I know this is one indicator, and a lagged one. But, this is one good for verifying, and so far not enough to trigger a buy signal. This could stay in oversold conditions for a long time. (But definitely keeping an eye out) Be careful on this move to the upside, the bears are still in control of the primary trend. Thoughts?

$BTCUSD: If the current low of $3,474.33 holds on this chart, which indicators show that it is unlikely to do so, the 50% Fibonacci level becomes key resistance moving forward. The price will have to trade above this level and even the 61.8% level to consider a trend change back to the bulls. The bearish trend continues, and with an ADX still showing strength...

There are many key indicators to look at to help define a bull market Moving averages Advances/declines Volume Identified support and resistance areas Momentum indicators. Since a bull market is one in which prices are generally rising, the basic indication of a bull market are up-sloping trend lines (and an up-sloping trend line needs to establish again since...

Each red vertical line is signaling when the RSI moved up out of oversold conditions. The price rallied nicely each time. This indicator can stay well under the green line to keep the market oversold. So, I will be looking for a buy when the RSI gets back above the green horizontal line and moves out of oversold conditions (or forms a divergence to price when...

The break of the blue trend line still has the downside target in play. Momentum still favors the bears, so look for this target as the next key buying support area.

The price is right on the long-term trend line. This is the last line of hopium for the chart. The only thing the bulls have going for them is low internal momentum for the bearish trend. Be careful trading longs here. Tight stops if adding longs. A break of this trend line would help validate my long-term call of $2800 from the beginning of the year.

The bounce off the 61.8% Fibonacci retracement support was key and a great sign for the bulls. The Average Directional Index (ADX), which measures the strength of trend momentum, is maintaining strength for the bulls. Since the green positive directional index line did not cross the red negative directional index line the 61.8% level becomes a nice floor. I am...

When you take the long-term trend lines into consideration, the bulls still have a chance here. Back in late 2015 the Average Directional Index (ADX), which measure the strength of trend momentum, was turning to the upside as the green positive directional index line also increased.. a sign for the bulls to take control. The trend line was being tested in early...

I would use other indicators for validation, but using RSI - buy when it goes back up out of overbought conditions (lower green line) Thoughts?

The small H&S pattern already hit and the market fell quickly, but found buyers at the low range of a watched order block. Where is the volume? I am staying long unless we break down through the order block where a bunch of buyers should hold as a floor. If not.. I wait for $4500 minimum on a decisive break before adding longs. Thoughts?

This is a rare pattern that makes a large descending triangle a reversal pattern and not one for a continuation of the bearish trend. In Elliottwave theory when two triangles nest inside a large descending triangle and has 9 hits into the apex of the pattern, and on falling volatility, the pattern favors the bears. So far the pattern is holding true with a...

Buying here near the blue 61.8% level could be a good play with news from Coinbase possibly coming out any day. However, watch the internal indicators.. the price could drop through support to set up a full retracement into the highlighted area. Thoughts?

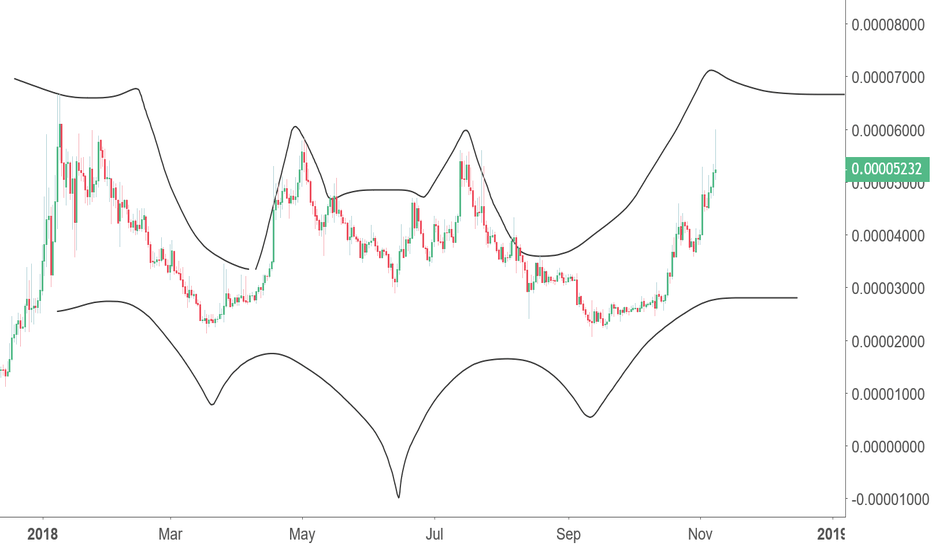

Pattern Fun - needs to drop to form the left wing ... hahahaha

The ETH market is finding some buying interest and momentum is trying to build strength for the bulls. There are some obstacles along the way before this market breaks out. The red trend line, the 50% and the 61.8% Fibonacci retracement levels all should act as resistance. Internal momentum with an increasing ADX needs to continue as price approaches these...

With two triangles forming one large descending triangle the outlook looks bullish from a pattern formation. After breaking trend line X of the large descending triangle pattern the price dropped back to an area of buying interest at the intersection of trend line 4 and trend line X. Internal momentum for trend is not strong, but trend line 4 is acting as a...