CountofCoins

EssentialBUY BELOW GOLD LINE SELL ABOVE EVEN A CAVEMAN CAN DO THIS Remember, it's gonna be a wild ride. And that ride never ends.

Big line go down. Active for several days to about a week. Look for my updates. Sell in red, close in green.

Island v Island, which will you choose? We buying this son of a bullion. Ultra short on the YEN. Don't ask me why. Sell peaks, because you never go all in on an island.

Buy the dips, hold the chips, and I'll see you at the top. TP 34-35 or hold

Buy the dips, sell the peaks, and I'll see you at the top.

Drawn from one of my better trading strategies. News, extremes, and broader techniques derived from my Secrets of Forex articles are at play. Sell, and keep selling into red. Close into green. It's made holiday simple. DSMA and DSR act as better targets. Always close within 4-6 range (on my chart time) if DSMA or DSR are not hit by EOD. Merry Christmas you...

Drawn from one of my better trading strategies. News, extremes, and broader techniques derived from my Secrets of Forex articles are at play. Buy, and keep buying into red. Close into green. It's made holiday simple. DSMA and DSR act as better targets. Always close within 4-6 range (on my chart time) if DSMA or DSR are not hit by EOD. Merry Christmas you filthy animal.

Drawn from one of my better trading strategies. News, extremes, and broader techniques derived from my Secrets of Forex articles are at play. DSMA and DSR act as better targets. Always close within 4-6 range (on my chart time) if DSMA or DSR are not hit by EOD.

The first in a long series, drawn from one of my better trading strategies. News, extremes, and broader techniques derived from my Secrets of Forex articles are at play. DSMA and DSR act as better targets. Always close within 4-6 range (on my chart time) if DSMA or DSR are not hit by EOD.

I'm assuming if you got this far, you might be smarter than the average Yahoo commentator. No need to rejoice, dear Gulliver, we're still in the tutorial. I have specifically designed this article to be long and heavy, hopefully to demoralize you out of intra-day trading. However, I know that for those who live outside the expected plot, demoralization doesn't...

The original article will be short and basic, like what you see in the mirror. It's just the supplementary reading to the prior article on technicals, it's the part seven point five. The emphasis is on what TO AVOID when conducting research or pursuing a technical indicator catalogue. There are thousands of dead end indicators, many of which are borderline...

This article will cover technicals (finally). It is part 8 in the series, and the first of two parts on technicals. It is strongly recommended that you read the others in order for full value. This one is long and more complicated than the others, because you deserve it. Part 1: Raytheon's Military-grade Market Trader There are two problems with selecting...

This is the second half of the deliverable on fundamentals. It covers content you don't normally learn about in the retail trading loserverse, stuff that is often paywalled behind shill "courses" or dismissed as unnecessary by wealth gurus. I'm here to short those paywalls with my appropriately priced FREE knowledge. Take everything in stride, this business...

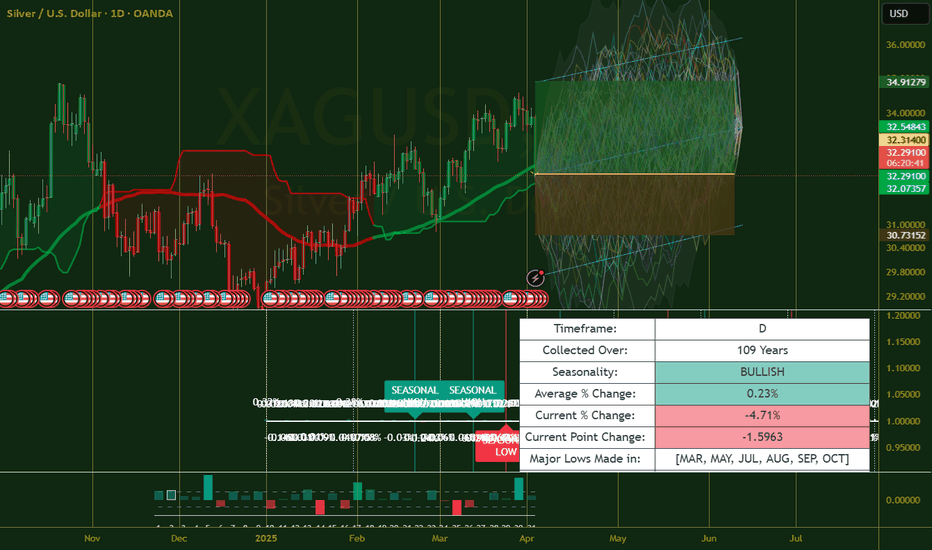

This section is on seasonality and follows the prior section on carry trading conditions. I strongly recommend reading the prior parts for full value. This is (pt. 5) in chronological order. And yes, this will be on the test. ----------------------- You probably have someone in the immediate or extended family that considers herself (let's be honest) an...

You must read the prior articles first. If this was a video game you would probably be trying to skip the conversation boxes at this point. Don't try to speedrun this, you'll die at the boss. --------------------------------------- I'm sure you're tired of all the poetry and want to get straight to the money. Money, after all, is the best form of...

You must read the preceding parts first. This one is a real doozy. Watch your reading comprehension levels go up in realtime. ------------------------------ "Very, very few people could appreciate the bubble. That's the nature of bubbles – they're mass delusions." - Buffett Last time we talked about how people who speculate are inherently delusional and are...

Be sure to read my prior article first. Chapter 1: Persistence is Another Word for Probability Okay, so we're finally back in action. Last time I edged you pretty far but now we can finally get some release. We determined that managing uncertainty (risk management) is the key to 'winning at losing' and paradoxically becoming a profitable trader of...

Citi has not shut up about their GBP bullish picks for the end of the year. And they might be on to something this time. This could be the trade of the year. Brexit will be a better deal than expected. Trump will exploit the window of vulnerability to push headlines for a new 'bilateral' or nafta plus option. The rumor alone will be good and it really isn't on...