**Meezan Pakistan Index – Buy Idea (Daily Chart)** Price has shown strong bullish momentum after rebounding from recent lows. The market is targeting the previous imbalance near 22,500–22,761, with a potential higher target at 24,532. A clear market structure shift is visible, and short-term retracements toward the recent demand zones can offer continuation buys....

✅ Buy Idea Summary Symbol: MARI Timeframe: Daily Current Price: 652.96 📊 Analysis & Plan Context: Price has bounced from a higher-timeframe demand zone (highlighted in blue) and is currently forming a bullish structure. Key Observations: Swing Failure Pattern near top (distribution clue). Liquidity Pool marked at 720 — likely target for short-term buy-side...

🔷 Buy Idea: FAUJI FERTILIZER CO LTD (PSX) Context: Price tapped into a discount zone, swept liquidity below the recent lows, and formed a strong bullish engulfing candle. The setup aligns with a low resistance liquidity run toward the higher timeframe distribution zone. ✅ Entry Criteria: Entry: Above the bullish candle close at ~366 Stop Loss: Below the recent...

Buy Idea: ADAMJEE INSURANCE CO LTD (PSX) – Daily Timeframe Price has recently formed a bullish dealing range (DR) after reacting strongly from the monthly demand zone (M T2). The current structure shows price respecting this DR, indicating potential upside movement. 🔹 Entry: Inside the DR box around 46.00 🔹 Stop Loss: Below DR low (~39.70) 🔹 Target: Monthly TP...

✈️ Aviation-Themed Trading Captions "Every flight needs a runway — the market is just taxiing before takeoff." "Before soaring to 179.8, it’s just aligning on the runway. Fasten your seatbelts!" "Just like a Saudi Airlines jet — a slight dip for alignment, then full throttle to the skies!" "Descending slightly, not to fall — but to gather momentum for...

📘 Buy Idea: Habib Bank Limited (HBL) 🔹 Timeframe: Monthly | Strategy: Structure + Type 1.4 + Context Targets ✅ Entry Zone: Buy between 145 – 155 PKR (near the marked "M Type 1.4" level). 📉 Stop Loss (SL): Below 92 PKR ("This low to be held as protected low" – the ITL zone). 🎯 Take-Profit Targets (TP): Target Price (PKR) Gain % Description TP1 240 ~60% First...

WTI Crude Oil (XTIUSD) – H4 SELL Setup Price has reacted from a key H4 supply zone after taking out previous highs. A clean bearish shift suggests continuation to the downside. 🔹 Entry: At supply zone 🔹 SL: Above mitigation zone 🔹 TPs: First support Equal lows Extended swing low Bias: Bearish Reasoning: Liquidity sweep + market structure shift + imbalance

Trade Idea: XAUUSD (Gold 15m Chart) Price is holding above the short-term FVG and showing bullish intent after reacting from a higher timeframe zone. A continuation move is likely if this zone holds, targeting the next premium zone above. Bias: Bullish Context: Market structure is bullish; price is building a base for a potential expansion toward the upper...

### **📉 Bearish Daily Setup - BTC/USD** **Bias**: Bearish **Context**: Daily DR (Dealing Range) is broken, and price is rejecting premium level. --- ### 🧠 **Narrative:** Price traded into a daily FVG (Fair Value Gap) near **premium zone**, then formed a lower high. The daily **DR (Dealing Range)** was broken to the downside, showing bearish intent. We also...

🧠 SELL SETUP - XRP/USDT (1D) Chart by: Asif_Brain_Waves 📍 Current Price: 2.1286 📍 Short-Term Liquidity Grab Target (DT T1): 2.2851 📍 Projected Drop Target: 1.5756 📉 Bias: Bearish 🔍 Narrative & Context: Price has recently broken below key internal structure with inefficiencies (FVGs) left behind. Currently forming a potential retracement move toward the breaker...

📈 TASI Weekly Outlook – Bullish Play in Progress! 💥 After forming a solid base around the Monthly Type 2 Zone, TASI is showing bullish signs of accumulation. We're now watching a potential explosive move toward the Context Target at 12,895.754 🚀. The current structure suggests a short-term pullback before continuation—ideal for bulls waiting for a clean entry....

SAUDI ARAMCO BASE OIL - Daily Chart (TADAWUL) "After a long bearish phase, the market finally pauses to breathe. If the next bullish leg confirms, it will unlock the roadmap to higher targets. With strong conviction, I believe the 2025 low is already in place. Eyes on 107.4 first, then 111.8. Let price reveal the story.

📈 Trade Idea: ALSAIF STORES (TADAWUL: 4161) Timeframe: Daily (1D) Current Price: 7.96 SAR Setup Type: Breakout & Retest 🔍 Trade Narrative: Price has broken above a recent consolidation zone (marked in light blue). Strong bullish momentum is visible after reclaiming the key level of 7.80. Market structure shows higher lows and a push towards previous liquidity...

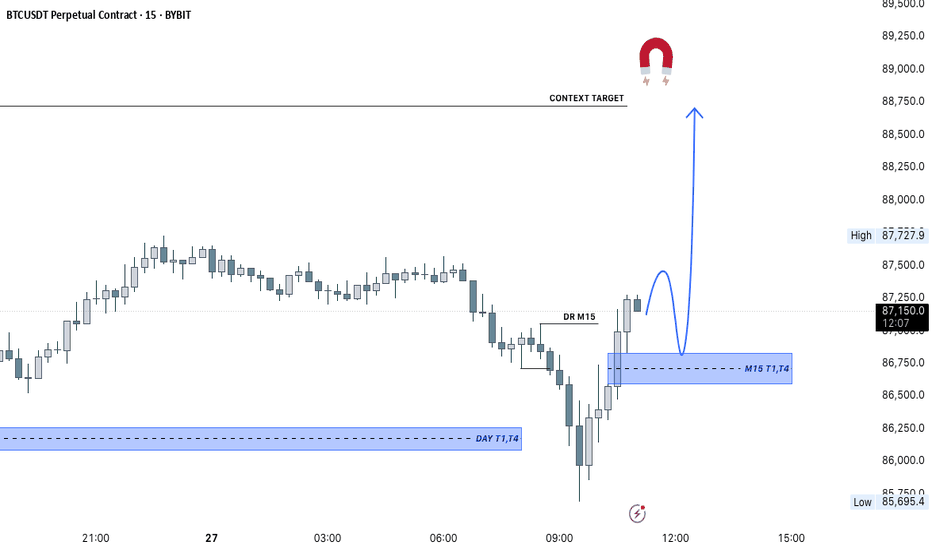

Trade Idea: BTCUSDT (15m Chart) Price has aggressively pushed up from the daily demand zone and is now forming a potential bullish continuation setup. A retracement into the M15 FVG zone is expected. If price respects this zone and forms a bullish reaction, a long opportunity aligns well with the context target above. Bias: Bullish Context: Price is targeting...

Trade Idea: DAX 40 (15m Chart) Price is currently retracing towards a higher timeframe Fair Value Gap (FVG) zone. This area aligns with previous supply and offers a high-probability short setup. Once price enters this FVG, watch for bearish confirmation such as a rejection candle or a shift in market structure on lower timeframes.

Watching price reaction at H1 and H4 FVGs — expecting continuation to the downside. Eyes on liquidity resting below recent lows. H1 & H4 FVGs respected 👀

Trade Idea (EURUSD - Buy Bias) Price has reclaimed the Monday Low (Mon.L) and mitigated the H1 FVG. It's now trading within a higher timeframe FVG (H4/D1) zone, showing bullish intent. Targeting a move toward the previous weekly high (PWH).

📈 TADAWUL: 3050 (Southern Province Cement Co.) The stock has entered a long-term demand zone near 30.70–32.00, showing historical support. If this zone holds, a potential bullish reversal could take price first toward the 36.90 resistance, then to 44.00, with a final target around 46.35. Trade Idea: Entry: 32.00–33.00 (inside demand zone) TP1: 36.90 TP2:...