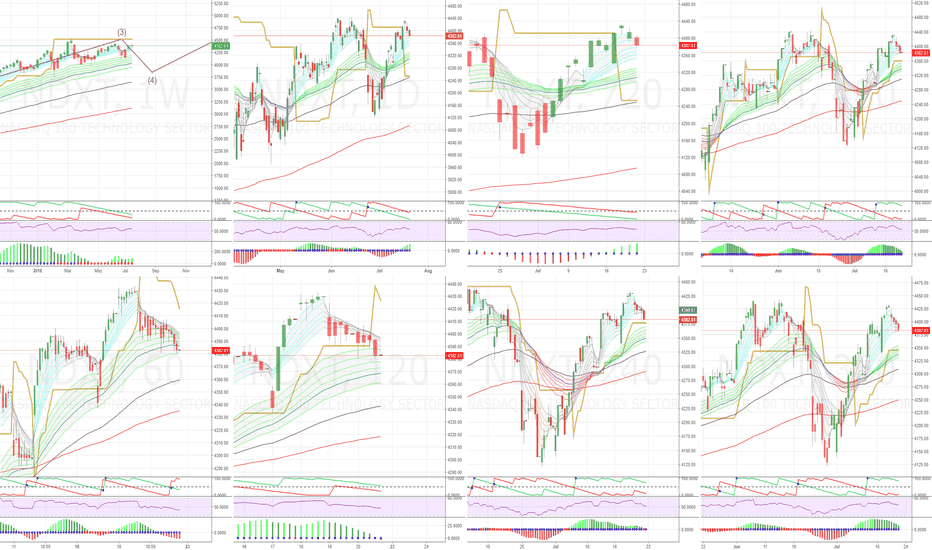

I'm using this mainly to see how it influences other stock markets. I've entered a small position size short on this based partly on experience on the 1H time frame. But that's not where the main action is. This market tends to influence events in the Indian and Japanese stock markets.

I'm out of it. I'm not getting into FOMO. Based on my own methodology, I'm not happy with stop-losses. So that's it. For me, I have to consider my stop-losses as 'gone'. That's money I'm willing to throw away on the chance that I'm wrong. So I'm not happy with the losses between 2H and 1D time frames. Gamblers who want to win a single trade may get involved....

I start off with the daily time frame and move into the 4H time frame where there could be potential upside. But it's not going to be easy. I can't see the future. If it goes north who's to say it's not a dead-cat bounce? ;) :)

In this screencast I'm looking both at the daily and 4H time frames on the JP225USD. The daily is into a potential reversal zone based on my methodology. The 4H is probably into a PRZ based on an ABCD pattern. Stay lively - stalk carefully. :))

This screencast follows from the previous video where I was stalking the weekly time frame. I've got the switch on the 4H and I'm trailing with a big stop loss.

In this screencast and links below I expose what's going on in market manipulations. In essence large organisations - who shall remain nameless - are busy buying back their own stock in an attempt to stabilise Wall Street and other markets. This is likely to give small investors a sense of security that they should buy stock. Price - to the minds of the big...

This is under the category of 'Beyond Technical Analysis'. It is about systematic risk i.e. something previously unrecognised that causes major upset in markets. What's *UFOs* got to do with this? Just about everything. Your world has been built on a sense of security that we are alone in the universe. People's religious beliefs, their sense of who is in power...

This is on BTCUSD on the Daily time frame. I get right into my own psychology and explain what I'm feeling terms of FOMO. I point out how the FOMO mentality causes people to lose big money. I've put on a paper trade, to explain this. Note that ESMA and the NCA's have pointed out that: ... trading across different EU jurisdictions shows that 74-89% of...

There has been serious price movement overnight. The gamblers out there shall be placing bets in the 'casino'. Sorry, it's not for me. As far as my analysis goes, BTCUSD is still pushing heavily south. In a previous video I warned about BTC having a near death experience driven by FOMO . I'm not telling people not to trade this. I'm saying that this is...

This video is not about an instant opportunity for jumping in the markets. I'm sharing how I stalk the markets. New or novice traders - all too eager to make a fast buck - tend to miss the big issues i.e. that it is about patience, vigilance and planning ahead. The methodology shown is relevant to trend following. How do we find trends? Well, we need to be...

This video is an update to the previous one on avoiding being flushed by the 'Economic Colonic'. There was some amazing price action today. Check it out!

In this screencast I show how I attack the US30. It's very different to what you see 'out there'. This is about a robust and real trend-following methodology. And not - I'm not selling anything! WYSIWYG. Totally for free! Everybody deserves a chance. Reality has come home to the markets - globally. There is a mega trade war on at the moment and it has been for...

In the video I explain some of my methodology. Overall I'm not one for shorting USDCAD. The safest bet - and I'm not taking it - is on the 4H time frame going long.

In this video I argue that there could be a limited price reversal on Bitcoin. This is about people who missed out before the big pump, thinking or fearing that they don't want to miss out the 'next time around'. So that lot pre-October 2017, are likely to jump in over the next few days or weeks. This is human nature. Caution: I predict nothing! I'm doing...

In this video I look at some serious volatility in GBPSEK and how you can approach volatility differently. Exotic pairs are very wild indeed. But fear them not. They can teach you much about how to take positions.

Sound quality is not great because I'm away from home, working on my laptop. Important things in this: 1. This is a parabolic chart in the last few months. 2. The uptrend on the weekly and daily time frames appear to show some weakening.

My probability estimate for the south is 51% on a 12H to 8H time frame. My estimate is based on my own analysis and perspective. I changed my mind based on new evidence and what I think is a more robust perspective. It would be great to hear other perspectives. That's how we learn. Share and learn. I'm not here to be right or to make predictions etc. I urge...

The NIFTY has been due a major correction. Something seems to be happening.