CryptoNicho

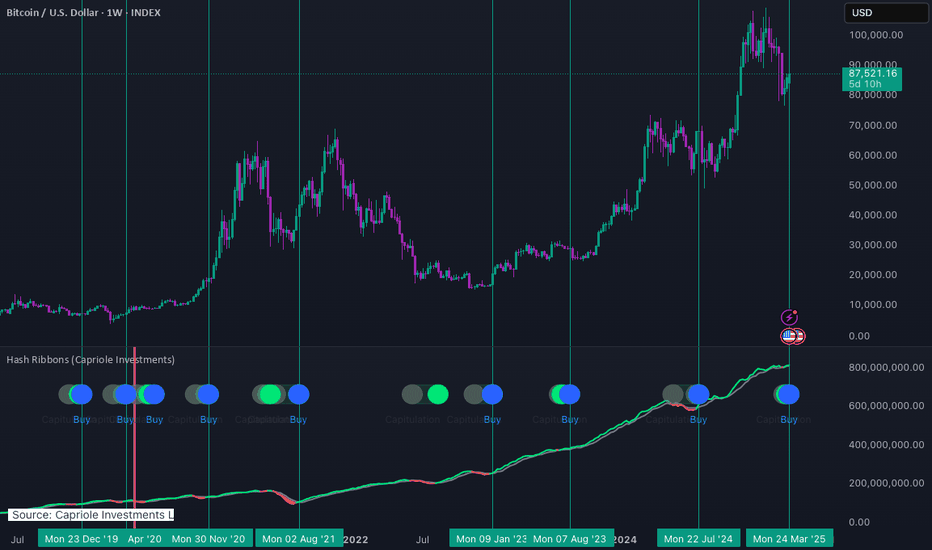

PremiumWe just got a major buy signal on the weekly chart. The Capriole Investments miner capitulation indicator triggered a buy signal. The indicator aims to show us points at which BTC miners are in distress and capituating. The idea is that it's showing when miners are shutting down their rigs causing drops in hash rates. These can often be areas of macro bottoms...

Macro Polymarket became infamous during the last US election where it absolutely nailed the result and proved to be way more accurate than the actual polls. Why is Polymarket so accurate? Probably down to the possibility of losing money. You're less likely to lie if it would cost you basically. Whats weird is that they have a current bet available; 'Will QT*...

Technicals M2 Money Supply Researcher Lyn Alden confirmed what alot of people already knew in September 2024, when she published a report showing that Bitcoin is strongly positively correlated with global money supply. Her paper concluded that BTC follows money supply 83% of the time and as a firmly risk on asset this makes sense, the more money there is to...

Technicals Institutions are dominating the market atm so CME gaps are being respected and we now have two bullish gaps open. Friday 7th we closed at $86.4k and then Friday 14th and $84.4k and with the volatility we'll get from the rate decision this week I expect both of these will get filled relatively soon. We have a potential incoming 'mini death cross' (I...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 4.747 47.1% • ⎿ Target 1 : 3.588 11.19% Entry: 3.227 ⌁ 3.227 • ⎿ Current market price: 3.227 Stop: 2.753 (-14.69%) Technical indicators: Volume pump, RSI momentum, crossing 20 & 50 MA • ⎿ 24h Volume: 11176946.9429 • ⎿ Satoshis: 3.227 • ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.1685 33.1% • ⎿ Target 1 : 0.1337 5.61% Entry: 0.1266 ⌁ 0.1266 • ⎿ Current market price: 0.1266 Stop: 0.1121 (-11.45%) Technical indicators: Trendline break, cross above 200 & 20 MA's, RSI momentum. • ⎿ 24h Volume: 4439111.1445 • ⎿ ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.06863 36.14% • ⎿ Target 1 : 0.05939 17.81% Entry: 0.05041 ⌁ 0.05041 • ⎿ Current market price: 0.05041 Stop: 0.04174 (-17.2%) Technical indicators: Trendline break, 20 & 50 (daily) Moving average break, RSI trendline break and under price...

Spot ETF (demand increase) + Halving (supply decrease) = Price Increases..... eventually It's no secret that the spot ETF launch didnt go exactly to plan. GBTC dumped into the liquidity and the OTC buying meant price stalled and it quickly, on the surface, started to look like a bit of a non-event. Now we, as cool guys who have a glassnode subscription, all know...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.005051 43.21% • ⎿ Target 1 : 0.00374 6.04% Entry: 0.003527 ⌁ 0.003527 • ⎿ Current market price: 0.003527 Stop: 0.003017 (-14.46%) Technical indicators: Trendline and resistance break with high volume. • ⎿ 24h Volume: 16739842.44215 • ⎿ ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: 5% • Exit: • ⎿ Target 2 : 0.3467 27.79% • ⎿ Target 1 : 0.2943 8.48% • Entry: 0.2713 ⌁ 0.2713 • ⎿ Current market price: 0.2713 • Stop: 0.2333 (-14.01%) Technical indicators: Trendline break, cross above 20MA, Resistance break (0.26, RSI Trendline break • ⎿ 24h Volume:...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% • Exit: • ⎿ Target 2 : 1.6617 26.91% • ⎿ Target 1 : 1.3938 6.45% • Entry: 1.3094 ⌁ 1.3094 • ⎿ Current market price: 1.3094 • Stop: 1.1614 (-11.3%) Technical indicators: Trendline break with volume and solid support. • ⎿ 24h Volume: 11533039.6952 • ⎿ ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 7.844 30.54% • ⎿ Target 1 : 6.447 7.29% Entry: 6.009 ⌁ 6.009 • ⎿ Current market price: 6.009 Stop: 5.14 (-14.46%) Technical indicators: Multiple trend and resistance breaks with volume pump. • ⎿ 24h Volume: 14805298.5378 • ⎿ Satoshis:...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.2819 32.41% • ⎿ Target 1 : 0.2345 10.15% Entry: 0.2129 ⌁ 0.2129 • ⎿ Current market price: 0.2129 Stop: 0.1878 (-11.79%) Technical indicators: 2039 resistance, 20 and 50 MA's, and trendline all broken by volume pump. • ⎿ 24h Volume:...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • Target 2 : 3.506 35.68% • Target 1 : 2.785 7.78% Entry: 2.584 ⌁ 2.584 • Current market price: 2.584 Stop: 2.087 (-19.23%) Technical indicators: Risky play but I like that rejection wick. Big volume spike pushed us through the 2.590 resistance. • ⎿ 24h...

Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.02419 35.06% • ⎿ Target 1 : 0.02092 16.81% Entry: 0.01791 ⌁ 0.01791 • ⎿ Current market price: 0.01791 Stop: 0.01537 (-14.18%) Technical indicators: Big Volume pump confirming breakout, key resistance break at 1791 (pullback active). • ⎿ 24h Volume:...

•Strategy: Long •Exchange: BINANCE •Account: Spot •Entry mode: Market order in range •Invest: Risk 1% Exit: • ⎿ Target 2 : 7.486 25.54% • ⎿ Target 1 : 6.583 10.4% Entry: 5.963 ⌁ 5.963 • ⎿ Current market price: 5.96 Stop: 5.291 (-11.27%) Technical indicators: Again cup and handle pattern into break of 5.573 resistance. • ⎿ 24h Volume: 77030986.0984 • ⎿ ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.09252 33.41% • ⎿ Target 1 : 0.07566 9.1% Entry: 0.06935 ⌁ 0.06935 • ⎿ Current market price: 0.06939 Stop: 0.06116 (-11.81%) Technical indicators: Cup and handle into break through 6749 resistance. • ⎿ 24h Volume: 9088402.10193 • ⎿ ...

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: 5% Exit: • ⎿ Target 2 : 1.9808 34.57% • ⎿ Target 1 : 1.6595 12.75% Entry: 1.4719 ⌁ 1.4719 • ⎿ Current market price: 1.4713 Stop: 1.1801 (-19.82%) Technical indicators: Resistance broken at 1.4045, big volume spike. • ⎿ 24h Volume: 104249721.84161 • ⎿ Satoshis:...