold Day Trading Strategy (Recommendation index ⭐️⭐️⭐️⭐️⭐️) 📰 News information: 1. The lasting impact of new tariffs 2. The impact of geopolitical conflicts 3. The Fed’s interest rate cut 📈 Technical Analysis: The recent market conditions have been volatile. Many brothers have reported that they have been trapped recently. They have just been released from...

📊 Gold Day Trading Strategy (Recommendation index ⭐️⭐️⭐️⭐️⭐️) 📰 News information: 1. The lasting impact of new tariffs 2. The impact of geopolitical conflicts 3. The Fed’s interest rate cut 📈 Technical Analysis: From the hourly chart, gold has formed a head and shoulders bottom. At present, 3320 below has formed a certain support in the short term. For now,...

Over the weekend, I gave a trading strategy for going long at 3315-3305. Today, I updated and optimized the long order trading, maintained the high-short-low-long trading strategy, and began to rebound near the 3300 line, and successfully touched the long TP 3333. At present, I am executing short trades again according to the trading strategy and holding short...

📰 News information: 1. 90-day tariffs are about to expire 📈 Technical Analysis: With the Trump administration's massive tax cut and spending bill officially implemented, the U.S. Treasury may start a "supply flood" of short-term Treasury bonds to make up for the trillions of dollars in fiscal deficits in the future. Concerns about the oversupply of short-term...

📊 Gold Day Trading Strategy (Recommendation index ⭐️⭐️⭐️⭐️⭐️) 📰 News information: 1. 90-day tariffs are about to expire 2. New unilateral tariffs 3. Geopolitical situation 📈 Technical Analysis: As I said this morning, shorting gold is divided into two times, the first time is near 3324, and the second time is at 3340 or 3345. If there is a short-term...

📰 News information: 1. 90-day tariffs are about to expire 2. New unilateral tariffs 3. Geopolitical situation 📈 Technical Analysis: On July 4th local time, there were constant turmoil in American politics and trade. Trump declared that the US government would send letters to trading partners that day to set new unilateral tariff rates, which would most likely...

📰 News information: 1. 90-day tariffs are about to expire 2. New unilateral tariffs 3. Geopolitical situation 📈 Technical Analysis: Good morning, bros. From a technical point of view, the overall trend of the daily line is a head and shoulders top. If the bulls do not recover 3360, the bears will still be the medium-term trend. The 4H MACD indicator is dead...