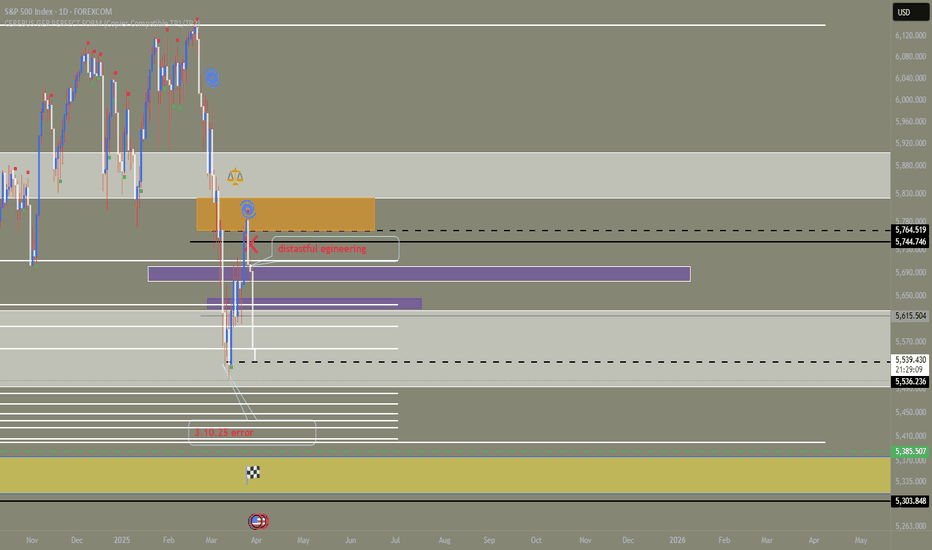

Let me start by saying SPX is my baby—this market gave me vision and taught me what I now call Cerberus. It pains me deeply to see such sloppy price engineering lately. These folks have gotten real careless with their price delivery, and that sloppiness is starting to spill into the broader global market. However, it's clear from the Thursday error that they...

While everyone is loving these easy gold buys, it's about to take a nasty dive. Now, I'll admit I don't trade gold often, but trust me, I'm still better than all you scrub gold traders, so listen closely. Gold's run time is almost over—enjoy these highs and start booking your profits because, believe me, the big boys Powell and NEM aren't about to let Trump slide...

Despite the narrative around Europe and its markets, there's surprisingly a sharp turnaround ahead. It's all thanks to those egregious errors engineered back in February. Whatever hand forced them to print has already lost their position and is now out of the market. The current sells we're seeing are just data entries setting up an explosive measured move toward...

GER shows a mild bearish undertone with potential for a larger drawdown if global risk isn't contained (I'll cover global risk in another post). Doing a top-down approach, the weekly chart is the most concerning—it signals a quarterly sell-off aiming to clear a long-range liquidity pocket. I'm eyeing 21480 as the profit-booking event, likely occurring around the...

THE TIME IS NOW 12/31/2023, AND A NEW AGE WILL BE ENTERED AS 2024 IS THE YEAR OF 8 AND 8 BEING OPPORTUNITY AND ABUNDANCE. AS THE STARS SHIFT, SOME WILL SAY WE WILL ENTER AN AGE OF GREAT DESTRUCTION AND TRANSFORMATION, FOR I ALSO SEE THIS INCOMING. As I have, I sat and stared at the charts with new eyes, I asked may the future be revealed. After some time passed,...

when approaching the market one must remember that price is one meaning that it is truly just going in one direction in the long term view. price is a creature of habit like anything else in this world once we fully understand this we can start looking at its observable patterns that has been hidden in plain sight. as spoke on before price or "they are to big to...

continuation of last week move now traping buyers and creating liquidity for sellers . all at the sime time unwinding the buy sell positions held for the movers

FRIDAY algo price has already ran the london algo yesterday playing above its target of 75. this will lead to chaos and traps as price tries to meet its order by wednesday 3 pm. much faith in the higher side has been taking out . now price will use the weak energy of the trades to lift to new highs leaving all sellers trapped for greed. if price closes just one...

i want to start this off by doing a quick update on my market aproach since its has been over 7 months since my last post. these ideas that i will share over time will be like a gift from god. over the coming months i will try to show proof that spx and all markets run off one cosmic time with the price being set into the equation a minimum of two swings before...

this is an update to a idea i shared a while back breaking down the state of crypto. as time has passed, fiscal policies have been set in place, and more unwinding of market structure we now have a clear pic for Q4 -Q2 and that is bullish AF starting off with the 1M WE can see that the mcap has did a 80% retracement which in my eyes is the golden...

here we have the daily on btc which is looking very bullish at the moment in respect to recent movements. so lets dive in and do a full break down! first thing first lets look at the higher timeframes starting with the total crypto mcap to cross reference the overall market health and projection alongside with btc for a better sense of direction total crypto...

on part two we will discuss how the 10% looks at the markert, and first thing first is understanding market structure from the proper lens. this time around i will save time by only talking about my philosophy to the market vs opposing retail so lets dig in. when approaching market structure one should ask. who why and where is price going . put yourself in ...

here we are looking at the 1d chart of btc starting from 1m down we have a swing high of november formed with the dec high respecting the nov body with an perfect 50 % rejection of the body. now curently jan high testing the balance created on aug- sep while at the time of this writting it is holding strong for the shorts liquidity is being formed on the 40k...

now that btc has hit my 54k target i will be expecting a small bounce to trap th buy the dip traders and the novice retail thinking thw worst has came if we look at the 3d btc ran too far under the open showing signs that it want to go lower the 1d the 3d also has fromed db which is always a target for me bc retail will place limit orders under allowing "them"...

im making this post to let my followers know that i will be returning to trading fx for the time being. this is only untill i can find more solid setups in the crypto market as my main focus will always be crypto other makrets are way to slow and boring! that being said i want to show my followers one that im the greatest trader lol. two that all markets are...

this is an upadate to the market cap i called a few weeks back im expecting the entire market cap to crash to 1.269 mcap key takes 1w jefe bear has formed indicating a sell top is in 1w low ran the open candle meaning prce want lower targets at 1.829 mcap next we can see a test/ bounce back to a 2.374 mcap as that would be a 50 ine fib level the 3d low ran...

TODAY IS friday and btc is now moving up bringin all the moon boys back to life btc has now hit its open bear target for profit booking/ possible full closure at 56887 btc also posted a 6hr bull jefe confirming bears closing out positions outside of that no other meaningful price action is on the charts at this time if we do an correlative analysis we can not...

today we have the total crypto makret cap w/o btc first thing that stands out is the 1d jefe bear that has fromed showing bears with a bull trap and aiming to drove prices down and shed some money off the markets overall the 1d chart also shows a db which will entice retail to think a market is bouncing giving way for a possible liquidation run for almost all...