Arvinas Pharmaceuticals is on a run thanks to FDA approval of phase 1 clinical trials on a new drug. It's above critical resistance levels and appears to have clearance up to 25.60. Personally I won't be taking a position in this one, though. Arvinas's earnings are pretty garbage, and honestly a phase 1 clinical trial doesn't mean much in this industry. We've...

American Outdoor Brands Corporation plunged after its recent earnings beat, but it has some trendline support at the current level. Recovery tomorrow would likely mean it forms a new upward parallel channel. I've bought in here with fairly tight stops, and we'll see what happens.

According to the Stock Trader's Almanac, today and tomorrow are "bear" days, when the S&P 500 has historically fallen more than 60% of the time. Given how many stocks I've seen fall below supports and trendlines today, I can well believe that the indices will fall again tomorrow. I've taken a small position in the SPXS, a leveraged fund that delivers 3x the...

Micron has been looking bearish in what appeared to be an emerging downward channel. However, after hours today it popped two and a half dollars per share on the basis of a supposed earnings beat. News outlets are reporting that earnings "crushed" estimates. The problem is that the analyst estimates are for GAAP earnings, and Micron's GAAP earnings missed by...

UNH is looking like a great buy. Not only did it break out today above a downward trendline, but it's also near the bottom of an upward-sloping parallel channel. Fundamentals look good too, with generally positive analyst ratings and a series of recent earnings beats. Healthcare is hot right now, with its low China exposure and other sectors looking overbought....

CERN has been forming a triangle as it decides between two different parallel channels. I expect the longer-term upward channel to prevail on the strength of impressive analyst ratings and the overall strength of the healthcare sector. Look for an entry below 71.63 in the next week, with stops below the triangle.

Snapchat fell out of its upward channel today. It may rebound into the channel, but then I expect it to fall. Good opportunity for a short play.

Malibu Boats just got some big analyst upgrades on the strength of upward earnings revisions. It's been in a gentle upward channel, but I actually think it could break out and establish a steeper upward channel leading up to earnings in September. Watch for the upside channel breakout and then buy the pullback. As always, this does not constitute investment...

I've been closely watching Hibbett Sports, which met stiff resistance at 19.20. This morning it's formed an upward trendline toward the top of its channel. With good analyst ratings, Hibbett could even break out of its downward parallel channel in the relatively near future. At the very least it should rise steadily today.

Beyond Meat should find some trendline support at its current price level. From there, we've got several longer-term trendlines that could slow its fall, and then solid support at 100 from historical volume. Given how overvalued the stock is, I'd hesitate to buy it unless it got down to at least the lowest long-term trendline, or better yet the volume support at 100.

GE is looking like a short after a big channel breakout today. I think the breakout is driven by GE's large investments in oil and gas, since oil prices collapsed today. GE is bearish below the downward-sloping trendline, but should find some support at 10.19.

Daimler recently gapped down in a big way after its dividend and a CEO change, which offers an opportunity for investors to get back in at low prices. Daimler isn't the sexiest automotive company, but it's fast becoming a leader in the autonomous vehicles space. It's already got a level 2 autonomous rig on the road, cutting the cost of traffic incidents by 95%. By...

Revolve has formed am upward parallel channel since its IPO. It's currently in the bottom half of the channel, with support from a trendline that's parallel to its channel. So far we're looking good for a reversal upward tomorrow based on this trendline support. Set tight stops, however, in case we breach support and head downward to channel bottom. Then look to...

Funko just broke out above a critical resistance level. Not a lot of resistance from here up to 2018 highs of $31 per share. It's got pretty good analyst ratings, growing earnings, and a history of earnings beats. It next reports in early August, so plenty of time to run.

After a recent downward gap, BIIB looks to me to have established a new upward channel. With bullish MACD, great analyst ratings, a history of earnings beats, and the next earnings coming up in mid-July, BIIB should be up in the short-to-medium term. Set fairly tight stops to protect against a downward channel breakout. Here's my Biogen trading plan Monday...

General Mills reports earnings Wednesday and should stay above the trendline in the meantime. It has positive analyst ratings and a positive earnings surprise expectation from Zacks. It may even break upward out of its parallel channel sometime in the next two trading days in anticipation of positive earnings, but at the very least I expect it to stay at the top...

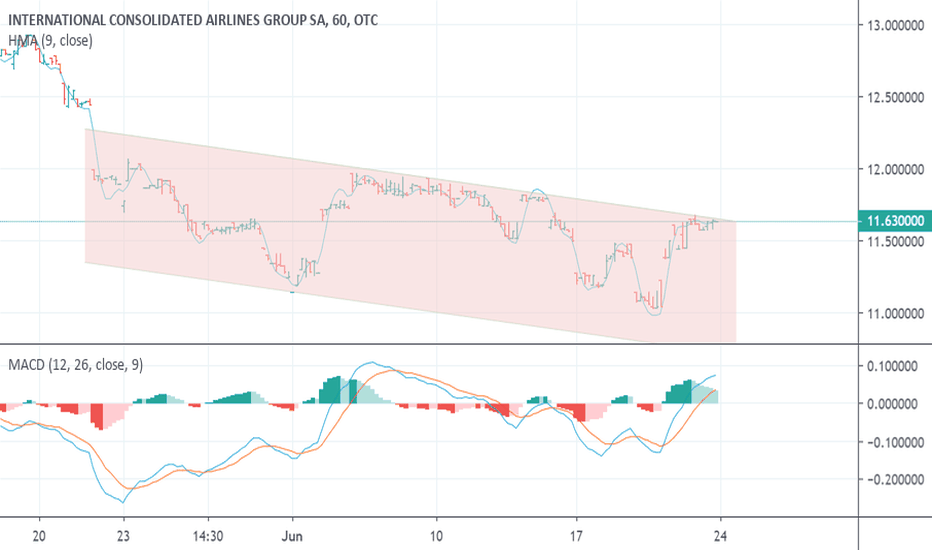

ICAGY is a great value stock, and I've been watching for a turnaround for a long time. It's got excellent analyst ratings, a good dividend, and a great P/E. Unfortunately, it's been in a downward trend for months and is likely to continue downward until a significant catalyst such as a beat on the August 2 earnings report. It got a bump a couple days ago when...

ITCI is moving mostly horizontally lately, and there's definite room for downside to its channel bottom around 10.40, so this is a risky play. However, a large stock purchase a couple days ago by one of the board of directors triggered a large volume of bullish option activity. Possibly the director purchased stock in anticipation of forthcoming clinical trial...