BullishCanadianInvestor

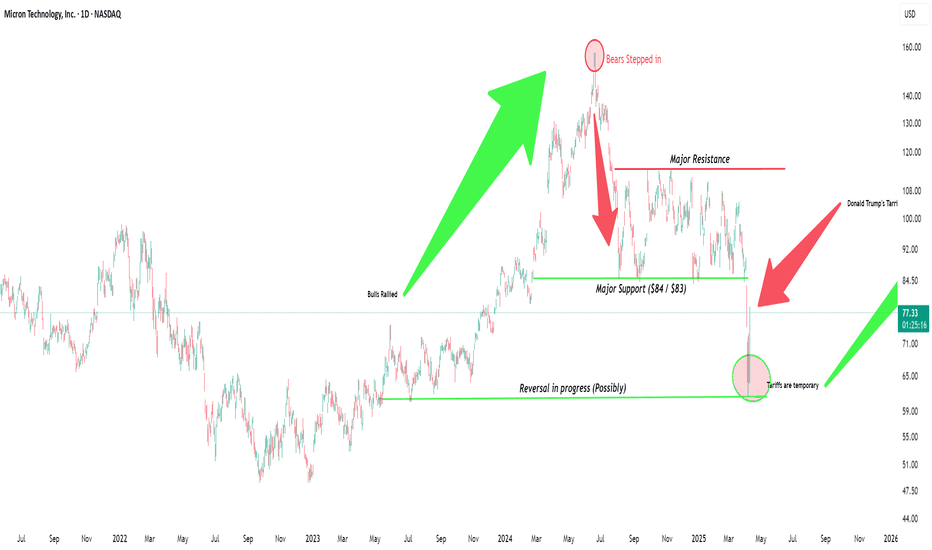

EssentialNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United...

NASDAQ:COST is an interesting company that benefits from inflationary conditions where consumers are looking for cheaper products or more product for their money. Costco is aided from its membership business model. The Stock itself rallied 38.35% YTD "Year to Date" and 60.79% in the last Year "365 Days" I personally like the stock but think due to the valuation...

NYSE:ANET is a popular tech stock with strong fundamentals while valuation methods such as PE Ratio, Price to sales, etc, might be signaling that it is overvalued, the forecast projections remain strong. Arista Networks has no debt and more then 3 Assets per Liability, With more then double the Cash to cover Liabilities also growing Equity rapidly this company....

NYSE:PLTR is one of the most popular stocks of the last 2 years , and not for no reason being a high revenue growth stock "16.8% Growth Rate" , My personal problem with the stock lays with the valuation holding a PE Ratio of 201x, and a forward PE Ratio of 172.5x, a 20.1x Price to Books Ratio, and a 32.8x Price to Sales (Revenue) Ratio. an interesting Return...

NASDAQ:COKE recently seemed to have a double bottom form in Coca-Cola Consolidated Stock , Where a recovery seems possible after having a small pullback in share price. NASDAQ:COKE Recently a lot of debt was added onto the balance sheet due to the buyback programs initiated by the management like ("$1 billion share repurchase program for its common stock.")...

One Of the Biggest Success stories of 2023... NASDAQ:NVDA Truly Gained traction under the insane Artificial Intelligence Growth and alongside the hype train that skyrocketed most Semiconductor Stocks. The Balance sheet is a undeniable strength with more then 3 assets to 1 Liability, with good cash able to cover debt based on the balance sheet. Nvidia has very...

Micron is in an interesting position after shedding a great amount of value in the last 3 months. The Fundamentals are great and Microns Balance Sheet has very few problems! with the double bottom forming this could be signaling a very bullish sentiment with a possible reversal towards the upside. Micron is currently being forecasted with Revenue and EPS...