CME_Group

UltimateMarkets were mixed across the board today with the precious metals leading the charge higher on the session. Gold, Silver, and Copper all traded higher again today with Copper being up near 1.5% and Gold and seeing slight gains. Copper and Silver are similar in the fact that they are more industrial metals and are affected by global manufacturing demand and...

Markets are having an interesting day after what could be considered a “bad” day in terms of economic data. Equities, Precious Metals, Energy, and Crypto markets all broadly traded higher today with crypto leading the way higher. Traders saw Bitcoin, Ether, Solana, and XRP all trade up over 4% on the session while Ether was up near 7.5% on the day. ADP Nonfarm...

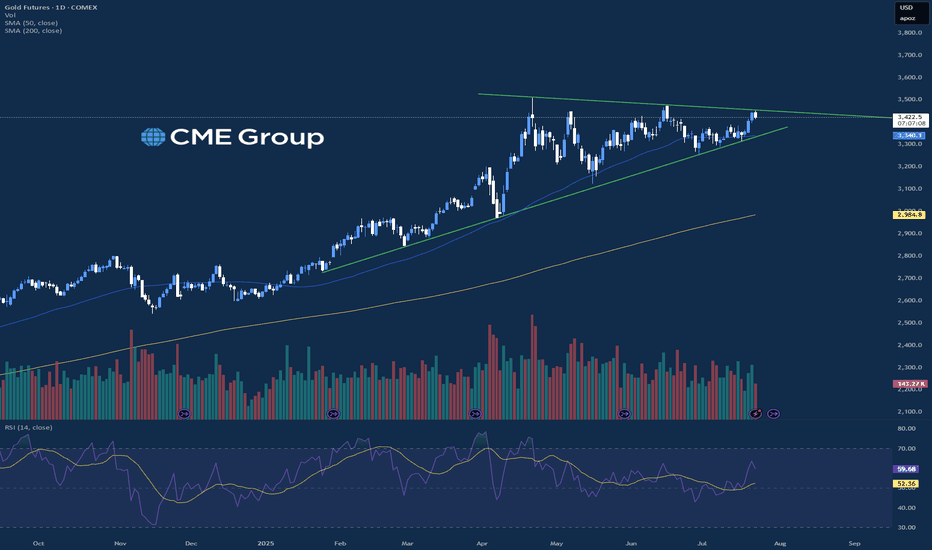

As we wrapped up the end of the month and the end of the quarter, it can be helpful for traders to take time and look back on how markets have performed. The second quarter of 2025 showed extreme volatility in many markets, starting off with the strong broad selloff with the tariff announcement in early April, and as that was walked back the markets have rallied...

The equity markets are seeing higher prices today with the Nasdaq leading the way higher trading up near 2.5% on the day while the S&P and Russell both traded over 1% as well. There was steep selling pressure in equities to end the week last Friday due to additional tensions in the Middle East, and the markets are seeing a strong rebound today, especially on the...

The crypto markets move to the upside continued in today's session, with Ether futures leading the way higher trading up over 8% while Bitcoin rose nearly 1.5%. There has been significant strength from the Crypto markets over the last few weeks, and Ether is now trading right near the 50% retracement mark from the December 2024 high price when looking at a daily...

Equity markets saw a positive day today with the Russell leading the way higher being up over 1.5% on the session. For the S&P and Nasdaq, this was the third session in a row with a higher high, and the 200-day moving average has acted as a floor in these markets since the breakout higher on May 12th. CPI numbers came out for Europe and came in worse than...

Starting off the week today, traders are seeing many markets moving higher with the precious metals and energy markets leading the way. Gold futures over 2.5% on the session while Silver led the charge higher being up nearly 5%, and the Crude Oil market saw gains north of 3% while Natural Gas was up over 7% on the session. Equity markets traded slightly higher on...

Equity Indices traded lower on the session today after seeing strong gains yesterday to start the week with the Russell leading the downside pressure being down near 1%. The FOMC minutes were released this afternoon and showed that the Fed was comfortable with rates remaining unchanged for the time being, and equity markets fell while traders saw Bond Yields trade...

Equity indices selling pressure is continuing from yesterday, with Russell leading the way to the downside being down over 2.5% on the session while the S&P and Nasdaq both were about 1.5% lower. Looking at relative strength on a daily basis for the S&P, the market was trading at the highest level since July of 2024 after having 6 consecutive days of trading...

Gold and Silver are showing strength starting off the week after showing gains yesterday and today, with Silver up over 2% and Gold up near 1.5% on the session today. Both Gold and Silver had strong moves higher in 2024, Gold most notable due to the market creating a new all time high price. A big component of the rise in Gold prices had to due with the Fed...

The S&P and Nasdaq finished the session today with slight gains while the Russel decreased near 1%, with tech leading the way higher for equities. Along with that, the precious metals saw more selling pressure today with Gold, Silver, and Copper all trading lower today with Silver leading to the downside, decreasing by over 2%. Looking at a daily chart for Gold,...

Inflation has been front and center on traders' minds for the last several years as it can impact not only consumer prices but also futures markets. Today, CPI was released and the number came in slightly lower than expected at 2.3%. Throughout the session, the equity indices, precious metals, crypto markets, and Crude Oil traded higher. The Nasdaq led the way...

Trade talks were front and center starting off the week, and the equity markets saw sharp increases with the Nasdaq leading the way higher, being up over 4% on the session with the S&P and Russel also up over 3%. The U.S. and China agreed to a 90-day pause on tariffs, and traders had been waiting for news about this since the initial breakdown in early April....

Yesterday, traders saw strong volatility across many different asset classes looking at equities, energy, and precious metals. The equities saw selling pressure early in the session and were able to recover some of the losses on the day, whereas Crude Oil continued pushing lower and was down near 4% on the session. Gold and Silver both slipped as well with Silver...

The first quarter of 2025 saw significant price movements in many different asset classes. Traders saw equity indices broadly selling off with the ES contract falling near 10% from the highs while Gold continued to push higher to all time high levels. There are many factors contributing to the price movement, including a shift in the administration in the U.S.,...

Over the last few weeks, traders have seen consistent selling pressure across equity markets, and today we are seeing buyers step in and the markets are moving higher. On the day, the equity indices, Gold, Silver and Crude Oil are seeing higher prices as traders saw CPI come in worse than expected and Crude Inventories came in better than expected. The NQ contract...

After testing all time high levels in the ES contract on February 19th, equity markets have seen significant selling pressure which continued today while the precious metals saw a boost higher. One of the volatility drivers traders are seeing is coming from global tariff policies from the U.S. and many other nations adding uncertainty to the strength of these...

Equity indices slipped today as they are looking to retest all time high levels for the ES and the NQ. Traders saw economic data released today including a higher than expected initial jobless claims number along with a lower than expected Philadelphia Fed Manufacturing number. As the equity markets slipped, the precious metals complex saw gains today with Gold,...