Bitcoin dominance chart. Major decision time this week: If trend line holds & there is a bounce BTC's rise will outstrip that of alts OR crypto dumps, alts get wrecked & money flows into Bitcoin. If trend line breaks then altseason 2.0 begins.

If you don't know what you are looking at you shouldn't even be looking at it.

Quick update for BTC. We had a bounce from the 6400ish region which to be honest I didn't expect and don't like. I was sure that any dump would take bitcoin lower, down to 6200 to 6000 region with a possible wick below 6000. I got in on the reversal at 6800 and sold at 7200ish. Had we gone down to 6000 then a much stronger reversal would have taken place,...

Pls have a look at my previous analysis on BTC which I published at the beginning of December as this will give you a good foundation for this. So we had two weeks of sideways action, some ALTS notably ATOM, XTZ and WAVES pumping and today boom, we go down. The way I see it there are two possible scenarios: 1) Double bottom here similar to what happened back...

On the 4H we went down to the neckline & FIB cluster support level at $7100 and $7400. If this breaks DOWN, we go to retest mid $6000 IMHO. 4H STOCH RSI oversold, RSI below 40 pointing slightly down, AO crossed into BEAR territory. MAs looking bearish. Not much to go on right now. Looking at the 1D, RSI pointing down and at 40, AO showing improvement but...

Very simple analysis looking at weekly & monthly mometum of BTC. What we are seeing is NOT great: 1) Double bottom forming on STOCH RSI, last time this happened was feb/march 2018 2) Weekly AO going into bear territory - repeat of feb/march 2018 3) BTC stuck in a 5 month bearish channel 4) Price below 10 period MA, 5 period MA below 20 period MA 5) 5 period MA...

Hey folks, quick update for BTC on the 4H. IMHO looks like a falling triangle. Ugly. My biggest worry are the EMAs. So far the 5 which was about to cross the 20 and got rejected. Looks very similar to the pattern from first half of July. If support is broken and price falls outside of triangle then most likely it's heading towards mid 8000's where it would...

Hey! Sorry I have been away for so long but been dealing with family things. Three scenarios on the chart. Chart is a bit messy but you get the jist. Personally would loooooooooooooove the 'red' arrow scenario to play out. If anyone out there remembers the 2017 bull run, the 100EMA retrace buys were GOD MODE entries. You made a killing buying at that level....

It's make or break time for XRP. Positive short term momentum is building like with BTC but there is a case to be said for the bears. If BTC breaks down and current support does not hold I expect XRP to go with it along with the rest of the market. Watch the resistance lines and remember always DYOR!!!

We are either in retest mode primed for further gains or a bear flag waiting to break down. 8200 level very important. Momentum is looking positive. On short time frames positive momentum is building but this does not guarantee rises. Need to be careful here and watch that support zone above 8000. If that breaks next major structural support around 7500 followed...

Get ready for a nasty move, a pressure point is building up and tomorrow at the latest we'll know how it has worked out. At this stage, it could go either way. Neither the bulls nor the bears want to yield. Yestyerday I was sure the double top would play out but today's big buying action really surprised me. It's as if the bulls are not willing to yield much more...

Ok so this is funny but I was playing around with the chart and here is what I came up with on the 1D. An ascending triangle. But ONLY if we manage to hold onto the current levels and we don't break below the ascending line in any meaningful fashion. I know this runs contrary to what I just published but I think it's a very important observation. there is still...

The double top scenario looks to be playing out although for the time being BTC has found some resistance in the 7500 to 7600 range. Honestly I don't think this will hold with the main resistance being around the 7200 mark. There was very clear weakness around the low 8000's level with the double top, failure to break out to the upside in the symmetrical triangle...

I think we are in a symmetrical triangle (red) although it could also be an ascending triangle (blue). Either way it can only go up or down from here and whichever way it goes the movement will be violent. Watch out for fakeouts either way. The wicks on this one could get very long.

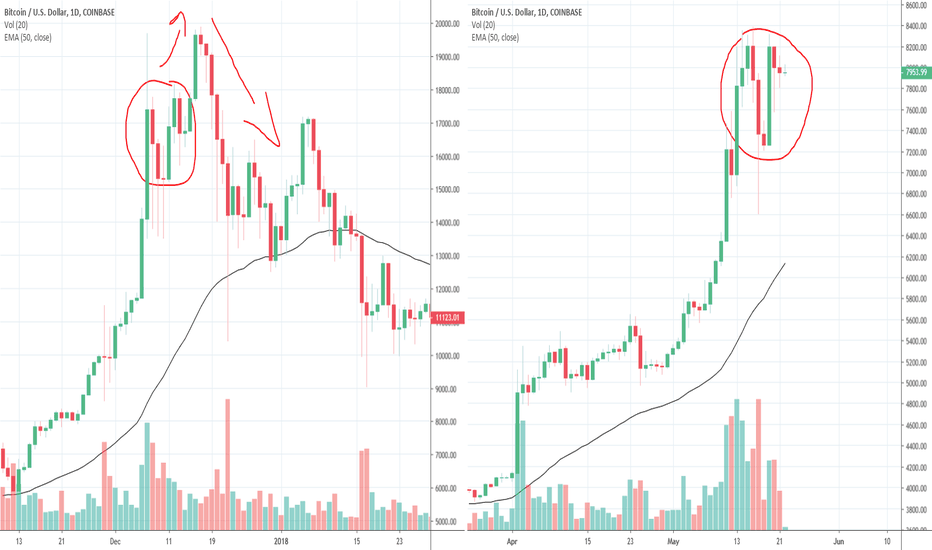

Check out this fractal on the 1D comparing December 2017 BTC peak with what we are seeing now. Almost identical. 1) Ultra bullish momentum pushing price way above 50MA. 2) 3 red candles down 3) Followed by super strong reversal (2019 one green candle, 2017 2 green candles) 4) 1 red candle down 5) Sideways for a day (in our case this is the second day) 6) Violent...

Frequently when looking at setups, charts, patterns, vertical and horizontal lines we forget to KEEP IT SIMPLE. Here we only look at the 50 period SMA, that's all. It's a very good predictor of how prices will move but is often overlooked. Price has clearly fallen below it BUT look at the action....it's very similar to what happened in February and twice in...

The chart really says it all. Right shoulder of a H&S pattern being formed. I thought that yesterday it would break out and we would have a relief rally but it's looking like we are heading down. My view would change if we form a low here and start moving back up above the EMA. Then on a 1 and 2 hour that would constitute a higher low. Daily momentum indicators...