BluntForceOptions

PremiumSLDB For those following Fib levels, SLDB’s surge from $2.41 in mid-May to over $7 has tracked cleanly through key zones. The stock hit resistance right at the 0.618 ($7.33), which also lines up with a prior breakdown area. Until we get news on potential accelerated approval, FDA meeting outcomes, or another catalyst, this may act as a short-term top. A healthy...

AAPL has now broken below a well-defined symmetrical triangle structure, as well as the ~$208 S-1 support area I’ve highlighted. I’m watching the $194.91 zone (S-2), which served as a key support and pivot earlier this year. If price heads into that area, I’ll be looking for confirmation and stabilization before initiating a position. If the setup aligns, I plan...

UNH is approaching a broad structural support region I’ve been tracking -- a wide zone from $239 down to $186, where (for me) the stock begins to offer compelling risk/reward and long-term value. Momentum, IMO, is still decisively lower, but we’re nearing levels where I start preparing. The midpoint of the “Buy Zone” near $213 reflects a potential average cost...

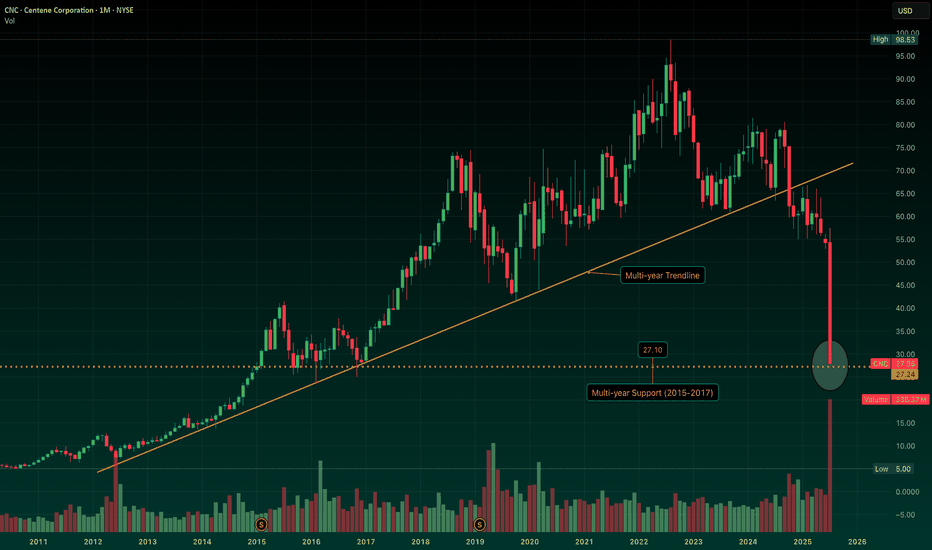

CNC broke its multi-year trendline months ago, and the recent flush drove it straight into key support from the 2015–2017 range (~$27). Big structural break, but also a spot where longer-term buyers may start stepping in. As noted earlier, I began building a defined-risk long via 2026 LEAPS (Jun $55s, Sep $50s)... a slow-burn recovery setup targeting...

Chart update: We tagged resistance at $4.44 (R-1) before pulling back and closing right at S-1 support ($3.82). After the strong multi-day run from the $2.50 zone, this kind of retracement is normal... even healthy. If we see further downside, I’m watching $3.25 (S-2), which lines up well with the reclaimed trendline that should now serve as support. Still...

After months of consolidation at depressed levels, the setup finally resolved with conviction. The chart shows a clean break above long-standing trendline resistance (new support), after a bullish reversal off that $2.50 zone -- a level that’s now proven to be a meaningful pivot. July 11 marked the first close above $4 in quite some time, with above average volume...

CAG has officially entered the Buy Zone I outlined in May ($21.12–$16.51), with today’s move pushing shares to the high $20 range. This marks the first time in over five years the stock has traded at these levels -- historically an area where buyers have stepped in. With the zone now in play, I’ve started initiating exposure via short puts and common...

CAG Approaching the upper edge of the Buy Zone I mapped out on May 25 ($21.12–$16.51), with today's move down to $21.57 putting it right on deck. The chart remains structurally weak -- monthly candle still hugging the lower Bollinger Band, and the long-term trend hasn’t shifted. Plan hasn’t changed: I typically begin scaling in near the top of the zone and add...

It’s been a strong week for longs. Cleared plenty of technical hurdles along the way: broke out of the descending triangle setup, reclaimed EMAs 50/100/200 on the way up -- exactly the type of clean sequence you want to see. Now testing that important R-1 resistance zone (early May rejection). A decisive push above $4.32 clears the way for further momentum. If...

The stock's been in a steady downtrend since late 2024, and more recently formed a textbook descending triangle: sloping upper trendline (resistance), flat lower trendline (support). That support level gave way on May 30th with a decisive break lower. We saw a brief attempt to reclaim that support zone, but so far, the $3.81 area has flipped into resistance....

Technical & Fundamental Update Stock continues to fail at the EMA 50 -- another rejection at overhead resistance keeps the downtrend intact. S-1 support at $1.18 is back in play, with S-2 at $0.88 marking the 52-week low. A sustained break of S-1 opens the door for a potential retest of that lower range. For those unfamiliar: the company announced it's...

Just sharing a chart for those who care about technicals. Despite my bullish stance long-term, the setup here is worth noting. The stock has had a strong move off that $2.50 multi-bottom, but it’s now stalling close to the 50 EMA -- which also lines up with the upper trendline of a clear descending triangle. That descending triangle pattern, by nature, tends...

GM, y'all. Not a flashy chart -- just laying out the key levels I’m tracking. Price is respecting the descending wedge, trading between clearly defined trendlines. My bias leans lower here. Watching that S-1 zone near $18.96 as the next potential support. If that fails, S-2 at the lower trendline could come into play. FWIW: Closed out my short puts with a solid...

Still in a confirmed downtrend, IMO, with price action reflecting a mix of structural and macro headwinds. No interest in forcing a trade here -- but I’ve mapped out a "Buy Zone" between $21.12 and $16.51, where I’d look to scale into a long-term position. The chart remains decisively bearish, reinforcing the view that the path of least resistance is still...

Consistent with my revised thesis and the elevated regulatory risk, I’ve outlined a downside range on the chart where I’d consider getting involved. The top of the zone is marked at $2.51 (April low), with the lower boundary at $1.81, the October 2023 low. Given the current backdrop, I’m not stepping in until price moves into this range and the broader setup...

The chart just printed a clean double top near $4.34, with back-to-back rejections signaling a potential short-term reversal. If this pullback gains traction, here are the key support levels I’m watching: S1: $3.93 – prior resistance turned support (breakout zone) S2: $3.55 – strong pivot level from April consolidation S3: $3.12–$3.15 – intermediate structure...

Chart update: KYTX broke above the neckline of the cup and handle pattern I flagged on Apr 24. I’ve updated the chart with short-term price targets at R-1: $2.52, R-2: $2.62, R-3: $2.71, and R-4: $2.91 -- which also aligns with the SMA 100, making that zone a key double resistance level. I’m particularly focused on the $2.71–$2.91 range, which looks well within...

Respecting the EMA 50 wall here and keeping a close eye on key support levels as the setup continues to play out. Important observation: Price action has consistently failed at the EMA 50 resistance level -- a pattern that's played out multiple times now, including the most recent rejection. In the current skittish environment, no real reason to expect this time...