CreatingFutureWealth

EssentialLYFT looks ready for an upwards break of a resistance around $65. With an increasing bullish outlook for the overall market and tech stocks flying high theres a good chance we hit $70+ soon.

Wow. As per usual with a crazy downwards move we have an analyst to take for the drop. But does the rest of the forecast and overall fundamentals still hold up? IRM management has been showing signs of being aggresively offensive IMHO in switching parts of their business into new service areas and new markets to increase revenue year-on-year. If we take a...

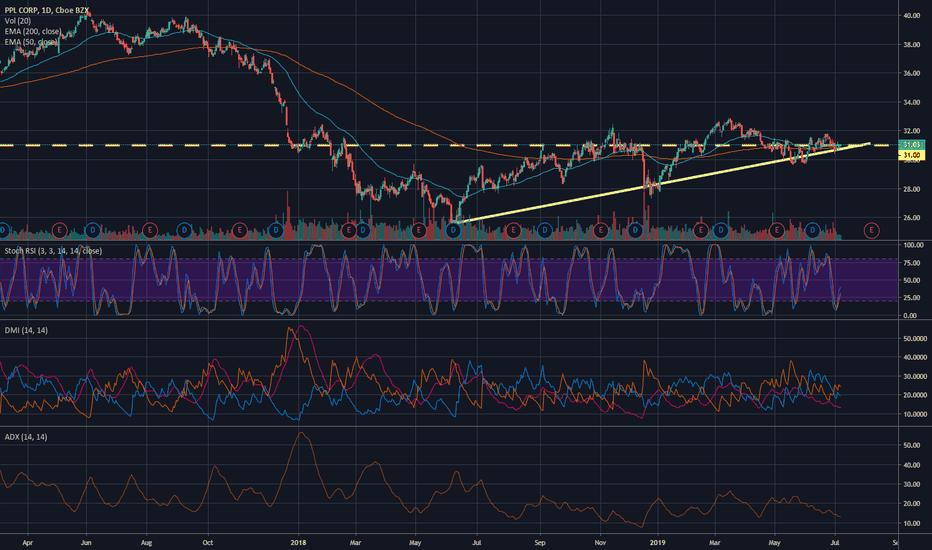

PPL Corp looks quite bullish from here and has a dividend of 5.32%. If it breaks out of this area here there is a good chance it could head towards the $40 area which is a 29% gain from here. As a power company with operations in the USA and UK its a great defensive play during possible market turbulence.

ETH along with Bitcoin has been on the move lately but it's far from over. An upwards crossing 50/200 MA and an upwards hooking StochRSI indicate a further run to $300 or more are on the way in the near-term. I'm long Sept 27 2019 300 Calls.

$IRM Iron Mountain has touched long-term support visible on the daily, weekly and monthly with StochRSI bottoming. This could be a great place to begin establishing a position for long-term growth.

$VIRT is continuing to form a nice ascending triangle pattern on the daily. A breakout of this pattern could lead to a near-term 5% gain at the next resistance line from previous breakouts. Longer-term a gain of 18% to the next resistance level around $30 is possible.

Simple setup with the StochRSI on Daily having bottomed out and strong buying volume up to this resistance level of 178ish. Target 188 in near-term.

This graphene maker has the potential for a 15% upside to the nearest resistance point as a minimum after touching it's long-term uptrend support last touched in 2015. Currently it has a 3.3% dividend yield and could surpass first resistance in the long-term.

Look for another possible breakout towards the upside from $DPZ today. It has been forming an excellent long-term base and has plenty of good news to boost its price. Expansion in Europe and upcoming earnings . This is a great buy on the dips.

After coming up short on earnings KO seems to have entered an accumulation phase forming an ascending triangle that presents a possible 5% upside move in the near-term. The 3.5% yield also provides an attractive long-term hold incentive if the current uptrend continues and this pattern plays out in our favor.

$TSLA has been in a falling wedge pattern for the past five months which fits within the typical formation length for a falling wedge and we are now near the long-term support level around the $255 area. With earnings coming out tomorrow any good surprise could lead to a strong upwards breakout or breakage of the support line. Recent negative news of a Tesla...

GOLD is showing a nice Cup & Handle looking pattern on the daily chart with a strong moving upwards trendline. There is strong support here at the $1299-$1300 area with an upside of nearly 38% to its previous highs of $1800. This makes for a great hedge play against other areas of your portfolio. Take a look also at Silver which is bottoming around $15. Silver...

$MOS has broken out of an ascending triangle and held above the past resistance line on strong closing volume from 22.04.2019. Look for a possible run to the resistance line at $28. This is a quick trade for around 3% gain.

Look for a possible breakout to the upside on $MEOH in the near-term. Next resistance is approximately 5% away. Earnings are tomorrow so proceed with caution.

H&S on the daily. Waiting for this baby to go under $7, ideally $6 before building a position. Patience friends.

$T is a great 5G and streaming content buy under $32 with an ascending triangle reaching near breakout. A near-term 6% upside to first resistance at $36 and a 6.5% dividend yield as a bonus makes this a great play.