Gold is narrowing in the pre-breakdown consolidation, hence, the break down is close. This set-up clearly shows seller pressure in the market. 1) The pressure is on the support of 1805, which may be broken in the near future 2) The trend is bearish (global and local). 3) Price reacts strongly to the resistance trend line 4) There is an important liquidity zone...

Gold closes the previous session at its lowest. The closing price is very close to the low of the day. Demonstrating the potential for continued decline 1) The downtrend continues 2) Fundamental factors continue to negatively affect the futures price 3) The price is in the range of 1821 and 1786, the price is directed from resistance to support 4) Oriented on the...

Gold confirms trend change to bearish. The futures breaks through the strong trend line, so in the medium term we should expect the price to fall to the area of 1800.1780 1) The chart to the left is a breakout of the strong trend line. 2) The chart on the left - the candle on Friday closes in its minimum, which suggests that the fall and the potential for...

The futures under pressure from the sellers renews the lows and breaks the strong line. This is clearly not the right time to buy. Let's see how the price reacts to the 1815-1825 area 1) The price re-tests the black line (trend line with multiple confirmations, formed in July 2022) 2) The price moves without strong impulses (by small candlesticks), this format...

The gold broke the support at 1824 and yesterday's daily candlestick tries to open a new potential. But, at the moment, the gold is stuck in a tight liquidity zone 1) Yesterday's candlestick closed below 1824, hence, if the price goes below yesterday's low, the bearish momentum could activate 2) But there is a strong support line, which might push the price up 3)...

Gold continues to decline. The triple top and the trendline will keep pushing the price down until it breaks the limit support. 1) The key support level is 1824, below which the price can go to 1810 and 1805 rather quickly. 2) The price forms a triple top near resistance, after which a bullish momentum is formed, a retest of resistance and a new downward attempt...

On Wednesday the futures market closed at lows.. Since the opening of the session, buyers tried to strengthen a bit, but all in vain. 1) Yesterday's closing candlestick indicates the potential for a continuation of the move down 2) The key level is 1824 3) The near retest foretells an attempted breakout. Hence we have lots of chances that the support zone can be...

The situation remains the same. It is too early to draw any conclusions about the further direction, but we will be inclined to the growth from the line. 1) The price is still in the upper plane, which implies a bullish potential. There is a possibility of a rebound from the black line. 2) We expect testing of the line to make some serious decisions. 3) There...

Gold continues to strive in the correction phase to the uptrend line, which divides the field into a green zone and a red zone. This line plays the role of a neutral point, dividing the plane. 1) We should wait for the retest, there is a high chance that it will happen 2) This maneuver may end up with a bounce or a break-up. 3) The global trend is bullish. 4)...

Gold does not give us a quick reaction to the 1821-1830 liquidity zone. The price has not yet tested the rising support line, so we have to wait for the end of the correction. 1) Price is heading for a final retest of the strong line, which plays the role of support 2) The trend is still bullish 3) We look for the entry point in the area of 1815-1820. 4) At the...

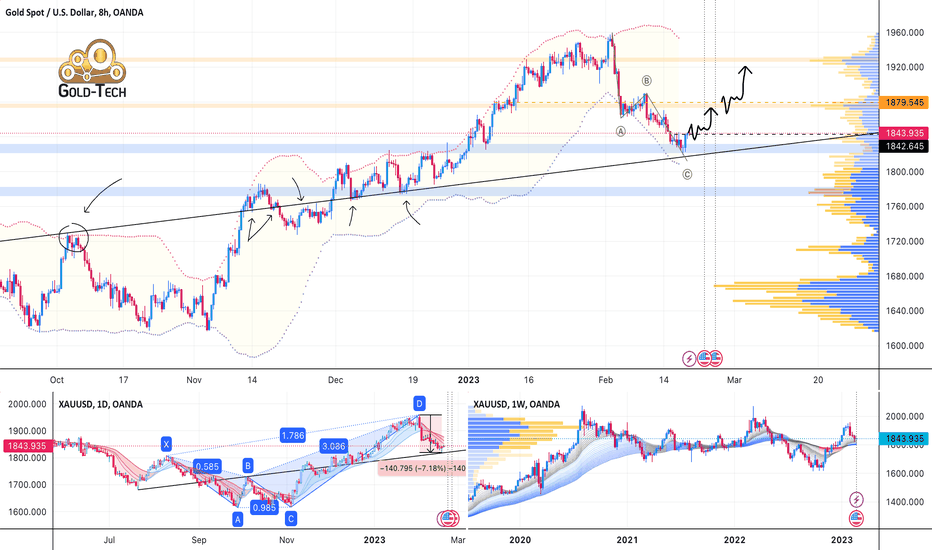

Gold is in the green zone relative to the uptrend line. Consequently, the market is still dominated by a bullish contingent 1) The price is in the local range of 1843-1824. A pullback to the support and to the strong trend line is forming - a chance to open a profitable order 2) The price is still in the correction phase, overcoming the level of 1843 may be the...

Gold finishes the correction and heads up. the local level of 1844 could form a support base 1) Presumably, the ABC correction can end at the 1840 area 2) A reversal forms and the price updates the local lows 3) Price locking above the 1844 level will form an entry point 4) The global trend is bullish, so there is a chance for growth continuation We treat the...

The gold touches the level of 1824 (strong consolidation resistance), makes a false-break and closes on Friday at the daily high, and today, since the session opening, the gold renews the local high. 1) False breakdown of the support at 1824 may provoke ending of the correction and resumption of growth. 2) Friday's candlestick closes above the opening and above...

Gold rallied 3.8% on Friday and is now hitting local resistance. What's in store for Monday and the week ahead? Let's find out! 1) The price reacted too easily and too fast to the white rising support, so there is a chance of a pullback to 1843 and a retest to the white rising support (long consolidation or false-break). 2) Gold, as I mentioned in Friday's...

There is a chance that the gold will finish its correction phase at 1808-1810. Let's analyze why: 1) The global Gartley pattern makes us understand that this phase and this movement fits into the category "correction". 2) The strong uptrend line, which plays the role of support. The price reacted to it many times, which tells us about the support zone in this...

Gold is testing the upper boundary of a strong consolidation. Perhaps price needs to go deeper to capture liquidity, but by how much? 1) The close of today's candle will determine the potential for Monday. If price closes above the level (not tight) there will be a chance for a pullback to 1840-1850 2) The close of the candlestick is very close to 1824, or the...

Gold can't get back behind the local line and is forming a consolidation below. The potential for a move lower is likely to be gathering 1) The daily chart is hinting at an impending decline 2) Price is consolidating under the liquidity zone 1840 3) Only bearish set-ups for the daily and medium-term potential are forming at the moment 4) Breakdown of the local...

Gold continues to decline. Yesterday's candlestick closed close to its low, which suggests that the decline will continue 1) Local trend is bearish. 2) The price tends to the 1823 liquidity area. 3) Below 1823 is the contagion zone and it will be very difficult for the price to pass 4) Daily RSI is in the oversold area, in the near future the indicator may show a...