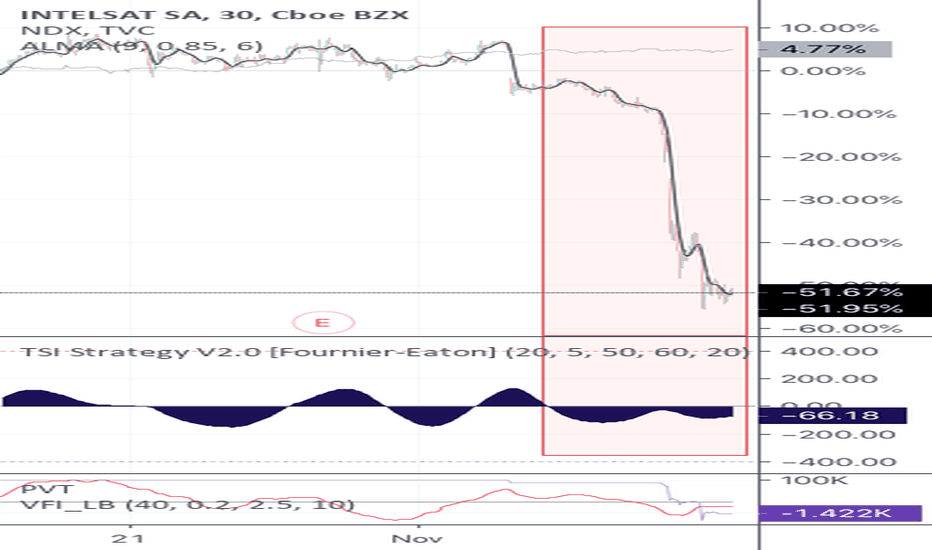

Trend Shift Indicator saved me from the worst of today with two weird peaks and a precipitous indicator drop that seemed scary enough to make me sell prior to the worst. Despite the very short upswing TSI is still hanging low. Volumes aren't great and the volatility is likely not over. We are exiting the speculation phase of sentiment-is-all and moving to the...

As the community of traders reckons with many a crazed new-comer and their love of gamestop GME and AMC we have to be glad that people are being more and more interested in trading. However, for many of us, trading isn't to make a statement: it isn't to make a point, to stick it to someone or to prove how resolute you are. For me at least, trading is the end...

QQQ seems not to have any near-term support within a wide margin Dynamical Support and Resistance Indicator shows possible drop or rise without much friction Beware

Great divergence indication prior to price jump using ERSI ERSI Since showing a bit of weakness ERSI best for buy signals. Hold

After the recent run-up I'm generally neutral on the "stock condition" but bullish on the company and the stock overall. Experimenting with buy points, ERSI seems to be giving some good buy signals without terrible sell signals ERSI isn't great yet at sell signals. Please try it and leave any suggestions you might have.

Early Reversal Signal Indicator (ERSI) and Trend Shift Indicator (TSI) opening on the 1 month view ERSI and TSI respond with 5 buy-points per chart view -- so look for support to last approximately 4-5 trading days ERSI is best at BUY SIGNALS -- look to TSI and EARS (bottom two indicators) and others for sell.

Updated Trend Shift Indicator Script indicating upper end of standard deviation, volume flow decreasing and macd of tsi lower. Time to take a break.

New more reliable indicator: ERSI-- "Early Reversal Signal Indicator" show positive strength on the 1M chart. Trend Shift Indicator also showing positive opening EARS (for very early reversal info showing red to green). Conclusion: not yet time to sell.

ERSI: Early Reversal Signal Indicator showing opening momentum Trend Shift Indicator: showing reopening momentum. Looks like we can hold a bit longer before a breather.

1. TSI showing weakness 2. Wait for blue with positive signal line.

Volume Flow is still positive, Early signals still positive - neutral, Look for market correlated drops as entry points.

Trend shift indicator (v2.0) histogram— along with other volume metrics —has this still weak. Wait for momentum and cross above 0 on TSI

Trend Shift Indicator flashing red again. Adding some caution and hedging could be smart.

Trend Shift Indicator did really well on both: 1. seeing the tops in the past 3 months 2. showing improving trading action while still in a price decline. Volume etc looks great. Time to get back in

Nice performance of TSI Update on AYX reversal Major Update to TSI: Please Read update on script Strategy version available: "trend shift indicator strategy V2.0"

Looks like the downward momentum is still established. Wait for signal line (crosses to turn blue(not purple))

Price was steady TSI signal gave >1 day warning (black) Confirmation gives several hours. (Main plot) ------- Signal now shows a potential level out. Wait for confirmation. www.linkedin.com

Good performance by the EARS (Early Reversal Signal) and TSI (Trend Shift Indicator). EARS signals early potential shift Downward trend in TSI likewise