CrashoutCapital

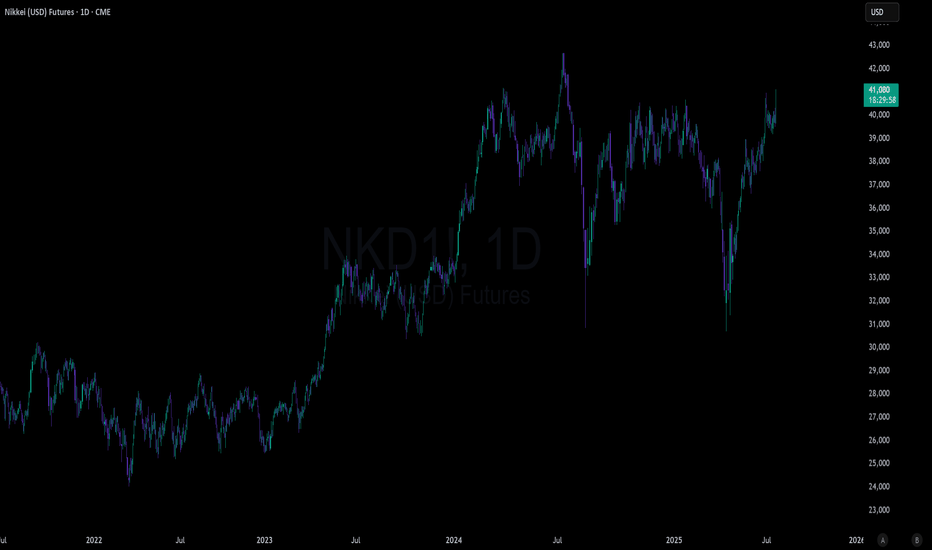

PremiumWith US President Trump finalizing an agreement with Japan by imposing a 15% tariff on US businesses for Japanese products, Japanese stocks are flying due to the new found competitive advantage they have

That's it, simple breakout if market sentiment allows it

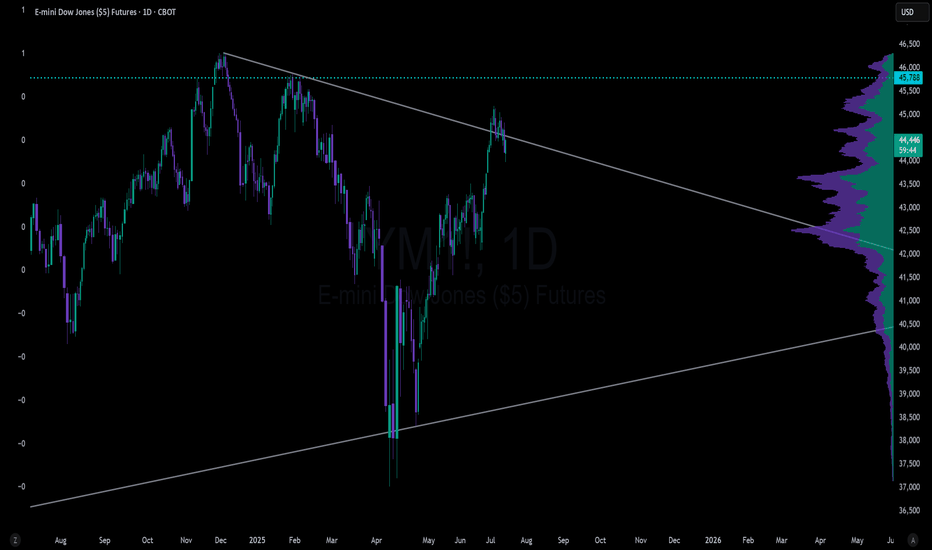

Dow Futures false breakout to the upside and now downside. Expect volatile price moves into 2026

Consolidation for months between 91k and 106k - Classic Wyckoff setup as an accumulation/distribution - Price targets of: 121.878 (122k is the popular target) to the upside with 75,827 on the down - Saylor today put out news to be raising another $2 billion to buy BTC. Either he is going to be able to hold the floor or get washed out - Trade can be taken with...

Absolutely insane for people to be saying things like "a new bull market" when it never ended. All of the risk is to the downside. If markets ran another 10% to the upside that gives investors a chance to determine if they want to buy a correction to see new highs or not. But to say that a bull market is coming is the antithesis of thinking when current risk is...

Token driven by demand from trading on Hyperliquid. Crypto looks set for a few month long consolidation probably into Q4. That loss in trading volume will reduce demand for the token and the company may be forced to sell the token to come up with large gains for its clients. Either way it's a bearish catalyst for the token which has really ran hard. Ugly head and...

A victim of the 2013 bubble has finally bottomed out and remains a leader in the 3D printing industry. As robotics and advanced materials advance, 3D printing will become the standard in manufacturing. A very beaten down stock for almost 10 years can go back to 50 and possibly higher. Has government and corporate contracts in: Medicine, aerospace, defense, and...

Strong pattern formed off a key level that could breakout in August or September. Upper price target of 90 as long as the gap is filled but not too far under

At a high of 125, it's had a great run, but a double top has formed going into earnings and a US government which may be forced into austerity. Insiders have been selling for months with no net buys - First Price target down to the neckline at 76 - Next price target would be 42 for the last real breakout test - Final PT would be 24 if the double top played out completely

Weekly has a double top formation but if it can survive and not retrace much more than 30-40% from the top it could play out a W pattern which is one of the most bullish around

Large selloff driven by price action in a macro rising wedge - Look for support hold - Island bottom or bounce with a wick less than half the body candle - Could see highs again by 2026/2027 - Could be a concern over Chinese invasion - China says not ready until 2027 to do so

There's no main price target in mind, however the company from a risk management perspective has been largely not investible for about a year. Multiple 40-60% moves from top to the bottom of the range. Now with diffusion global competition will eventually eat into Nvidia's earnings/market share. Without a major wave of monetary inflation in the United States it's...

Nikkei futures have setup an inverse cup and handle on the daily. A somewhat rare pattern as most of them turn into double bottoms or sideways consolidation. Maximum downside target for the pattern is 21,000 - Global macro trends continue to worsen - BOJ stuck between saving the Yen and helping the dollar - Japan economic fundamentals may allow BOJ to allow...

Trade is fairly simple here. Go long treasuries and if it breaks down cut. - A bounce and push back up could be another ugly catalyst for the US stock market. - A breakdown however would push yields up (and economic growth forecasts) which would be quite bullish for stocks especially down at these levels

Dow Futures daily forming a downwards channel with price targets potentially down to 34k and 31k. These drops would be about 20-40% which is considered a true market crash. The falling wedge pattern plays out until potentially June of 2027, but wedges from the top of the range are dangerous as they can turn into bull traps. - Economic fundamentals have been...

Rate cuts in the US have never been bullish for equity markets in macro cycles. The idea that rates coming down from 5% to 4% suddenly making people more creditworthy is a farce because rates never move in anything other than large timeframe tides. These tides reflect growth/inflation expectations, not borrowing costs. Were Jerome Powell to suddenly become very...

W pattern forming at resistance with a 15 point range (from 107 down to 92) - Breakout of pattern takes BTC right to 122 which is the old weekly cup and handle pattern price target - Trump inauguration and "crypto ball" coming with a possible announcement of bitcoin strategic reserve - Also possible sovereign wealth fund

BTC / USD bull flag and cup and handle patterns on the weekly timeframe. Has upside price targets of FWB:98K and $122k respectfully.