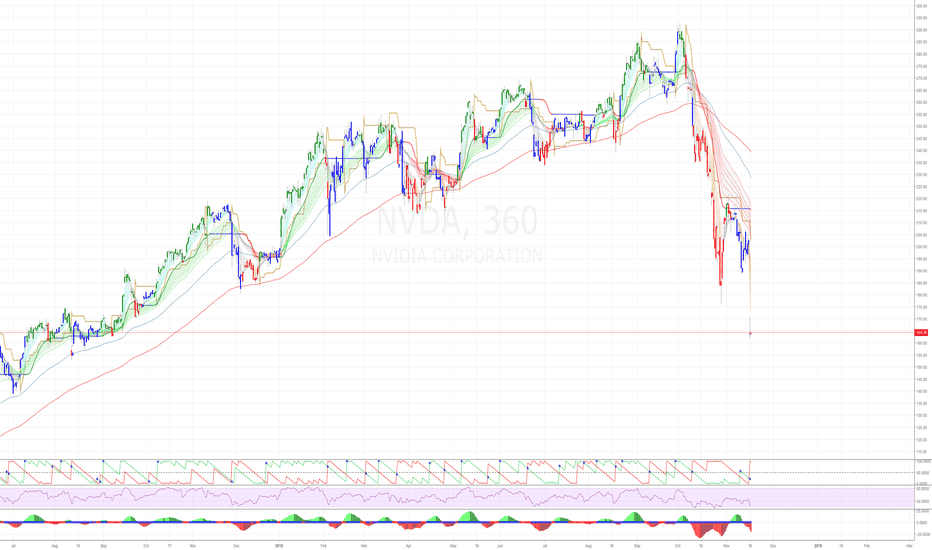

In the screencast, I give a little story first about someone (not from Tradingview) who enquired about buying into NVDA. My simple "No" wasn't received with much enthusiasm. What happened in ULTA is a lesson for people interested in NVDA.

Some say that Bitcoin has died or is close to death. Others live in hope. I'm not interested in those opinions. I do not do predictions. In this screencast, I have put on an experimental trade and mirroring it on a live account. What I am doing is exercising discipline on a small time frame. If the 15 min trend wants to move north, I'll follow. If it moves...

Amazon has just crossed $1 Trillion in market value. This is without doubt a parabolic expansion. History has shown us that parabolic charts like this suffer a significant correction. Do not expect me to say when - as I have no crystal ball. Tech stocks have been propping up Wall Streets expansion. But there is a problem. The stock markets in the US and...

As usual I have no crystal ball. Overnight and into this morning, I've been watching the order-book action on Coinbase . What was striking was the amount of volume being exchanged on Ethereum compared to BTC. In essence BTC volume appeared to be quieter than Ethereum. I'm talking about he 'buckets' of trades - not the actual amounts of money. See my 44...

I do not trade this index. In this screencast I show how there was a major struggle in the world economies between February 2018 and today 28th October 2018. I explore potentials for Bitcoin and Gold. A major corrective move south n the MSCI-ACWI has happened. This index is an aggregate of world indices. What we see on this chart is: 1. Price struggling to...

I'm stalking GBPCAD and other Sterling pairs for action next week, as Brexit talks have yet again broken down. Stalking is about vigilance, and investment of time in being prepared.

EURAUD is a pair that from my experience has many surprises. This is just based on long experience of understanding the 'personality' of this pair. I also know that there is a probable move south on stockmarkets which the Aussie tends to follow. The EURO took a beating last week, so punters are likely to try for a 'good deal'. So if both happen, EURAUD has some...

This is my 'homework' for the week ahead. I'm stalking - 90%. This is what we do!

I explore possibilities for next week.

Join me - to boldly go where 'no man' has gone before. This is the Final Frontier. I take on the big issue - head on. This is the one that is more likely to make the biggest difference to achieving consistent profitability. I assert that it technical and fundamental analysis are not most important issues in trading - at all! If 'everybody' could simply do...

In this screen cast I explore the Halloween Effect -which is a seasonal pattern - going back to 2012. My overall position is that from 2012, the Halloween Effect is more probable, However, it is not 100%. Statistical studies have been tracking this effect based on data largely based on a far more data before 2012 (but including the time up to the the present)....

Whilst a whole load of people are preoccupied with Bitcoin and Ethereum, there is something of a rumble happening in other parts of the cryptosphere. A whole load of so-called altcoins have taken off on daily time frames. I show only a small handful that I follow but on big exchanges many 'unknowns' are moving well up north in daily trends. I speculate that...

In this screencast, I'm looking ahead for potential moves, possibly south in the US-Dollar. This is about preparedness. In the video I explore emerging geopolitical and macroeconomic issues that are taking place. The US-Dollar strength has big influence at this time on: 1. Commodities 2. Metals - especially Gold and Silver 3. Oil 4. Stock markets in the US and...

I'm sharpening my axe for next week so this is my multi-timeframe perspective on probabilities. I haven't decided as yet whether I'm going long or short. I'm thinking about it and sharing thoughts. This is what I do - 90% of the time. I may not enter at all. The golden rule is,' if in doubt stay out '.

In the screencast, I explore the main timeframes and show my reasoning for shorting. (Not a recommendation or advice for anyone else to short).

The US-Dollar got hammered on most pairs in the last day or two. Day traders may have suffered or gained. The US-Dollar index shows what happened. On the Daily time frame US-Dollar is still pretty bullish, so stay tuned on lower time frames.

This is a short screencast showing an excellent entry position. (this is not advice to enter a trade). The gold market is holding it's breath I think. Keep in mind that generally Gold has an inverse correlation with Stock Markets in troubled times. I suspect that people are watching for a Halloween Effect, or something with the Stock Markets - so they're...

This is shared experience, on how curves can be exploited. It requires much experience timing and trading management. Curves don't rule the markets - obviously. The markets will do their own thing. Generally though, there are some probabilities that emerge, which can be exploited.