A brief pause in the gold run may be a good time to pick up some of these cheap miners I'm coming across. For those less risk tolerant (is that possible in the mining sector?), AEM , GDX, WPM and others are breaking to new highs. I see WPM at 75 within the next year or two and big moves from NEM from current levels. If you have nothing in gold/silver/miners...

I've been sticking with Pfizer for far too long to abandon it. The dividends have continued to roll in and with a 7%+ payout rate, this one is bound to get some bids, sooner or later. I'm adding at this level.

Downward possibilities for SP can be breathtaking. 1000 point drop possible. Cheap puts can score big. Perhaps Friday's job report will be the trigger??

High probability that GLD will move to the 20 day moving average at 295. The BBW indicator shows that momentum is softening. At this signal, prices generally revert to the mean or in some cases, sell off quickly to the -2 standard deviation. I've been using the futures to hedge my positions. Interesting that the CME has come out with a 1 oz gold future. The...

The Head and Shoulders top appears pretty obvious here. But I have been fooled in the past by so obvious "tops" only to see my short positions get destroyed. That being said, with such generous profits still in hand, I'm taking some off the table in anticipation of a very possible pull back. This has been typical "end of month" futures-related price action yet...

While rates soften after a recent surge, the 10 month moving average will likely continue to rise over time. Paring back on rate sensitive stocks seems like a good idea going forward.

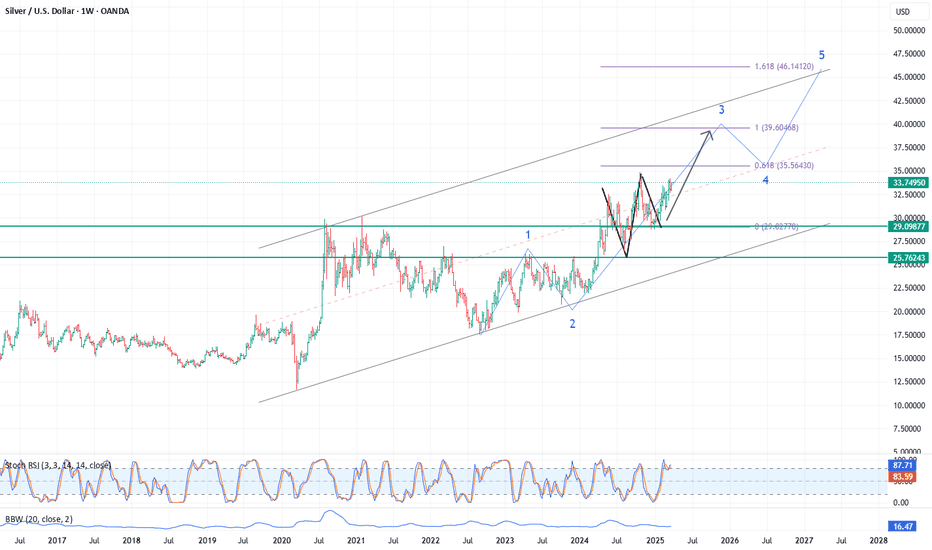

Appears to be a Wave 3 in motion. At the recent high, the measurement was 1:1 of the first wave has been achieved. I expect a bigger move. In theory, wave 3 is never the shortest and often extends past the 1.618 level to 2.618, 3.618 . . . The major gold companies are going to start catching attention and explode. It might take another quarter or to in...

I've been nibbling on BX as it is continuing to maintain in a possible upward channel. Looking for an eventual move above 200 once this minor cleansing shakes out. They can do Real Estate much better than I.

In doing long term analysis last year, I noticed that major waves 2 and 4 generally terminate at the 40 month moving average. So it appears that 472 is the current target. Keep in mind however that wave 5 will eventually take us to new highs. Then, - LOOK OUT BELOW

Reverse Head and Shoulders seems to have building out for some time. The Major Right shoulder appears to be completing the head of yet another reverse head and shoulders pattern. When this formation resolves, no reason that XOM can't easily pass 150. My gut is telling me that the inflation is going to get really ugly. Can't imagine that oil prices won't keep...

Silver is gaining some momentum. I believe that it is going through an extension of wave 3 that should rise to test $40. Maintaining upward momentum and remaining in the current channel, a test of the all time highs is inevitable.

Over the long term, I expect to see NEM at 100. My crude wave count shows that we are entering into a wave 3 that can boost shares to mid $80s.

Could be completing a Wave 2 correction formation. Appears to be a Reverse Head and Shoulders with a neckline just above 120. If, in fact, we are beginning a 3rd Wave, a 1.618 of Wave 1 move would put XOM at 240.

As the "Made in America" - "Made in China" battle heats up, FXI projections may indicate that China will made strong advancements in its economy. How tariffs play into the scene is yet unknown, the chart patterns, including the extension formation makes me think that price can target the 2.618 measured move, up to 50.

The fibs lined up just under 560 for a few time frames so I'm entering at this point. Many expected a Primary Wave 4 to occur before a fifth wave higher. Can't be sure how long this will last but surprised that people might be spooked by recession talk. Seems that we have been in a recession for quite a while, although it hadn't been reflected in the stock...

Gold is clearly in an impulse wave that I feel is the wave five of a larger third wave. Generally, a fifth wave in commodities is often the biggest. While in normal trading vehicle, the third wave is the largest. So either way, momentum remains strong. GDX however is not as strong but my expectations are for this to change. Recent miner financials have...

Inverse Head and Shoulders potential with current position, bottoming of right shoulder. Good spot for pilot or add to take advantage of a coming impulse wave higher. Current target: 145.

If there are any doubts about the fact that inflation greatly increased during the Biden presidency, this chart is revealing. agricultural commodities were in a long term decline until the Covid pandemic marked the low. Since late 2020, grains have been on a tear, more than doubling, based on the DBA price. Still has a long way to go on the upside.