CryptoHyve_

EssentialXRP broke the critical upside trendline earlier in the week and created a BOS on the 4h chart. It has now pulled back to this BOS zone at 2.00. Targets 1 and 2 are still in play once we get a confirmation that the pullback is complete. This trade will be invalidated if we break and close above the bearish trendline (red). NFA and trade carefully due to the...

AUDUSD broke structure to the downside earlier and pulled back to this exact zone around 0.62600. I will now wait for this pullback to complete and confirmation to enter my short trade with 1st target set at 0.60770 and 2nd target set at 0.59.500. Trade carefully due to PPI news today!

LINK is currently trying to break out of the downtrend on 1h chart. As we are in a big downtrend at the moment, link could potentially pullback to the 13.00 area and continue its bearish movement. If we end up breaking the 13.00 resistance, link will head higher to the next resistance which sits at the 14.35 level. I will watch link closely at the 13.00 level,...

#XRP broke the critical bullish trendline which started back in November. We have had a pullback to the BOS zone which also resulted in a rejection candle on the 4h chart. Looks like we can now expect to drop to the next support zone which sits at $1.37. This would now indicate that we are in a bear market as per TA, however, the recent price action and not...

#GBPAUD created a CHOCH move on the 4h chart after bouncing off the weekly resistance zone. Once GBPAUD enters the pullback area and confirms it's continuation to the downside, I will be looking to enter a short position there with a potential target being the long-term upward trendline.

NZDUSD broke out of its uptrend by breaking the trendline on the 4h chart. We may get a confirmation pullback here depending on the strength of the trend. The first target sits at 0.56800 and if we break this support, we may even head back down to the 0.55950 zone.

XTI created a CHOCH on the 4h chart and is looking bullish with 2 targets in sight. Once we complete a pullback to the CHOCH area, XTI will be looking at TARGET 1 in the 70.40 zone and once broken, the next target is at 73.00 Always wait for confirmation before placing your trade and use appropriate risk management.

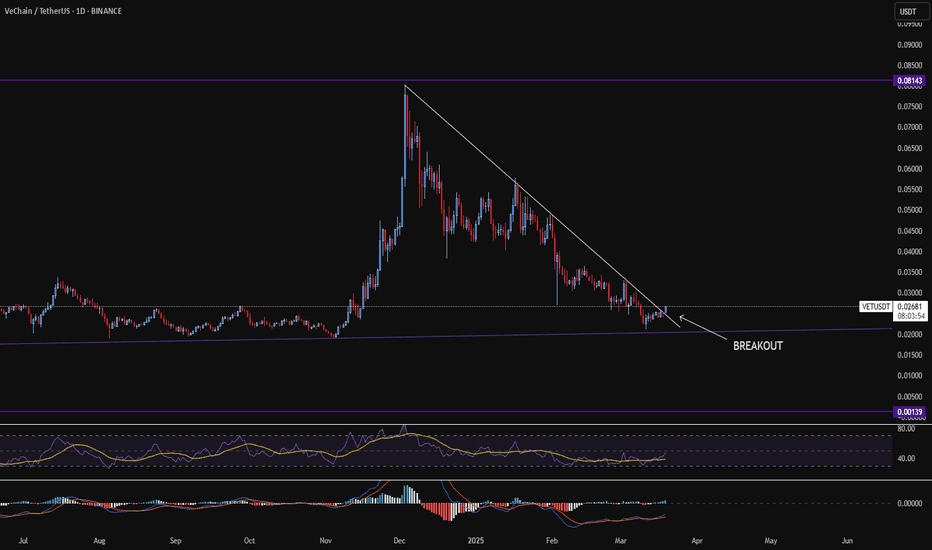

Is altseason about to begin? VET is currently breaking out of the downtrend after touching the LT critical support earlier so once we close the daily candle on a bullish note then we are going to go higher! There is currently plenty of positive news out there but the sentiment is still pretty bearish. Let's remember that corrections are very healthy and it...

XRP is creating LHs and looks to be heading for a final dip to the long-term upward trendline (purple) which would make this correction complete. The ideal scenario is that XRP will complete this correction and with bullish momentum will reach a new ATH within the next 2 months, however, let's see how XRP reacts to this critical support first!

EURUSD is currently struggling to break through the resistance at 1.095 and is looking to correct sometime soon. We can also see a RSI divergence which would imply a trend reversal. Trendline break and close would confirm a short-term trend reversal and correction needed for EURUSD to trade higher in the long-term. Best to not trade before the CPI today!

USDJPY broke through the downward momentum trendline on the 4h chart, however, due to to the unstable market at the moment, it may head a little lower to touch the support zone in the 146.100 area before reversing to the upside - depending on the strength of the US Dollar today. I will be looking for a confirmation candle close on the 1h chart to enter my long...

The recent 'pump' due to Trump's announcement disappointingly only created a pullback to the previous area where a downtrend had already been triggered. Looks like BTC will continue with the correction down to our next support level which sits at $67,792. Once BTC gets to this level, we will either see a nice bounce off this support and we can continue higher...

BNB reached all our targets and is now continuing with the falling wedge pattern. If its rejected from this current area, we can expect more downtrend for now and possibly even complete a correction to the critical support zone (upward trendline). A breakout to the upside is also possible and would see BNB reach $635 in the short-term. Market is very unstable...

AUDUSD has formed a falling wedge on the 4h chart which implies a breakout to the upside, however, today's CPI will have an impact on whether we go lower first before the breakout. There is a chance AUDUSD may touch 0.62 first before the bounce up and in this case, the next resistance is at 0.6355 (white zone). If a breakout does occur in the short-term, the...

BNB failed to close the break of the falling wedge and rejected at the zone, as well as breaking the support on the 1h chart meaning BNB will continue down for now, with the falling wedge pattern. The next support zone is at $560 which is my 1st target, the area at $510 is my 2nd target, although we may see a little bounce off the 1st area first!

XRP broke out of the triangle formation and looks like it will retest the support zone around $2.00. Hopefully we will see it bounce back from there but there is a possibility that we may go even lower towards a very strong support at $1.80. For now, I will be taking my profits at $2.05.

USDJPY failed attempts to be break the strong downtrend and is heading towards the next support zone at $1.46 (TARGET 1). There, we may get an attempt at a pullback before potentially heading even lower towards the next major support (TARGET 2). Let's see how USDJPY reacts off target 1 first - will update once we reach this level.

Due to the dollar gaining some strength NZD looks to be loosing uptrend momentum. Once the hourly candle closes on below the trendline, I will be entering a short trade here down to our next target zone at $0.56400.