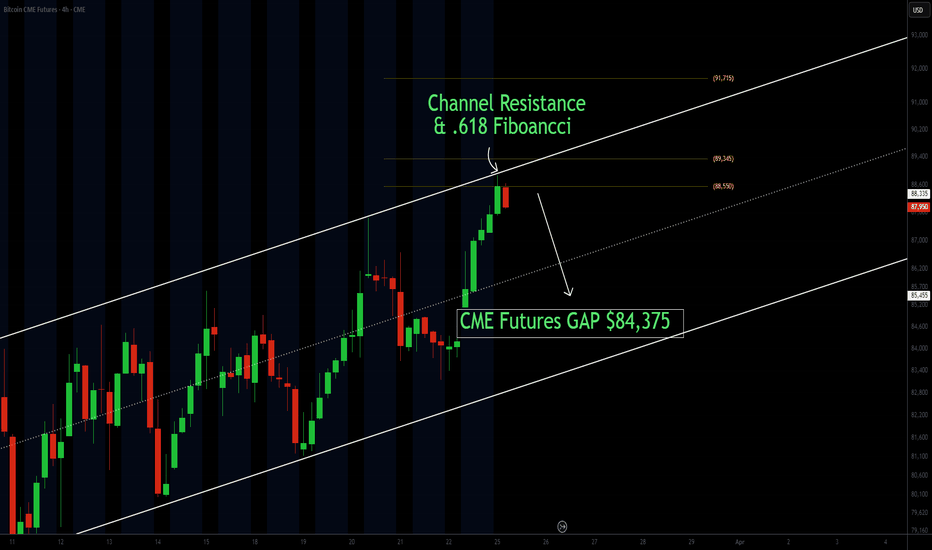

In today’s analysis, we are focusing on the CME futures chart, which has been open for trading over the past 24 hours. A key observation is the gap at $84,375, which remains unfilled despite Bitcoin’s bullish expansion on Monday. Historically, CME gaps have a high probability of being backfilled, making this an important technical level to watch. Currently,...

Fatcoin is currently testing a key technical zone on the daily timeframe, with a wick into the 0.618 Fibonacci retracement level, which aligns with both the VWAP and the value area high. A rejection at this level could lead to a retest of lower support, particularly around the bullish order block, which also confluences with the VWAP and another 0.618 Fibonacci...

Bitcoin has been trading within a rising channel formation since January 2024. The initial bullish expansion led to a breakout above this channel, where price traded for a while before ultimately breaking back below. This rejection back into the channel is a bearish signal, increasing the probability of Bitcoin testing the lower boundary of this structure....

Tesla has recently experienced a strong bearish expansion, retracing toward previous value areas and currently trading below the value area high. It is finding support at a key daily support/resistance (SR) level of $217. At this stage, Tesla is approaching a potential reversal zone, but for a long trade setup to be confirmed, we need to see consolidation on the...

Ethereum’s recent price action suggests a potential short trade if resistance holds. The market has seen an impulse move into the 0.618 Fibonacci retracement and VWAP SR support, aligning with a lower high and lower low structure. Key Points: • Testing Key Resistance: Ethereum is currently trading at the 0.618 Fibonacci level and VWAP SR support, both acting as...

Bitcoin’s recent price action remains within a defined trading channel, with most closes near the range high. This level aligns with the value area high, a major liquidity zone, and the 0.618 Fibonacci retracement, making it a critical area to monitor for potential reversals. Key Points: • Liquidity at Range High: Bitcoin is trading near the value area high,...

HyperLiquid (HYPEUSDT) has faced a sharp sell-off, leaving price action extremely oversold on the daily time frame. This sets up the potential for a relief bounce into key resistance levels. Points to Consider: • Price has formed a new daily SR level with two strong bullish closes, but the key wick remains untapped. • The swing low at $11.62 has not been...

Bitcoin remains in a local trading range as we head into the weekend, with price action showing signs of rotation and liquidity grabs. Points to Consider: • Bitcoin deviated above the range high, potentially signaling a liquidity grab or fake breakout. • A confirmed rejection back below the range high could target $76,600. • Price defended the current low and...

Hello Traders, Bitcoin remains in a local trading range, with price rejecting from the range high after a liquidity sweep. An oversold bounce is now testing resistance, and failure to reclaim the range high could trigger a move toward the range low. • Price tapped the range high, swept liquidity, and dropped back into the range. • An oversold bounce is...

The S&P 500 Index has been experiencing a sharp downturn, heavily influenced by broader macroeconomic factors such as President Trump’s tariff policies. This has had a ripple effect across risk assets, including the cryptocurrency market, which has been closely correlated with traditional markets. In this update, we analyze whether 5400 points could serve as a key...

Solana has broken below $135 support, confirming a bearish shift in market structure. The next key level is $96.85, a high-timeframe monthly support that could provide a reaction. If the Market Auction Theory plays out, a full rotation to $19 is possible, aligning with the Point of Control (POC) and value area low—a major confluence zone for...

In Today’s analysis -METISUSDT-rejecting from a clean Daily Resistance, now resting above its local Value Area High with a lower support projection. Points to consider ✍️ - Value Area High - Daily S/R Resistance - Point of Control - .618 Fibonacci S/R Support - Swing High Objective METISUSDT bouncing from Value Area High after first test, loosing this area...

In Today’s analysis -ETHBTC- bottoming around a support region that has multiple technical confluences. Points to consider ✍️ Point of Control Support - Dynamic S/R Support - Bullish Order Block Support - .618 Fibonacci Confluence - Swing High Objective ETHBTC’s market structure has been bearish for a considerable period of time, price action is currently...

In today’s analysis -ADAUSDT - trading in a high-time-frame channel with multiple confluence at an approaching resistance region allowing for a short bias. Technical Points to consider ✍️ - All-Time High VWAP Resistance - Daily S/R Support - Channel High Resistance - .618 Fibonacci/ SFP Entry - Channel Low Support - Bullish Order Block The current price action...

In today’s analysis -WIFUSDT - correcting from a strong bullish expansion, confirming a S/R Flip retest at key support will allow for a long trade. Points to consider ✍️ - Value Area High S/R Support - Declining Volume - .618 Fibonacci Support - Daily S/R Support - Swing High Objective The immediate price action is correcting, it is trading towards a region of...

In today’s analysis - PNUTUSDT - trading in a local corrective phase, an acceleration towards a key low will allow for a long trade entry. Points to consider ✍️ - Falling Wedge Pattern - Value Area Low - Value Area High -Point of Control S/R - Swing High Objective The current price action is at Value Area Low, here a bottoming structure will signify...

Evening Traders, Today’s analysis, \ Initial reaction bullish from support, if price action continues to hold around these regions, it will increase the probability of rotating back to the highs. The .618 Fibonacci has been respected with local bullish price action; continued bullish impulses are needed for a continuation up. Overall, in my opinion, the DXY...

Evening Traders, Today’s analysis – MATICUSDT- rejecting from a key level, a bearish retest will allow for a short, Points to consider, - Price action impulsive - Daily S/R Resistance - .618 Fibaoncci Confluence - Rotataional Range MATICUSDT’s immediate price action is trading at an area of resistance that has technical confluence with the .618 Fibonacci...