Asymmetricalbets

PremiumThe setup never triggered today and also confirmed why I passed on the trade yesterday. the odds of taking positions when the Nasdaq is on a sell signal are not good.

It will trigger just above the Inv Hammer Candle, with the Nasdaq on a buy signal it would be a no brainer. Today I will let it go and pass.

On Monday I am looking for a retest of the of SPY all time high. To take a short I am looking for a higher high and a weak close. The LBR Oscillator making lower high with negative momentum. And Volume Delta is already negative not confirming the new highs. Stop should be high of the day.

A test of the medium line from below could be a nice spot to go short in a couple of days.

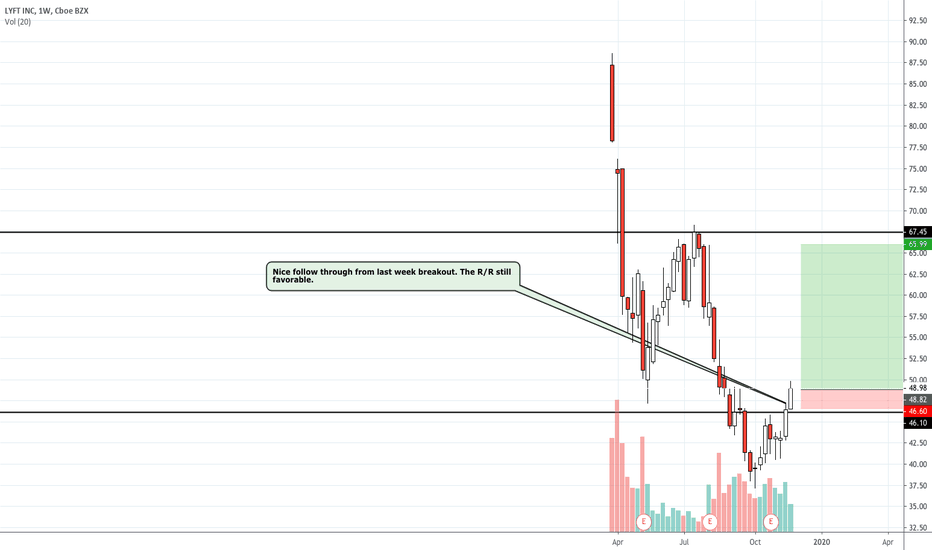

Last week LYFT broke out in the weekly time frame. Follow through this week with R/R still favorable.

The SPY, DIA and QQQ continue their strong rally and for most traders and investors they appear overextended and hard to get long at this levels. The Russell 2000 just broke out of a seven month consolidation and offers a low risk opportunity to get long exposure to the markets. I am playing for a sector rotation into small caps and and a catch up rally to SPY and...