Upon reviewing the USD/JPY chart on the daily timeframe, we observe that due to the sharp drop in the Dollar Index, the price has reached the 140.850 level. This decline was very strong and impulsive; however, as seen on the chart, the price has now approached a significant demand zone between 139.6 and 141. If the price manages to close and stabilize above this...

Upon reviewing the EUR/USD chart on the 3-day timeframe, we can see that following a sharp decline in the Dollar Index (DXY), the pair experienced a bullish move, reaching the 1.15 supply zone. If the price manages to stabilize and close below the 1.15–1.17 area, we can anticipate a further drop in EUR/USD to fill the created Liquidity Void (LV). This analysis...

By analyzing the #Bitcoin chart on the weekly timeframe, we can see that after our last analysis, the price successfully hit the $80,800 target and even dropped close to the second target at $73,700. Eventually, after forming a bottom around $74,400, Bitcoin saw renewed demand and has since surged to $93,600. Take note: the $93,480 to $99,500 zone is a key supply...

Upon reviewing the 15-minute gold chart, we can see that the price once again reached a new high today, rallying up to the key psychological level of $3500. Following this move, gold has experienced a pullback down to $3423 so far. If the price stabilizes below $3442, we will likely see a further correction toward the next target at $3411. (This analysis will be...

By analyzing the gold chart in the 1-hour timeframe, we can see that the price managed to register a new high at $3245, but after that, it was followed by a correction and created a change in market structure. I expect that if the price stabilizes below $3213, it will be accompanied by further decline. The targets are respectively $3187, $3177, $3155, and $3138....

By re-examining the gold chart on the 30-minute timeframe, we can see that the price once again moved exactly as expected and finally managed to rise back above $3100, reaching as high as $3136.5! Currently, gold is trading around $3120, and I expect we will soon see further decline in gold. The potential downside targets are $3115, $3105, and $3100 respectively....

By examining the gold chart on the 30-minute timeframe, we can see that yesterday the price once again moved exactly as expected, hitting all four targets: $3022, $3016, $3010, and $3000, and even dropped further to $2956, resulting in a total return of over 700 pips! Currently, gold is trading around $3003, and if the price stabilizes below $3014, we can expect...

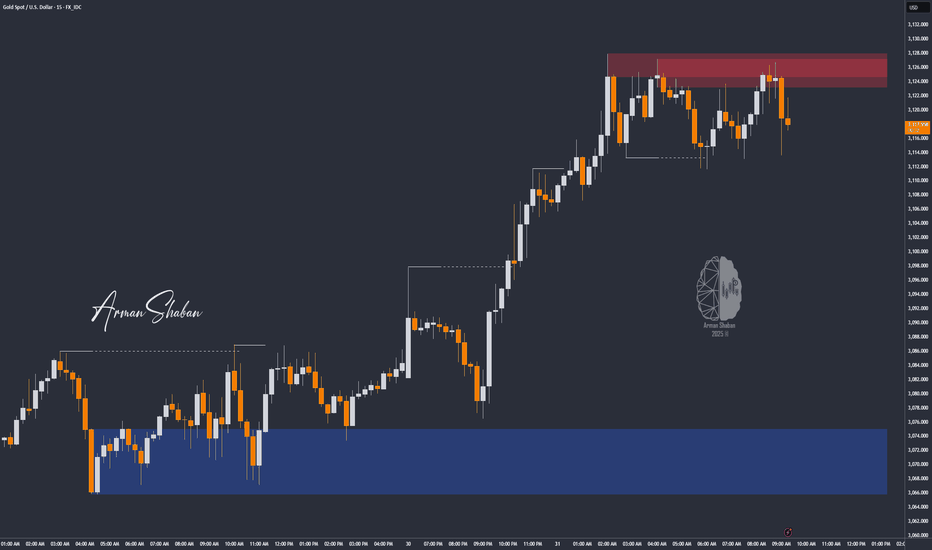

By examining the gold chart on the 15-minute timeframe, we can see that the price is currently trading around $3122, and I expect the price to soon reach higher levels such as $3128, $3133, $3135, and $3143, and after reaching each of these important levels, we will probably see an initial negative reaction! Ultimately, I expect a strong rejection from the price...

By analyzing the Bitcoin chart on the weekly timeframe, we can see that the price is currently trading around $83,000. This week alone, BTC has dropped by 6%, showing signs of bearish momentum. A correction toward the $70,000 zone seems likely in the near future. Key supply zones are located at $93,400 and $99,700, while key demand zones are at $80,800 and...

Upon analyzing the USD/JPY daily chart, we observe that the price precisely hit our previously forecasted target of 148.65 before declining further to 146.5. Following that, USDJPY rallied back up to 151 and is currently trading around 150.680. Should the price manage to stabilize above 150.5, we can anticipate further gains in this pair. This analysis will be...

By examining the EUR/USD chart on the 3-day timeframe, we can see that the price has moved exactly as expected since our last analysis. After reaching the supply zone between 1.083 and 1.093, the pair began a correction and is currently trading around 1.079. Keep in mind, only if the price stabilizes below the 1.080 level can we expect further downside from this...

By analyzing the gold chart on the 15-minute timeframe, we can see that after the market opened today, a price gap appeared. Once gold filled this gap, it resumed its bullish move and recorded a new all-time high at $3,128. Currently, gold is trading around $3,119, and if the price stabilizes below $3,120, we may see a slight correction. However, note that there’s...

By examining the gold chart on the 4-hour timeframe, we can see that, as expected, the price continued its bullish movement and climbed close to its all-time high of $3057, reaching $3056 today. Since this level acted as a Bearish Rejection Block, we’re now seeing a price correction from that area, with gold currently trading around $3049. If the price stabilizes...

Gold's 2-hour chart shows that the price successfully reached a new high of $3057 today before retracing to $3025. Currently, gold is trading around $3037, and I expect a short-term push towards $3049 before looking for a trigger to potentially ride a correction down to targets below $3022. Stay tuned—this analysis will be updated soon! Please support me with...

By analyzing the gold chart in the 2-hour timeframe, we can see that the price has finally made its big move, just as we predicted! After a correction to $2905, demand increased, pushing the price up by over 400 pips to $2949. Currently, gold is trading around $2940, and there are two key scenarios: 1️⃣ Holding support at $2940, leading to a rise above $2950...

By analyzing the 2-hour timeframe for gold, we see that the price remains range-bound with no clear directional trend. Currently, gold is trading around the $2900 level, and if it fails to break above $2913 again, we can expect a downward correction. Potential targets for this correction are $2870, $2861, and $2853. Keep an eye on price reactions at each of these...

By analyzing the gold chart on the two-hour timeframe, we can see that the price followed the expected bearish movement yesterday, correcting from its recent high of $2928 down to $2900 before finding temporary support. Currently, gold is trading around $2916, showing signs of indecision as it consolidates within a key range. 🔍 Key Levels & Liquidity...

By analyzing the EUR/USD chart on the three-day timeframe, we can see that the price has started to rise following the sharp decline in the U.S. Dollar Index (DXY). Currently, it is attempting to fill the identified Fair Value Gap (FVG). The key supply zone is located between 1.08300 and 1.09380. Traders can look for a suitable sell trigger within this range for...