This is our weekly selection of Pairs according to the strenght and weakness of their Index. Pairings for the week: BUYS GBPAUD GBPNZD EURAUD SELL AUDJPY NZDJPY AUDCAD NZDCAD USDJPY****CAUTIOUS Watch Full analysis here: youtu.be

Major Trend still down, and we have seen participation at 50% retracement of the recent down-move. Price has been trading in range since the 50% was traded. Weakness in Yen yesterday has given this setup a nice boost. We are short below 74.20 Stop Loss @ 74.50 Take profit @ 72.30

Below 109.90 we are short the UJ. We have a clear Series of LL's on the intraday TF from end of last week. What we have witnessed so far this week is only a retracement as long as price stays below 110.02. The Stop Loss is 110.04 T1: 109.42 T2: 109.23 T3: 108.74 Extended Target

Price has completed the DownCycle after a Violation of the Downtrend on Tuesday. We are Long the AUDUSD from 0.6706 using PA as confirmation, other key tools agreed with PA too. Low Risk SL: 0.6698 A break above 0.67777 will confirm a new trend and we should buy the dips only. Enjoy!

The rally in the USDJPY has lost momentum below the Previous Momentum High. according to the current price behaviour, the Downtrend has been violated; buy 1 more Lower Low is expected below 108.43. Sell Entry @ 109.49 Stop Loss: 109.72 Target: A break below 108.43.

The retracement cycle in the AUDUSD is now complete. The ket to this is; price must not break below the Low of Today 0.68436 We are going to long above the 0.6853 targetting the structure @ 0.6910. Stop Loss: 0.68436.

We are short the USDCAD from 1.3177, the cycle of retracement ended at the open of London today. A Lower High is in place and we expect at least 1 more Lower Low in the Hourly Chart. STop Loss at the High of 1.3184. Target: 1.3114.

The current level represent a fair price to enter short position in the NZDUSD, Price has broken the High and structural point yesterday, and the currect PA suggest a sustained reversal in price is expected. Short @ 0.6584, Stop @0. 6603. We will target 0.6550 DRL. and 0.6546

Price made a low of 108.428 on the 4th Dec. and then rallied making 3 consecutive HH's before retracing back to the current low of 108.43 . 108.495 is the Low of Friday, this stands as our preferred Buying price in the USDJPY. A trade back above the 108.495 will trigger our long entry position, and the stop loss will be below 108.40. Our Target is 109.35.

Manipulation phase is now over after a lenghty distribution phase. Price has broken the high 1.30129 which has plenty of orders just above it. Additionally, we have previously seen Two completed Structural failures to the downside before the price was manipulated back above the highs in order to trigger the weak sellers stop loss. This trade is now a High...

Intraday position. Entry Long above 108.76 Stop Loss 108.62 Target 109.18

This pair has the potential to capitulate again, it all depend on the Yen Strenght that is currently obvious in all the Yen crosses. Technically, price has rejected the 61.8% retracement of the Lower High created on 8th Nov. We will go short from 109.04, stop is at 109.30. Intraday Target is 108.54.

The USDCHF yesterday retraced from the high posted on Friday 0.9979, measuring Yesterday's range and the price action during the Asian session indicates more downside should be expected. This however depends on the 0.9950 which corresponds to 38.2 retracement of yesterday's range. Short below 0.9940. Stop @ 0.9952 Target1: 0.9920 Target2: 0.9900

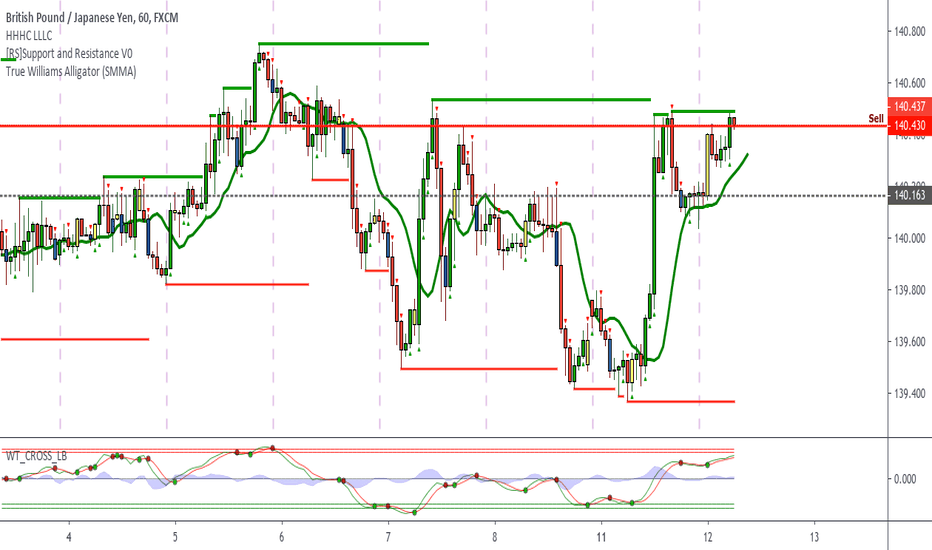

GBPJPY is currently printing another lower High, price on the daily chart has been in range for several days and we have seen a breakdown from smaller time-frames. Yesterday rally can be considered as a discount in price. First indication is 140.43 is an area of interest, this price level was sold yesterday and another failure to advance beyond this point with...

The Major Trend is still down!!! Today's key price is 0.6877, the low of Monday; this low represents the Daily breakout confirmation of the mini consolidation after the momentum high. Another price level we must watch closely is the Low of yesterday. Below 0.6861 the downtrend will resume and more lower prices will follow. Sell Again @ 0.6877 T1: 6810 T2: 6670

The key here is that AUDUSD has printed 2 Lower Highs, current upside momentum can be considered as a discounting in price. A snap back below 0.6907 is a sell. Buying is not an option below the momentum High of 0.6929. T1: 6810 T2: 6670 SL: 6930

According to price movement on this pair, we are expecting one more upside move in the EURUSD short term towards 1.1176 Entry @ 1.1128 Stop Loss: 1.1111

We are long the AussieDollar from the retest of 2DL after trading back above it. Target = 0.6880 Stop = 0.6833