Very smooth flowing price action right now for Gold. After price reached our Wave 5 zone within the green resistance box, we saw bullish momentum slow down & a bearish rejection take place. We're now seen a break below + a retest of the green resistance zone. We should see bearish momentum continue to the downside in the coming weeks!

Gold has been moving bearish as I said it would & hit our previous TP. So what's next? Option 1: Gold keeps dropping towards $2,980 next which is a huge support zone. Option 2: Gold pushes a little higher towards $3,040 before it starts to drop. Which option do you agree with more?

Gold has been dropping lower today as I said would happen last night. So what's next? Option 1: Gold keeps dropping towards $3,020. Target is very close. Option 2: We see Gold consolidate and play out a redistribution schematic within this yellow zone. Which option do you agree with more?

Gold is now down 570 PIPS from its high & melting down so far. Much more downside to come😉 We're currently seeing 'Minor Wave 1' of the overall bearish trend take place. Next we can expect to see a 'Minor Wave 2' correction. Those who haven't entered already, can take advantage of Wave 2 corrections. 📉

Like I told you all on the video update, we wanted to see a push up into $3,030 - $3,050 which we successfully hit, before a decline takes place. Now that we’ve seen a major Wave 5 (made up of 5 Sub-Waves) complete, we are seeing bearish momentum kick in & start moving price lower. Slowly but surely📉 All major and minor waves of my Elliott Wave Theory is...

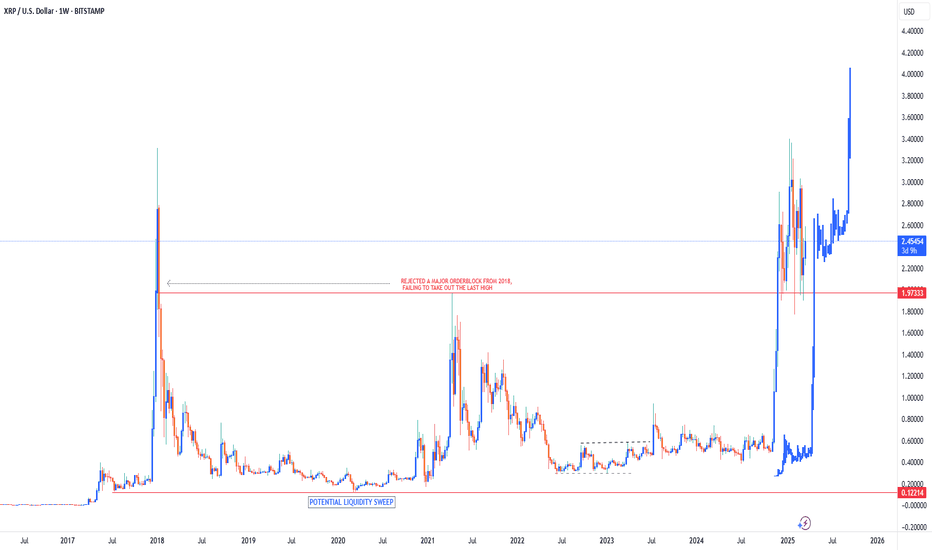

XRP still has more bullish momentum left & we can see an ATH towards $0.45! Now that the XRP settlement has been dropped, there is not much stopping it from moving higher.

So what's next? Option 1: Gold drops lower towards $3,020 as market is overbought. Option 2: We see Gold consolidate and play out a redistribution schematic within this yellow zone. Which option do you agree with more?

Our $3,035 buy target has been hit. So what's next? Option 1: Gold drops lower towards $3,020 before pushing back up again. Option 2: Gold pushes higher towards $3,042 before it DROPS lower. Which option do you agree with more?

As you can see from the video analysis, we’ve re-counted 5 Sub-Waves within the Major Wave 5 bull run. Now we’re waiting for some form of reversal📉 Selling Confluences👇 ⭕️Wave 5 Complete. ⭕️Bullish Momentum Slow Down. ⭕️DXY Found Support.

BTC buyers are holding up nicely so far. We have even seen a BOS to the upside, indicating further upside will follow. Now that Wave 4 has taken out all late buyers, we can see smart money come back in now from these lower prices and push BTC back up!

Last night I said I want Gold to hit $2,980 which it did this morning. So what's next? Option 1: Gold buyers hold steady & climb towards $3,020 - 40. Option 2: Gold DROPS lower from here towards $2,970 - $2,940. Which option do you agree with more?

As you remember from Saturday’s update I did say that Gold has surpassed $3,000, which opens up potential upside towards $3,030 - $3,060. 2 Scenario’s On How It’ll Play Out👇🏻 Scenario 1: Gold has a 3 Sub-Wave correction towards $2,964 - $2,940 (Wave 4), before buyers come in. Scenario 2: Impulse move towards $3,030 carries on from CMP.

As per yesterday's video update I gave you all, I said Gold would push higher into $3,030. That target has now been hit! Gold has pushed up strongly today, up 380 PIPS in less then a day. I'm waiting for bullish momentum to slow down as an indication that market structure will shift to bearish. I'll be keeping an eye on the smaller TF.

Since I posted this the other day, Bitcoin has been pushing up in profit! After a redistribution phase where late buyers got wrecked at the top the market, we've seen price drop back down liquidating billions in buy orders in the past few weeks. I believe this Wave 4 shakeout will now be followed by another bull run, like we are seeing happen now.

ETH buyers can't find enough momentum! That's the power of EW Theory strategy. We can see ETH remains within a 3 Sub-Wave (A,B,C) correction channel. From pure price action we can see that price remains bearish. Wave C target still remains around $786🩸

Since I posted this last night, price of BTC has been pushing up very nicely! After a redistribution phase where late buyers got wrecked at the top the market, we've seen price drop back down liquidating billions in buy orders in the past few weeks. I believe this Wave 4 shakeout will now be followed by another bull run, like we are seeing happen now.

Gold hit our $2,964 TP today, but failed to hold as resistance. So what's next? Option 1: Gold keeps pushing higher towards £2,993 before rejecting and dropping. Option 2: Gold DROPS lower from here towards $2,976. Which option do you agree with more?

After a redistribution phase where late buyers got wrecked at the top the market, we've seen price drop back down liquidating multi-billions in buy orders in the past few weeks. I believe this Wave 4 shakeout will now be followed by another bull run.