Bwinks

PremiumSeriously, no "crypto guru" i've found mentions how BTC.D started high AND DIVED at the start of a btc-then-alt-season run.... NONE... meanwhile this season BTC.D and BTC only keep up with eachother... What is different about this cycle? My thoughts: institutions are heavily involved THIS RUN... they bought in during the bear season. They know how to **** most...

I was hoping the rally will be going up and up through the holidays but it looks like it needs a breather DURING the holidays. bullish

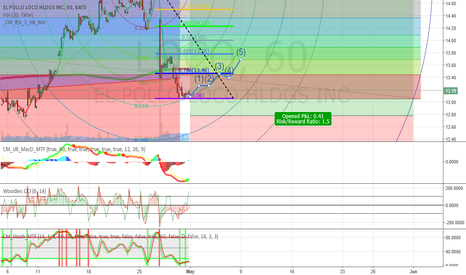

Currently in holding pattern to see if entry is a go... targets found. 4H

I was wrong in my idea last night that we were following a bat harmonic pattern in bear country. While I still see a pull back imminent, I note what I realize this morning, that this is not matching ANY harmonic pattern (AB and BC aren't aligning to the required .38 or .88 ratio)

Expecting a rally the first few hours on the first day...

NNA has solid fundamentals, but obviously that's not enough these days to mean much in short term trading. Dailys are showing solid bull set up with the indicators. Hourly indicators are a bit mixed. Daily Fib-arc, Bullish Gartley, pitchfork, and pitchfan are showing gradual-immediate bull. I'm in, are you?

I don't have trust in any energy stocks these days... CRC is no exception. Most indicators are showing it in the next few weeks tanking with or without the rest of the SPY. I'm assuming the price will drop and recover from the support at 1.76 and bounce back. Hopefully it will pass the mid-median parallel of the pitchfork and continue to the .786 or .618...

I'm seeing a set up for a bull run. Trend lines have been upward slanted the last few months and is still be tested (currently we are on/around the median). Fibonacci resistance/support lines are being tested too. I'm thinking either in pre-hours, or early hours after opening the price very well might fall due to exterior motives (SPY tanking); but I don't...

Indicators are showing solid grounds for a bull run. I'm assuming towards pitchfork median.

I'm seeing a shortterm bull followed by a quick bear move to the pitchfork median below.

Unless we go into an all our recession, I'm pretty sure this stock will keep doing it's own thing (based on beta). With that said, it's looking like over the first few hours on Monday this stock will do some dropping, most likely hitting the 1.618 pitchfan line created on the weekly and overlaid on the larger pitchfork. The area of the 1.618 is very close to the...

A very respondent stock in regards to Fibonacci analytics. The colored flag is from the trend based (12-month) retracement. Layered on top is the 1 month high/low Fibonacci retracement. I added a hourly and a daily fib arc (which the price action is currently trading within). Stochastic, CCI, and MACD look ready for bull switch over (though temporary). I'm...

Bloomberg (or was it Reuters?) predicted in November the economy would be moving sideways in a correction phase till mid-autumn 2016 at the earliest... Seems correct so far The head and shoulders is a bit obsolete but still can be considered a vague indicator of the direction (based on volumes). Fibonacci levels are agreeing between the different peaks and...

Again, most indicators are leading to a correction; I'm going short. With the recently tested 23.66 resistance, plus the blue downward-slopping warning line from the pitchfork, I'm guessing the price action in the next few days won't go above the 23.66 price point. The hourly and daily lower indicators (macd, rsi, cci, slow stoch) are all showing a possible...

For every indicator/tool used pointing to bull or bear, there is another pointing the opposite direction. If I had to make a choice however, I'd say this is bear. Failed attempt to touch median back in April, clear bear sign. Been coasting on lower parallel. Heavy resistance near 35 (from moving averages, along with prior resistance levels).

Looking at the fib levels, and hourly lower indicators; i'm pretty sure we are in for a bear in the next few days. However, things look a bit different (indicator wise, at least), when you bring in the dailies. They are looking bull.

Strong conformance to long-term Andrew's pitchfork. Lower screen indicators are not peaking, with the macd below zero; cci looks like its moving up towards 100; all signs of some bull movement. Have a strongly confirmed trend-based fib extension, fib retracement, and fib arc. Signs that this isn't longer-term bull market: (besides global news and markets) price...