"Smart money signals: Whale ratio (top 10 addresses) up 17% monthly Exchange outflow spikes (+$8.2M past week) Open Interest rises while price consolidates Technical confluence: • Adam & Eve double bottom forming • Volume surge on up candles Entry strategy: Scale-in between 4.40 − 4.40−4.60 with 6:1 RR profile"

Critical technical juncture: • Price testing 200DMA

"Comparative analysis: GT: Highest staking yield (15% vs HT's 8%) GT/USDT volatility 23% vs sector average 18%

"After 18% correction: • RSI at 29 (oversold territory) • TD Sequential buy signal on 12H chart • Liquidity pool clusters at 4.25 − 4.25−4.35 Risk-reward ratio 1:3 at current levels. Watch for: Exchange reserve depletion (down 8% weekly) BTC dominance reversal"

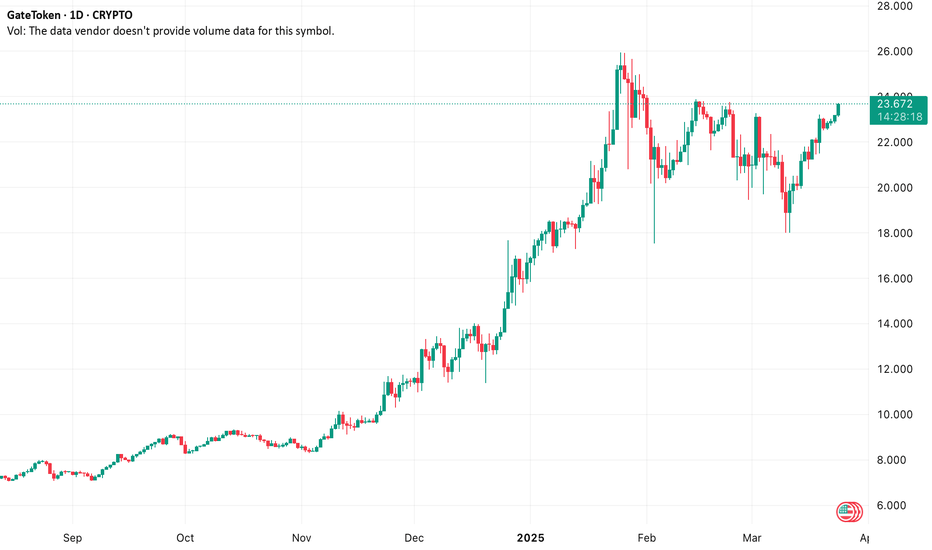

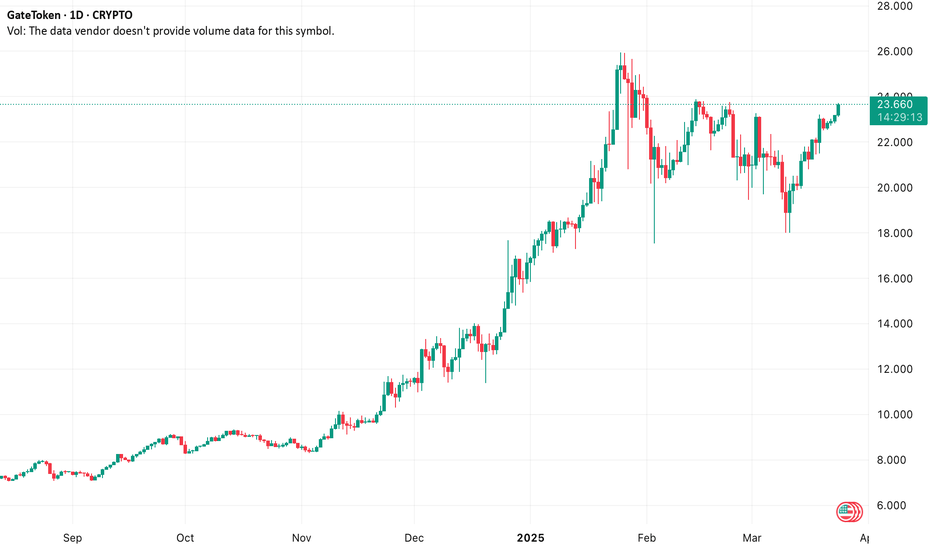

"Daily chart shows: • Flag pattern after 32% vertical rally • Volume decreasing during consolidation (healthy) • OBV indicator maintains uptrend

On-chain data shows 12% supply moved to cold wallets last month. Price correlation with BNB strengthening - monitor BTC dominance for sector rotation opportunities.

"3 reasons to watch GT: GateChain mainnet upgrade (Q3 2024) 15% APY for GT staking - highest among top 10 exchanges 80% circulating supply locked in products Technical outlook: Cup-and-handle pattern developing on weekly chart. Measured move target $6.80 if pattern completes."

"4-hour chart shows: • Price makes lower lows while RSI makes higher lows • Volume profile indicates accumulation near

"While major exchange tokens consolidate, GT shows relative strength: Golden Cross (50DMA > 200DMA) confirmed 24% TV growth in Gate.io ecosystem Q2 2024 Key Fibonacci levels: $4.80 (38.2%) acting as support MACD histogram turns positive on weekly chart Speculative buy zones: 4.60 − 4.60−4.75"

GT breaks descending channel on 4H chart with rising volume.