Chad_Sniper

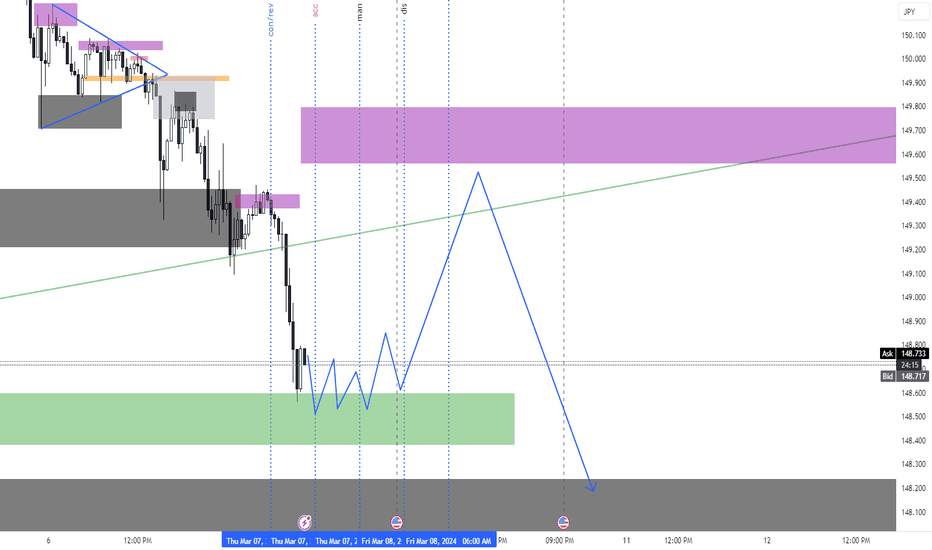

Assuming this pair decided to go bullish this year, using cycles we see that Q3 is manipulation. We see the shift or change of character to the upside. Waiting for price to hit the discounted zone before buying.

Price played a range last week. Be aware with a break of structure or change of character as it will determine if next week will be a continuation or reversal for GU. Good Luck!

On a higher tf, price is sitting on a discount area (gray zone). We see weakness as shown by AO through divergence. On a lower time frame, we see a trendline being broken upwards. This can be considered a change of character. (two previous highs were taken out - yellow lines). If the price will continue to go up, it could tap into the nearest discount zone (black...

XRP on a weekly tf is looking bullish. This is based on price hitting demand zones or discounted zones multiple times. On a daily tf (March 11th candle), price made a change of character to the upside, and again retraced to a demand/discount area.

Price is approaching a demand zone (rally-base-rally area). Watch out for break of structures and liquidity to determine where price will go from there. Good Luck!

Price is sitting on a discount area. Price could shoot up from there.

Price is sitting on a discounted area. Price could continue going up after a pullback.

Price pivoting at 1.28030 could result in a bearish candle on a monthly tf. Price could retrace to around 1.26904 and Short from there.

After manipulations yesterday, this asset created higher Hs. If trend continues, then buying the lows would be profitable.

Last week was bearish. We could see a continuation at least to the nearest pivot zone. From there, price could continue being bullish.

We can see weakening in AO. Price is sitting in a pivot zone. Price could make a pullback.

Bearish overall trend. Price could swing downwards after finding liquidity.

Higher TF, gold is sitting in a resistance level. Last 5 day session, gold consolidated and formed a triangle. Price could potentially break downwards and start mitigating the gaps left after weeks of bullishness.

Price is sitting on a SBR zone. Price could potentially short after finding liquidity.

We saw a bullish rally last week. It could continue the trend as it has not yet hit the premium/supply just yet. If it is bullish then expect it to find support in the demand/discount zone.

After the huge dump last week, this pair could possibly do a retracement to the upside before continuing its bearish trend.

Overall trend is bearish. Price is sitting at a key level. This could mean a potential scalp buy short term. We wait for accumulation of price and a clear breakout to the upside, we can trade the small retracement going up.

Gold is looking bearish after seeing divergence. Hope the news later will be in favor of the bears.