AmritB

The mentality of the top companies are the world is... "We're gonna recover this pretty easily". Especially now cloud/digital/internet based tech doing so well. Even capital-intensive companies are doing all right (DOW / S&P). I'm looking for a short term short at these levels, most likely will double top in my opinion. Once that happens, swap over to long-term...

I had really good entries back in my previous ideas at the recent bottom (linked in post). Sold them off pretty quickly due to the large uncertainty in world conditions in this time. I'm still expecting a good amount of volatile sideways action and promptly uptrend when COVID-19 nears calming. I have good belief that the markets are somewhat efficient and...

Primarily looking at NASDAQ. %50 wiped since 2016's stagnation. All analysis points towards ~7000 being a key level. Once fear settles down and Quantitative Easing regulates the economy, a pullback or sideways movement here is expected. Further crisis in the economy can hurl world indices another ~10-20%

There still seems to be negative economic stimuli affecting the world for the time being. I see another ~10% down a very real possibility or it needs to re-bounce now (As of March, 13, 2020).

Current drop is now same in magnitude of the previous large drop in Dec, 2019. A critical resistance at ~8350 defines whether this was again, a standard pull back or a larger ABC retrace. This ABC retrace is only valid if: Upwards rally doesn't maintain above ~8350 for 3+ days. If it shoots past ~8360, stop is here. If this partakes, corona virus was again...

Somebody look at 'BTCUSD longs', been skyrocketing for weeks with no stopping while BTC/Bitcoin itself is tanking. Might be a pump incoming.. Falls to the ~6050 range, I'd recommend starting position here. I also believe with such high long volumes a shakeout will occur as it has in the past, average down your cost all the way to ~5000. The long positions have to...

Huge positions on BTC longs being taken for several days in a row. In the past a good sized pump ensues this type of long positions. Watch out! I'm not gonna even say I know where this is gonna go, cause it all looks like whale waters here. Long target would be ~8300, short would be ~6100.

Bitcoin's long term fractals fall within Gann fan's analysis perfectly. This all seems within Bitcoins volatility and should resume a upward trend towards $11k.

Gann analysis on Bitcoin has been accurate on this rally so far. The green circles denote the most likely bullish situations while the red circles denote the most likely neutral/bearish price movements. Not too much explained here other than how bitcoin fractals can be easily analyzed through Gann analysis.

Gann points are which 2 or more Gann fans create an intersection point that the asset will likely move towards and either break through or get rejected. Using Gann fans we are able to increase our predictive ability not only on price action but also a timeframe on which the price will be acquired at. Bitcoin hit one of the two intersection points perfectly on...

After extensive Gann theory research and analysis, if the overall trend is bullish it will have to pass the 2/1 line for a correction to finish. Comparing to the 2013-2016 fractal it took ~1 year after the hard correction to resume a bull run, it looks pretty much like the same situation now. Looking at this now long term holding was and is a viable option. These...

Significant money has been made the last time the market had a hard correction with the 2X inverse ETF. Now with Canada holding interest rates and worldwide trade difficulties there's lots of fundamentals backing another short-term bear run. This is a good time to short the markets as you cant really lose money from shorting the top, worldwide economic growth has...

After a near-decade long bull run we have reached a possible falter. Taking into consideration the current state of politics and global economic events transpiring, there is no clear direction in the short-mid term on what can really happen. Seeing lots of traders still making the mistake of self-predicting the market instead of surfing the waters, watching the...

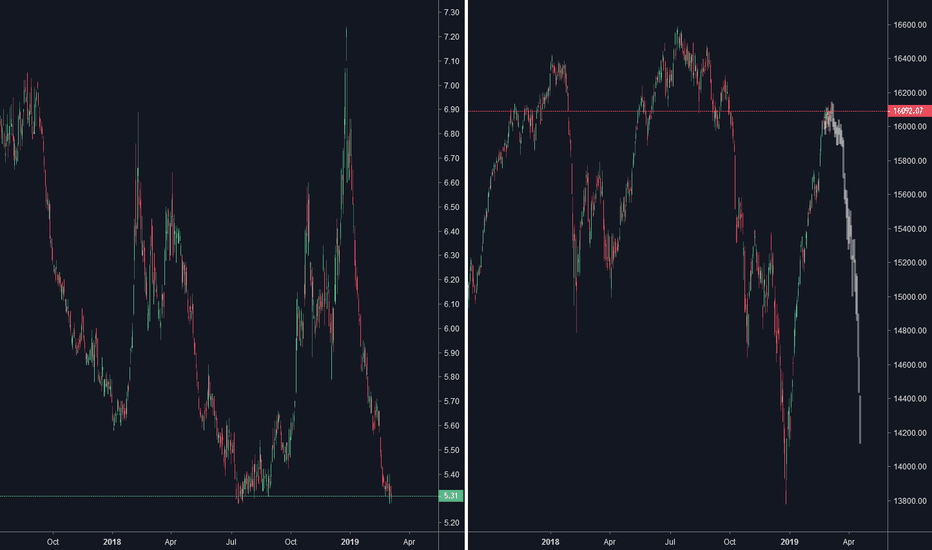

More BTC into the shorts and constantly fishing to reach a double top (right) and gonna cut them out there. Price will fall down to a likely correlated double bottom and explode upwards for a possible exit out of bear city. Or rebound (green arrow) and continue another sideways correction. Please don't take this as investment/financial advise.

Trend seems to want BTC to approach another bottom to create a double-bottom reversal pattern around the 6k level.

BTC downwards trend could still fall to the next hard support of 6100-6200 and then rebound upwards. Suspecting two paths on how it could play out but we would need some time to see where it catches support. If you're still shorting; think about when to close the short and a soon buy in for long. I think that BTC could flip at any time and one should pay close...

BTC bear flag is in action! Will rise towards the strong downtrend resistance line (White), then fall back down to major support levels at 6690, which is incidentally also where the 500 EMA and Gann line is at so hoping for a strong rebound there. Get your shorts ready!

BTC has risen 27% from the 6200ish bear run, where its strength is not shown in the other altcoins. Looking at ETH where almost its entire chart past-2018 has followed BTC quite closely, it has fallen even as large volume is invested into bitcoin. Looking like whales and institutional investors pushing to close out certain short/long positions and also close...