Binary_Forecasting_Service

PremiumBACKGROUND - Please read previous posts linked to this post. WHERE WE ARE - This (yellow) route to 3777 makes WAY more sense by now mathematically than previous blue draft. This route is now the strong favorite with one minor outcome to eliminate on the way. In chart above, gray hi-light is most likely version of yellow route RIGHT NOW. We are at that stage...

If you need back ground for this work, the links two the previous four posts are linked to this draft. For everyone else, trend super detailing made me realize that the black trend line that held the rally from 2580 to 2955 is going to break again, TWICE. As stated previously, this would ensure that the 26-year resistance line is (dotted at top) will get hit. ...

This drop today put one more twist in this route, but it's not obvious that blue will win yet. This is because price can still reverse to yellow route. The rule here says until bold black line breaks, yellow should be favorite. This is technically true. But From 1 hour bar, the writing is on the wall that says 3000 won't come until second half of March. Which...

I have the route. I have the pattern. Trend map readings reliability off the charts. But, you have to read all the notes in the previous draft first. If you haven't, this is not going to make sense. So do that first. Otherwise, this continues directly from previous notes. To sum it up, we are going to kill it. Will add more soon.

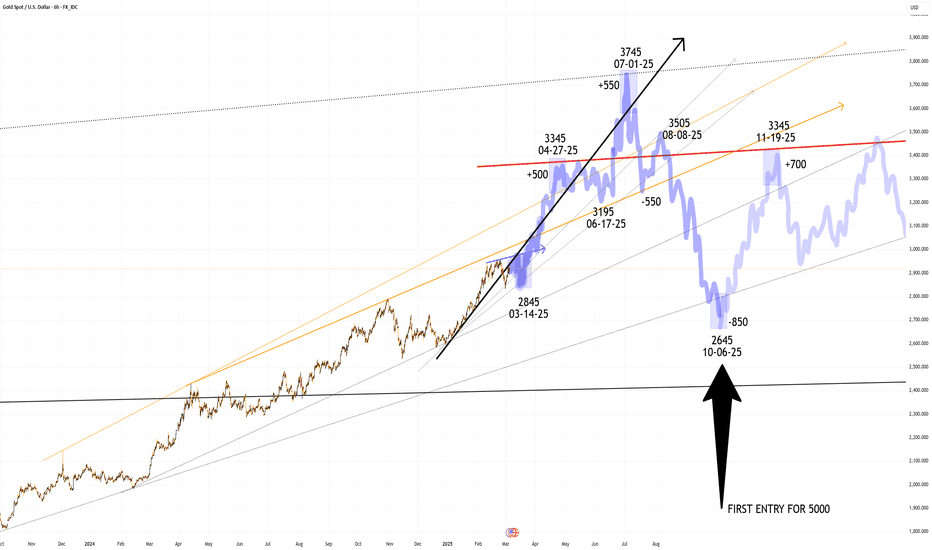

First and foremost, gold is in long term bull market. I can see $6500+ from here, but that's talking years out. This also implies that the one day, probably years after 6500, gold will be 10,000 and higher. That is the base case and it's hard to disagree with. However, once gold clears 3135 (and I think 3215), the correction is somewhere between $925-$1300. ...

This is the only route I can think of to make everything make sense. Why? The yellow box in chart above is the runaway since 2840s which is incredibly difficult to make fit IN ANY SCENARIO. First, this last 100 points from 2840s to 2940s means the run is not over by any means and at a minimum, should clear 3135 by early June. Let me be clear that if price...

In last notes I wrote that yellow route would mean prices move for 2975+, on its way to 3333 and ultimately 4900-5000. The short term momentum is implying top is in, and while this is not final, I just cannot make that route make sense in the long term picture. So I see only two routes forward that makes sense, and I think it's BLUE ROUTE.

By now, blue route is favorite by a wide margin. The only question is which of these blue routes it will be. We are only talking minor variations of the same move, of which dark blue is the outstanding favorite of them all. This issue, I will cover with "modified continuous coverage", best fit to the trade we are trading for. And that is: 1) BUY 2715 AT BLUE...

This draft is the base case for route to 3000 and eventually 4000 as discussed in closing notes of "RUMORS OF A PIVOT REQUIEM PART 3". In "continuous notes", this is a sample of 8-min bar continuous coverage towards "LAST ENTRY FOR 3850" period, full stop. Odds favor blue box over yellow box right now about 2-1 to 3-1 . What is "8-min bar continuous coverage"? ...

Continuing from notes in PART 3, this post serves several purposes. Let's summarize the "LONG TO 3850" first. I have already expounded on this subject several times but in danger of repeating myself: 1) we are well past "the entry" weeks ago at 2590s 2) the last "good entry" for 3850 is actually in March, 2650-2670 3) but the last STRONG ENTRY, is about...

Price has rejected all faster combinations of this move. So no update needed until after FOMC in late January. This means 2765-ish before FOMC and 2675-ish after FOMC before 2850-2900 in late February. Until then, we are total long with total conviction.

01/02/25, 4:07 PM ET, New York time: What does that even look like? So first, in chart above, the light gray rectangle was the 12/30 or 12/31 high 2760-2820 original target for "December long". The second move to 2595 on 12/30 apparently fooled a major player and from the looks of short term trend maps out 60 hours or until 3 AM ET Tuesday, they are going to be...

Since Trump got elected, we have eliminated the 2380-2400 check down to 45-year trend line. We have raised the floor to 2450, 2480, 2520, 2580, now we are breaching 2600 current March low looks like 2618 AND RISING. It is NO LONGER OBVIOUS THAT the check down after 2800s is under 2680s. So what this means is that the "December long" which became "January...

This is most complete draft finish minutes ago. This is published for our group to track the move ending 12/30. Note that the 12/30, 2820s exit is simultaneously the entry for JANUARY SHORT to 2540s. 190 points in 12 days is pretty damn good reason to post this.

In PART 5, I wrote that my only concern was a shift to a faster route than PART 5 (but still slower than PART 4). With the 2024 elections in the history books, I have enough now to call the entire route for the next 27 months or basically to February of 2027 to a high of 4800 (or higher). In last notes in previous post, I wrote that the 2780 high before November...

First, thank you for all your kind messages but the reality is there is not enough demand for me to keep doing "continuous forecasting". With that said, I know now PART 3-6 with link here (hit replay twice): ... is more than likely to miss the route to 3600-3750. Since PART 4 (posted months ago) is not going to help, PART 5 is a summary of what I wrote at...

We are going to go to 3600-3750 by September to December of next year. However, there is going to be a giant sideways to up move that can take four months to resolve before price moves aggressively higher in February next year. That said, price action has not revealed "which sideways to up pattern this will be". Beyond that, I am losing interest in the...

LEGENDS NEVER DIE, OR SO I HEAR: This is a pretty massive call now that we are here and because of the the time restriction. First, I fully expect price to bet at 2645-2650 on morning of 10/07. Halloween is 10/31, so in that range there are less than 19 trading days to run up 425 points or 16%. A call for gold to move 16% is meaningless by itself. BUT A...