Commodity_TA_Plus

EssentialThe dollar should briefly correct while metals rally in the near term

Update on a trade from Feb. Take profit on NG shorts

Oil is roughly as cheap as ever denominated in gold. A significant upside move is due, repricing oil accordingly with gold

Barring an imminent or protracted recession, CVVUF looks ready to confirm a close out and above this massive bullish pattern

Uranium should experience significant upside as it becomes repriced accordingly to gold

SBSW, GROY, and LUCMF, all relatively well known PM related equities are near all time lows, while gold continues making new highs, present with a great deal of upside and minimal downside

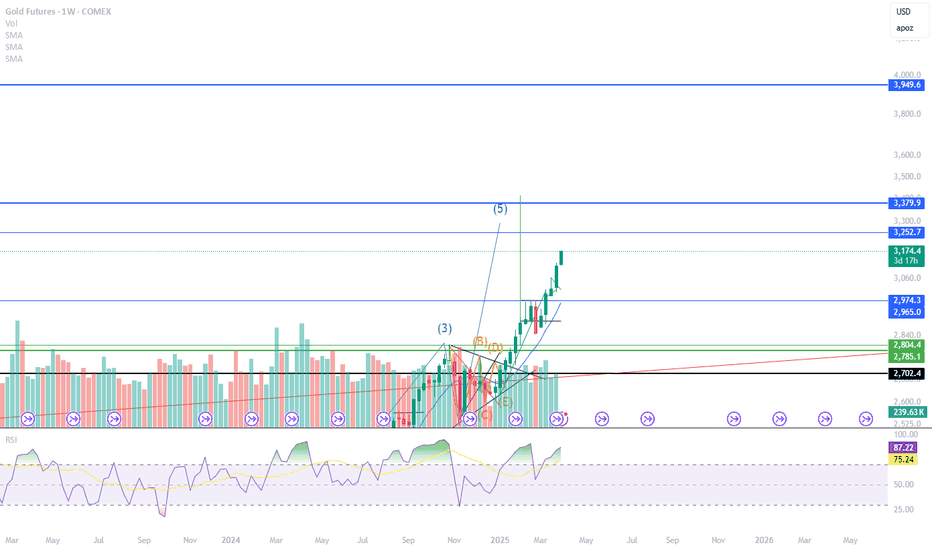

estimated time frame 1-2 weeks to begin a ~1 month correction to a level we have not seen in a while

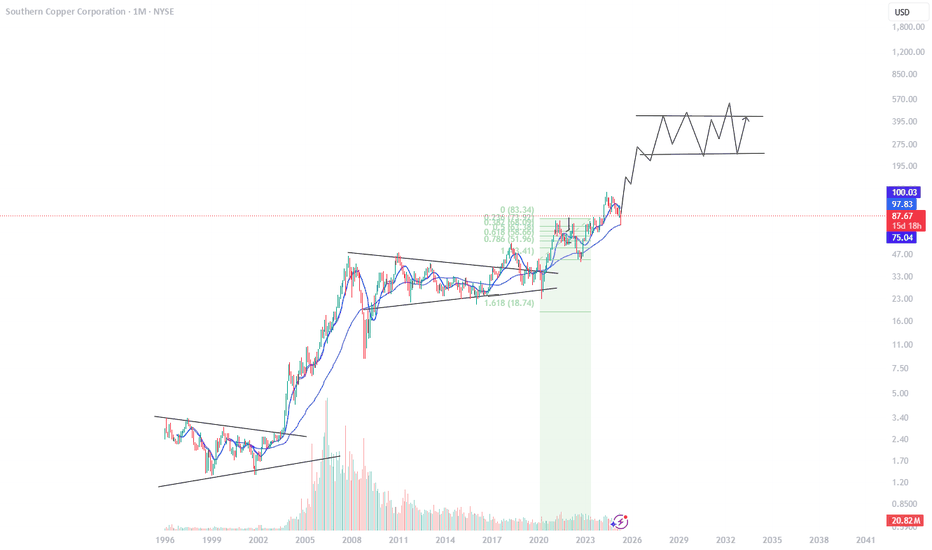

Copper equities are lagging the metal and wit recession looming will they have time to be milked

Looking at the cyclicality of the precious metals complex and which moves first, vs lag

Error at end of video. I believe I said 375 million would be the market capitalization in the best case price projection scenario. It is in fact, 3.75 billion, which is certainly not out of the question.

Uranium and LEU price analysis and technical perspective

DXY tanking has gold making a higher high after a 20 week intermediate cycle. Is this a false breakout or the next leg up?

Making the case for an 8 year cycle low in palladium

Likely levels that all sectors tend to bottom at using Fibonacci retracement, measuring likely degrees of magnitude on falling knife bounces, as well as determining the PM sector bottom via platinum price, and looking at ratios.

Stocks are pulling the entire market, every sector, down, as it approaches a final 4 year cycle low. Here are the criteria most probable to be met in anticipating a bottom

Gold may have put in an IC top, or we could be early on a missed ICL

The DXY will determine what kind of week Monday brings

Expect big fireworks these final weeks of the advancing stage of an intermediate cycle