CJBlueNorther

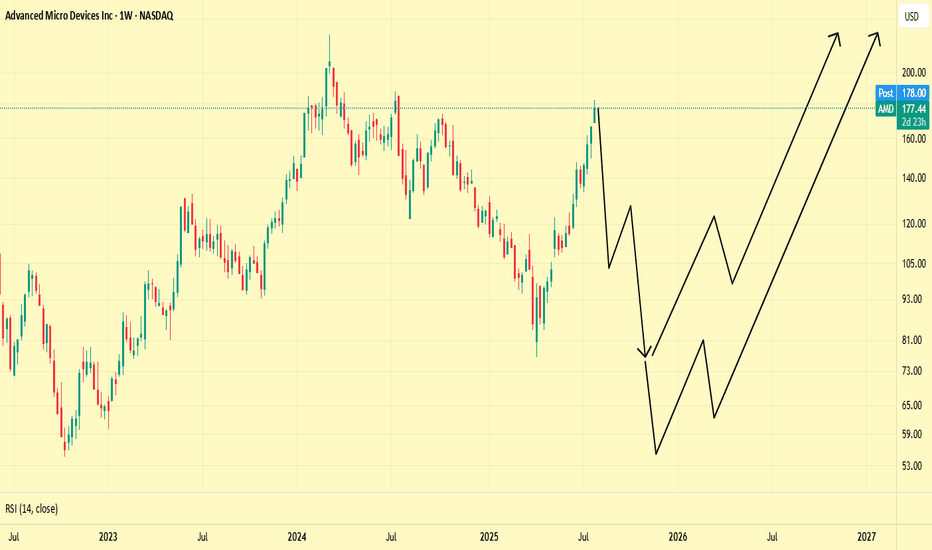

This is how it's going to be. You can disagree and be against it all you want, but much more consolidation in price will occur first over the long term, before a proper bull run returns.

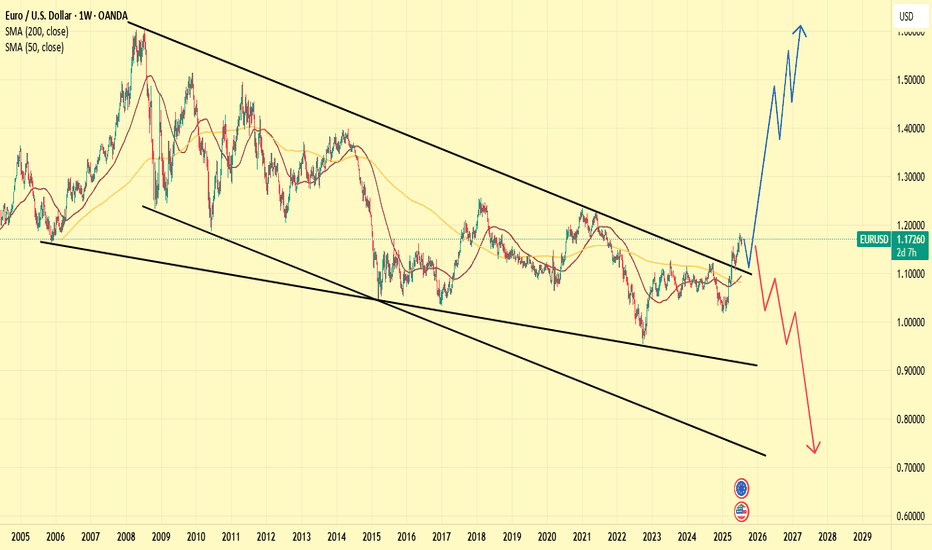

The mighty Dollar will once again prevail in the long term across all major pairs. It's status as the world reserve currency is far from removed.

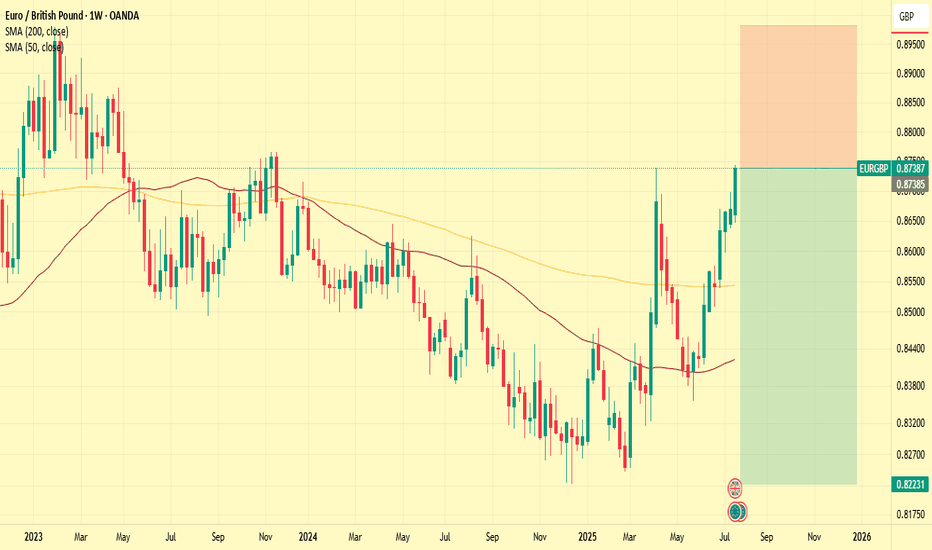

Price will likely turn bearish again soon. Expecting the Pound to regain ground.

The value of the US Dollar currently sits at an interesting place, both from a fundamental and a technical standpoint. Is this the beginning of the end for the Dollar, as the world's reserve currency? Or will America prevail once more?

I'm buying puts expiring on October 31st, All Hallow's Eve. I'll give price room to keep melting up to 666 at the farthest, that is my stop level. If we breach that price, then just know that tech is unstoppable and Artificial Intelligence is the Mark of the Beast. If the market doesn't drop here, then the sky is the limit.

This isn't going to be a V shaped recovery y'all. Another leg down is on the way.

With the US tariff trade wars about to commence, I feel that many investors will once again flock to the venerable Swiss Franc as a safer asset.

Just set and forget. Trump's goal is for a weak Dollar to balance the trade deficit.

What we witnessed last summer was just the start. Equities will take a hit as a result.

Expecting price to retest the bottom descending channel and return to the moving averages next year. From there, price will likely rebound hard and surge back upwards to continue the muti-decade ascent.

Entry: 157.0 TP1: 162.0 TP2:166.6 SL: 151.3 Expecting a recovery in price soon.

Society isn't crumbling yet.... We'll get there sure enough, but as for now, there is still plenty of spoils to be had.

The markets don't operate based off logic, y'all should know better.

Potentially a great swing long opportunity for next year.

Expecting this triangular price channel to hold. If a successful breakout were to occur, I'll look for a new long position.

Regarding how price action will play out over these next couple months, there's 3 likely scenarios, and it involves how price will interaction with the daily 200 MA: BLUE: Price makes a convincing break above the daily 200 MA, retests it, and then surges onward, continuing the long-term bullish trend. PURPLE: Price falsely breaks above the daily 200 MA and tests...

Now that a proper correction was been made, price has made a strong rebound off this major zone of support, as the 200 Moving Average and the bottom ascending channel both have indicated. There is a good chance that price will surge upwards from here, continuing the long-term uptrend. My price target is 120's area by summer.

Just set and forget on this one. Once this initial hype of Trump's policies dies down, the Dollar will depreciate hard, because if you know anything about Trump, you'd know that he has supported the concept of a weak Dollar for quite a long time.