This chart reviews the four major cycles affecting humanity, being the: - Kondratieff Cycle; - Strauss-Howe Generations Cycle; - W.D. Gann Property Cycle; and - Solar Cycle. I contrast these cycles with Global events of the time, the price of Gold, the US M2 monetary aggregate, and US Interest rates. My commentary on the chart is available on Patreon for...

With Bitcoin sitting below the 2018 high, we see the importance of the 0.786 retracement level demonstrated in the Bitcoin chart. The cyclical low so far this bear market has stopped just short of the 0.786 retracement from the previous all-time-high at $69k. Price has also found support at the 0.786 retracement level (red line) of the recent move up to $21.8k....

After breaking down below $25.3k on June 13, Bitcoin found a new low at $17,567, well below the 2017 all-time-high of $19,697. Signs of a Reversal In doing so, a pronounced price divergence appeared in the 4-hr chart, signalling a bullish reversal could be coming, and this was corroborated with the bullish engulfing bar at the low. Elliott Waves From that...

It is fitting that just after the Solstice we find ourselves considering terms that connote a change of season. The Wyckoff Spring, just like the Solstice, is a pivotal event that signals a change in trend. The Solstice signals a change in the trend of daylight hours in the day. The Wyckoff Spring signals a change in the trend in asset values. Or more...

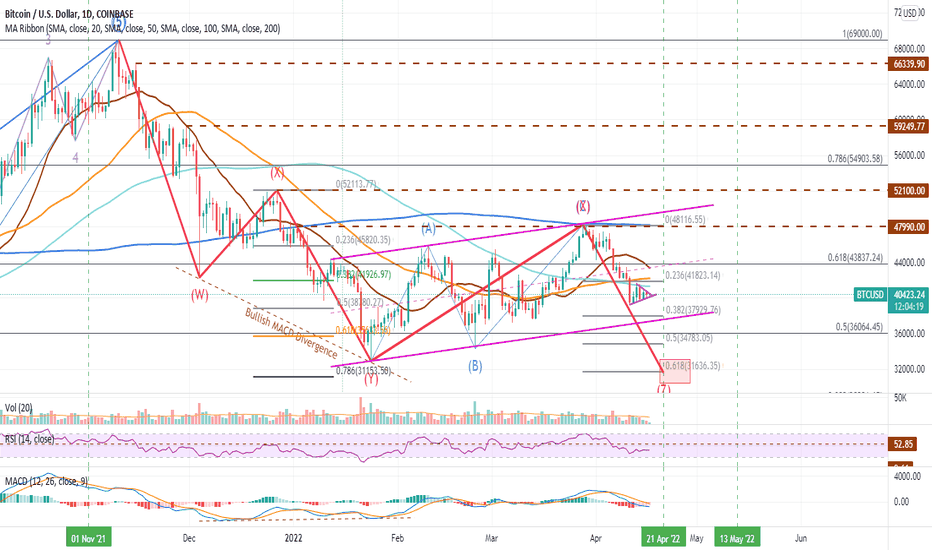

The previous period of triangular consolidation resolved in a break to the upside, with price then confirming past levels of resistance as support as a second triangle formation has taken shape. This current period of consolidation has the 1D 12MA rising above the 20MA, making one wonder what a bullish break of this new triangle might bring. While the potentials...

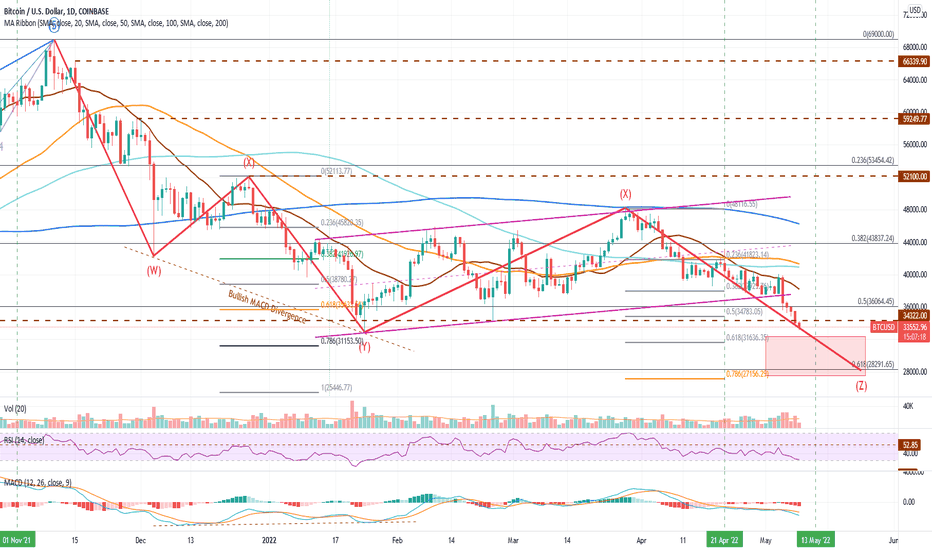

As this bear market has played out over the past few months, it has conformed pretty closely to a classic Wycokff Accumulation pattern. In the above chart, we see the Selling Climax (SC) at the end of January, followed by a bounce called the Automatic Reaction (AR), before a Secondary Test on Feb 24. A zig-zag correction up to $48k at the end of March set the...

In what looks like a possible wave 4, descending triangle correction, it appears as though Ethereum is projecting a lower-low is in the future before the end of this bear market correction. With volume declining, the MACD looking very week and the short-term MAs still falling below the longer-term MAs, the trend is still quite possibly lower. If price breaks...

Just looking at the BTC daily chart and we see an inside bar pattern signaling a trend reversal, a retracement to confirm support on the top of the prior trend line and growing confidence. What do you think? Is this a good time to go long?

As you can see in this daily chart, the telltales previously identified of a market bottom are all confirmed now except the cross of the 1D 12MA above the 1D 20MA. But price is on the right side of those MAs for that cross to happen tomorrow, giving confidence that the market lows are behind us. However, you can also see a $29k - $30k level of prior resistance...

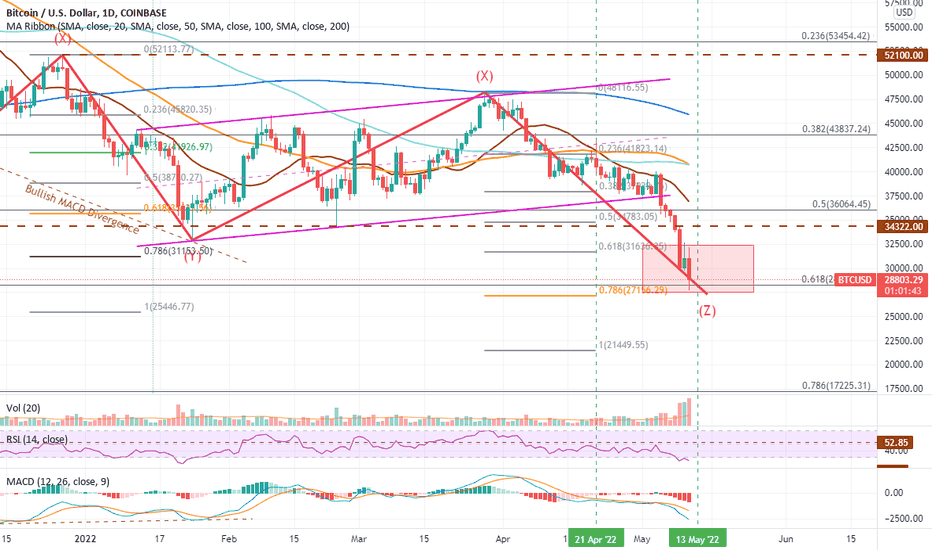

With the price consolidation over the past two weeks, we have seen a triangle pattern form that is projecting the continuation of the prior downward trend. Another look at the wave structure of the leg down from March 28 and it appears as though the $25.3k low was in fact a Wave 3 bottom, the current consolidation is a wave 4 correction and the next and final...

Bitcoin is forming its cyclical market bottom. A spike to a lower-low with a v-shape recovery is in the future, IF history is any indicator. Looking at the 2015 market low (left) and the 2018 market low(centre) we can see clearly that the once price crosses above the 1D 12 MA AND 20 MA then the market low is in the past. In both instances that crossing was...

In 5 minutes of trading yesterday, Bitcoin pushed through its $45.5k resistance level to close up 5.19% higher on the day at $46.8k. A very impressive 5 minutes, indeed. However, overall volume for the day was below average. Today, price struggled at the first level of resistance, pulling back from $47.5k, while the RSI moved up to touching the over-bought...

To extend upon my thesis that we have seen the low of the BTC bear market, I point out that we have seen a strong reversal pattern just complete, that is more obvious in the 4hr chart. Above you will notice the Inverse Head and Shoulders formation has completed around the $25.3K low. It is early days and anything could happen, however, this is also coincident with...

I am not presenting all my reasons for believing that the bottom of the bear market has occurred, however, you can see in this chart that all Fib levels have been attained, the RSI is oversold, the MACD is at an extreme, there has been more sustained volume over the past few days than anytime since the March 2020 lows. These observations coupled with the...

With the decline today into the $27k range, Bitcoin has basically fulfilled all my expected targets for the low of this bear market. But where to from here? Shall we see further declines, a period of consolidation or will the recovery get underway. Well, I expect perhaps a little more give in the BTC market before the recovery can be considered to be moving...

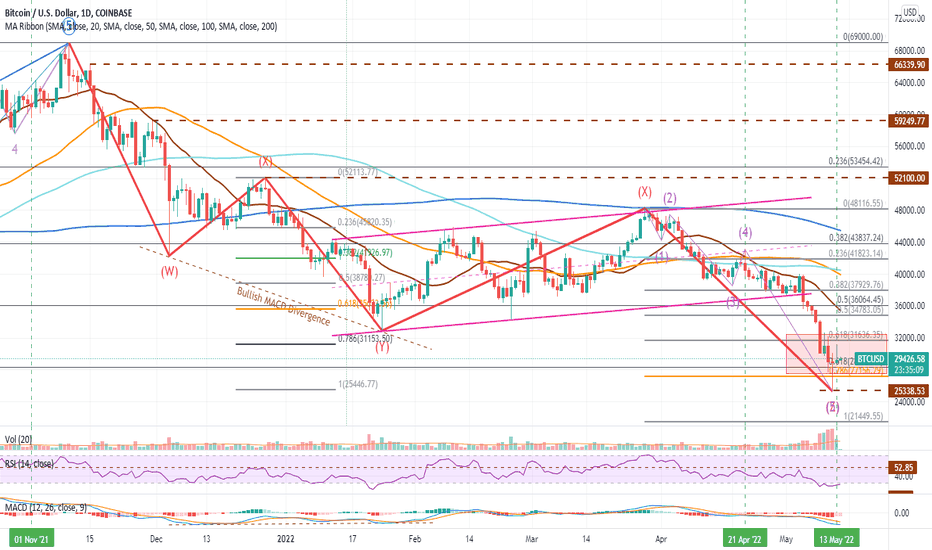

With Bitcoin breaking below its trading channel and in its 5th consecutive red day, the bear market is appears to be firmly on track to print a new low and break back into the $32k range. That is just a short drop from my first target low of $31.6k and gives me the expectation that my oft-mentioned $28k target may soon be realised. A look at the weekly chart and...

It’s been a week of decidedly bearish action, with BTC breaking below two structural supports; one a short-term channel, the other was a line of support that had held since January. Currently we see BTC flirting with support at $37.5k, however, another close below $38k confirms the break of the longer-term parallel channel and Bitcoin will be seeking out lower...

Seeing price rejected at the $48.2k level and what looks to be a bearish flag forming could see BTC break downward towards $31.7k. This would complete a lower low of its WXYXZ correction and set the stage for price appreciation.