Binary_Forecasting_Service

PremiumBut reality doesn't work that way. Odds change when facts change. And right now here are the facts: 1) this continues directly from "6200 BY HALLOWEEN" 2) which I stayed was not going to happen AHEAD OF THE WEEKEND 3) which Trump bombed Iran and everything... 4) so here we are, I wrote of 3 routes in play 5) in chart above here's how it's going to go 6)...

This took a lot of headache to figure out, but I finally did it. And here's what I see: ` 1) we top this October, gold at 6200 2) silver, I could care less until it surpasses gold meaningfully 3) and I still don't see it this year 4) silver's 45-year line is UNDER $51, I do not see this breaking 5) despite gold moving agressively to 6200 6) that is what the math...

1) features 2877 low for gold 2) 31.45 low for silver 3) by end of July 4) with entries coming end of September 5) long to March 15th 2026 6) gold to 6655 7) silver to 144.55 8) if both charts hit to September 9) I'll have something going on then

If you are reading this, it is because you have followed my gold forecasting for some time and you also realize we are at A SUPER CRITICAL INFLECTION POINT for both gold and silver as precious metals attempt to reclaim their rightful position in global asset allocations. That is to say, the possibility for wealth accumulation in the incoming 7-year window in the...

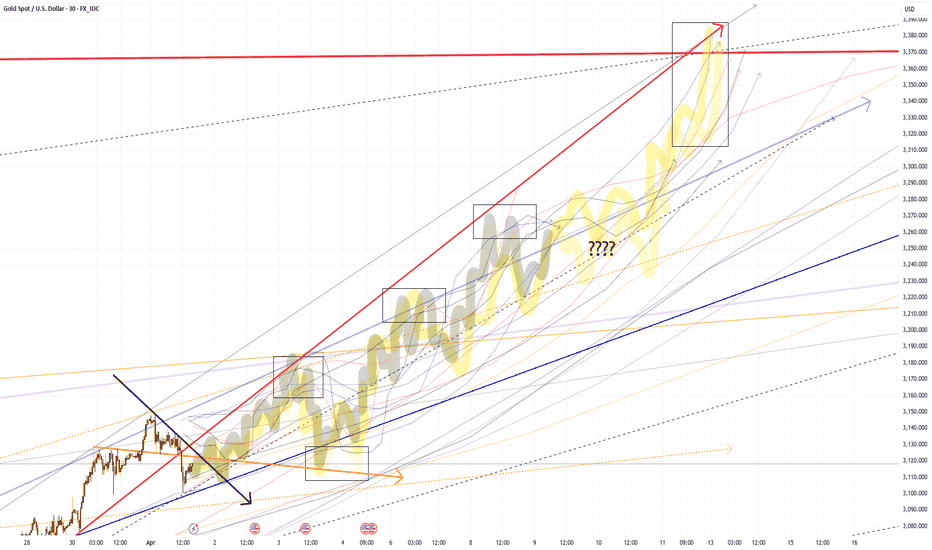

Bulls are favored as long as prices remain above 3320 ahead of FOMC. However, since U.S. aftermarket close, bears have dropped price $50 already but they still need $65 more. It's FOMC tomorrow at 19 hours out from publishing this post and chart above is the binary outcome. Bulls' route to 3760-3850-3965 have only appeared in the last 18 hours, but have strong...

This continues directly from post #12. Considering what is happening in S&P 500 as well as silver, this should be the favorite right now with 46xx ceiling in April of 2026. Second place is 2960-3160 floor with 5000+ ceiling. I just do not see how we move "massively up" without some kind of wipe out in this window. As usual, I will add as we go. But be aware...

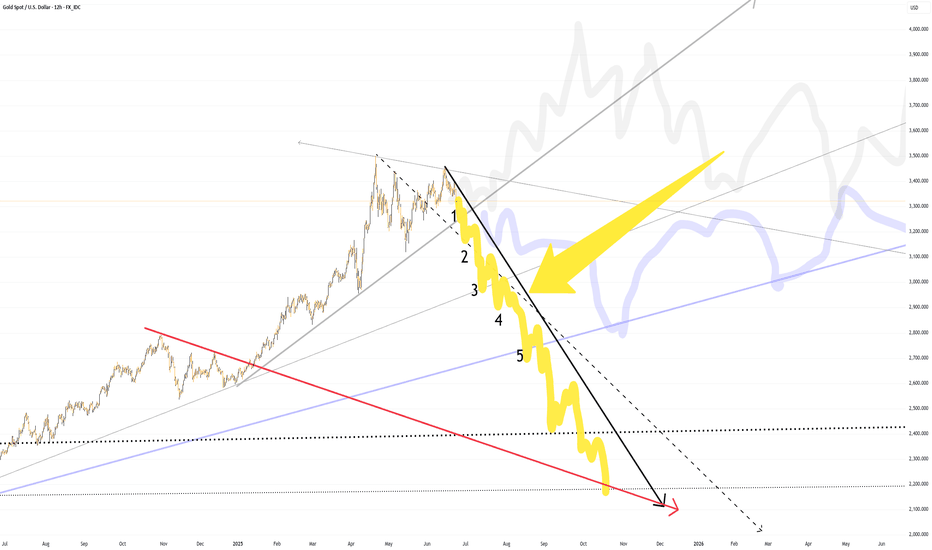

All the details necessary to understand this draft, I have written in closing notes of DRAFT #11 (previous draft). On an ALL TIME BASIS, it's not obvious top is in. However, the record high volumes (across all markets, or otherwise understood as cross-market volatility) has me convinced that top is in and we are going down to 2163 BY SEPTEMBER 26TH. All that...

As stated last night, DRAFT 10B would invalidate in 12 hours. This is what this looks like now, with the 4/11 ceiling now lower. Let's get this up and I'll add notes. YOU CAN GIVE ME A REASON TO KEEP FORECASTING - I need a reason to keep doing this - and what I need is attention for my work - so let's make a trade right now - a lot of my time for just a...

I did not label the previous post as #10. Since this revision comes from gray route in last notes of previous post - and that that the remainder of the move is essentially the same - this is DRAFT 10B. In chart above, this revision have been edited four times and it has only reconfirmed what I thought his morning wit when I posted: 1) so since that draft, the...

Continuing directly from post #9, I expect a NEW ALL TIME HIGH ADJUSTED FOR INFLATION. 1) I spent the last hour to reconfirm that this move should be out right favorite 2) and the math is undeniable 3) first 3190-3210 on 04/01 and/or 04/02 4) the retrace to 3100-3120 will absolutely be bought 5) and understand that as I type, price is 3119.xx 6) this can only...

So I wrote these notes only for my followers before the open: >> 5) while working on this (this post), I found that there is one legitimate outcome >> 6) that I have not eliminated >> 7) and that is SAME MOVE to November, BUT 2X SPEED >> 8) that would mean 3900 by 5/15, AND 2600 BY 7/30 >> 9) if this is to be the case >> 10) then we would hit 3245 by this...

This could be the call of the year. I have been trading for ten years. I have been forecasting gold prices for five years. After two and half years of forecasting (or 30 months), I already knew I what the long term meant for gold prices. Replay this chart from posted 11/10/2022, still hitting now, 28 months later: This chart above posted November 2022 was...

Continuing directly from post #7, this if the intermediate draft until 4/11, simultaneously the final public intermediate draft. From a technical perspective from doing this 10 years now, this can be consider a semi-perfect draft on an 14-trading-day basis (now to 4/11). It's incredibly difficult to manually do it much better. If you've followed me long...

Ran out of time last night to say what I wanted to say. So let's get this up IMMEDIATELY AT 6:35 AM 3/24, 2025. In my very humbled opinion, BLUE ROUTE IS NOW THE ONLY CASE PERIOD WITH THE ONLY EXCEPTION BEING WHAT HAPPENS IN THE NEXT 21 HOURS. That is to say what does the zig-zag if any look like from now to London open tomorrow? Will add notes as soon as I can.

So right now it's July 3777+ high and November 2580 low, with extensions to 2425 and even 2222 not eliminated. Should those hit too, they would come in December, January, early February at the latest. This is why I've called this series "12 BASIS" starting last month. Long story short, super detailing trend maps reveal that it is very very difficult to...

This continues directly from #4. We are at max stall for bulls, something has to break and odds heavily favor a bullish move to 3110 in less than 24 hours, with 3130 extension Sunday night. This is the 22-min bar chart that best describe trend action of this move. In chart above, there are some details I want to talk about soon, but the main points are: - as...

The route price is taking means 3250 soon. There is not a lot to discuss except detailing the move up. These five boxes are my best gauge of this pattern right now. Will add more when I can.

This continues directly from #2, so if you need background read previous posts. You are not going to understand what I am doing if you don't have background. Otherwise, I said previously that I would cover this move until price checks 100 down from the high. Well it looks like it's going to be 3065 Wednesday before FOMC and then 2945-2955 on Thursday 3/20. ...