Key Observations from GEX Chart 1. Call Resistance: * Strong call resistance at $210, indicated by the highest positive gamma concentration. This level is likely to act as a ceiling unless there's a strong bullish breakout. 2. Put Support: * Significant put support is observed at $185, with additional support near $180. These levels are critical for...

Key Observations 1. Put Support: * A significant put support level is observed at $115, with a high negative gamma exposure of -73.82%. This level is likely to act as strong support due to market makers hedging their positions. 2. Call Resistance: * Call walls are visible at $125 and $140, with the second call wall at $140 being the strongest resistance...

Technical Analysis: 1. Trend Overview: * SPY is consolidating within an ascending wedge pattern but is now testing critical support levels near $598. * MACD shows bearish momentum as the histogram dives deeper into negative territory. * Stochastic RSI has entered oversold territory, hinting at a potential bounce but no confirmation yet. 2. Support and...

Technical Analysis Overview: 1. Trend Analysis: * QQQ is trading within a broad descending wedge, approaching critical support near $510. Resistance remains strong near $533, where previous highs align with the upper trendline. * The current drop indicates bearish momentum, but potential reversal signs may emerge as it tests lower boundaries. 2....

Technical Analysis: * Trend Overview: IWM shows signs of consolidation after a rejection from the $230 resistance level, creating a descending pattern. * Indicators: * MACD: Bearish momentum is building as the histogram dips further below the zero line. * Stoch RSI: Oversold conditions with potential for a short-term bounce. * Key Levels: * Resistance:...

Technical Analysis: * Trend Overview: NVDA has recently broken below the short-term support trendline, aligning with a bearish pattern. The stock is testing a critical support zone around $116, with declining momentum. * Key Indicators: * MACD: Bearish crossover with increasing negative divergence indicates selling pressure. * Stoch RSI: Currently near...

Technical Analysis: * Trend Analysis: AMZN is consolidating within an upward channel, indicating a potential continuation of the uptrend if resistance levels are breached. * Key Levels: * Support: $232.20, followed by $225.85. * Resistance: $241.77 (recent high) and $250.00 (psychological level). * Indicators: * MACD: Bearish divergence signals a...

Price Action Analysis Tesla (TSLA) continues to demonstrate high volatility, trading within a range defined by critical support and resistance levels. The stock recently attempted to breach the $420 resistance but faced rejection, with current trading levels near $402. Downward momentum is building, indicated by increasing selling pressure and key technical...

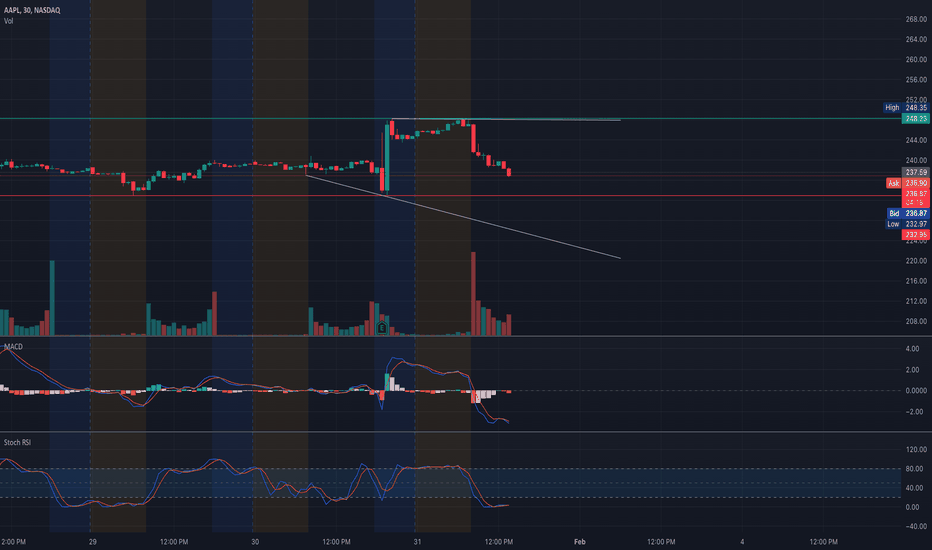

Technical Analysis (TA) Overview for AAPL: * Price Action: AAPL faced a sharp sell-off from the $247 region, breaking below intermediate support at $240. Currently, the price hovers near $233. The volume spike during the breakdown signals strong bearish sentiment. * Trend Lines: A narrowing wedge is forming with lower highs and support near $230, marking this...

Technical Analysis (TA): Current Price Action: * GOOGL has recently broken out of a descending channel and is now trading above $200, showing bullish momentum. * The price reached a high of $205.48 and is currently consolidating. Key Support and Resistance: * Support Levels: * $200 (psychological level and recent breakout point). * $192.50 (historical...

Current Market Overview * Price: Trading around $237.21 with a downward move today. * Volume: Noticeable volume spike during the recent sell-off, indicating active participation. * Trend: Breaking below key EMAs and weakening momentum suggests bearish sentiment in the short term. Key Observations 1. Support and Resistance Levels: * Immediate Resistance:...

Market Structure Analysis: SPY is trading within a symmetrical wedge, suggesting consolidation with a potential breakout approaching. Recent price action indicates higher lows, creating an upward bias, but resistance around $610 needs to be cleared for confirmation of further upside. Support and Resistance Levels: * Immediate Support: $600 * Key Support: $590...

Price Action Analysis * Trend Overview: The price has been moving in a consistent upward channel, forming higher lows and maintaining support at key levels. The current price is approaching a resistance zone around $533-$535. * Support Levels: * $521 (short-term horizontal support). * $502 (major support from previous consolidation). * Resistance Levels: ...

Technical Analysis (TA) Summary * Trend: NU is in a short-term uptrend with a rising channel as seen in the chart. * Key Support Levels: * $12.80: Strong support near recent price action. * $12.39: Intermediate support in case of a pullback. * $11.85: Critical support and potential stop-loss area. * Key Resistance Levels: * $13.55: Immediate...

Technical Analysis Price Action Overview: * Trend: AMZN is currently in a consolidation phase, forming a tightening symmetrical triangle pattern. This suggests a potential breakout, either upward or downward, depending on volume and market sentiment. * Key Levels: * Resistance: $241.78 (previous high) and $250 (gamma wall and psychological resistance). *...

Technical Analysis: * Price Action: META is consolidating between the key resistance at $716.17 and support at $676.49. A breakout above the resistance level could indicate further upside momentum, while a breakdown below $676.49 might signal a bearish shift. * Trend Analysis: The stock has been maintaining an uptrend channel, supported by ascending trendlines....

Price Action Analysis * Current Price: $401.00 (Ask) * TSLA is trading within a consolidation zone near $400. Recent price action suggests indecision, as the stock tested resistance at $413 but failed to sustain momentum. * Key Support Levels: * $395: Immediate support, aligning with previous consolidation zones. * $378.85: A stronger level that could act...

Price Action Overview LLY continues to show strength with a clear upward trajectory. The stock is trending within a rising channel on the hourly timeframe, supported by increased volume. It recently tested the upper boundary of the channel around $825 and showed resilience, suggesting strong bullish sentiment. MACD and Stochastic RSI indicate overbought...