Canadian_007

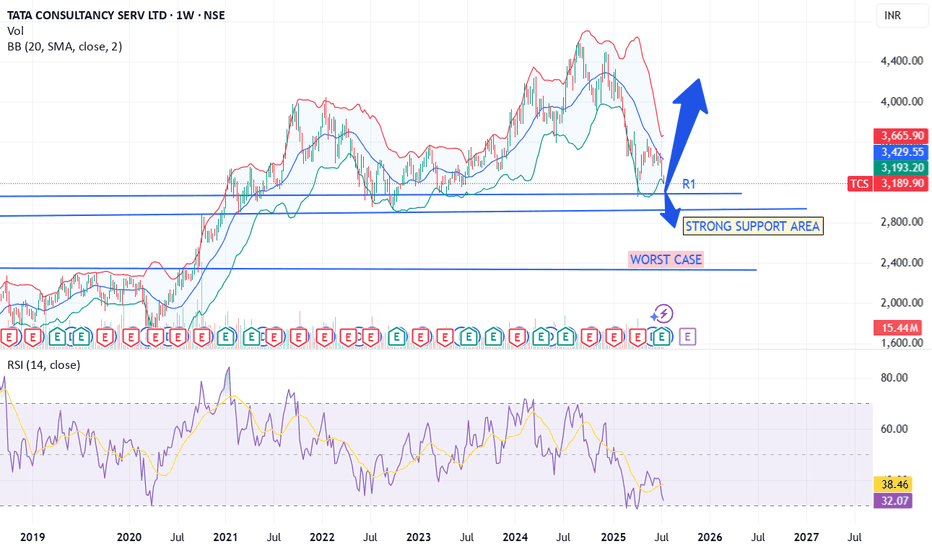

Essential📝 Recent Performance Q1 FY26 Net profit: ₹12,760 crore (↑6% YoY) . Revenue: ₹63,437 crore (↓2.2% YoY), third consecutive quarterly decline . Margins remained solid (~24%) . Stock Momentum Broke below key technical support post-Q1; could drop another ~5% . 2025 is the worst-performing sector—IT stocks down ~14%, TCS down ~21% YTD . 🌍 Key Headwinds Global...

Recent Stock Pressure Weak Q2 guidance from Centene weighed on sentiment, dragging OSCR down ~14% . Wells Fargo downgraded it to underweight, citing rising medical costs and pricing pressures in 2025 . 📊 Key Drivers for OSCR 1. 🩺 Healthcare Reform & the ACA / Medicare Advantage Trump’s tariffs are targeted at pharma, not insurers. But if drug prices rise,...

Tariffs news are temporary but pump of any good news can lead us to 640 but remember we have to fill the gap 570.