CryptoSwindle

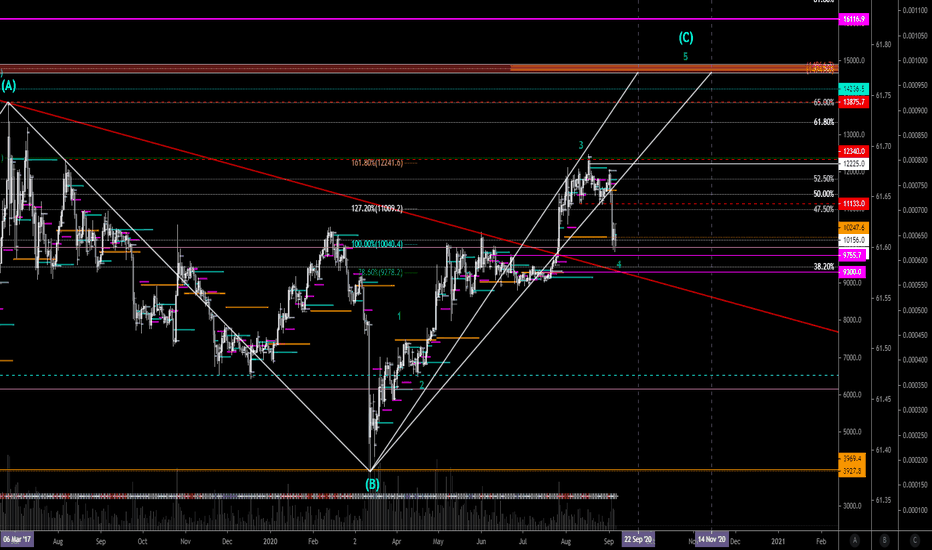

Started from scratch from 2018 onward, higher timeframe count which fits in the big picture I had since 2018, inc. possible bottoming in 2024 still stands and feels right. One more leg up should do. There is some time left as well. Invalidation at 1. Observation of what happened last days and my conclusion on it: Pullback without any (significant) bounce on key...

Still in range, 2 corrective legs down. Bigger picture should at least finish 3rd leg in bullish trend at $13k. Fifth leg finishes around 16k. Risk is now limited. Full moon pisces (strengthening of illusion) dump, tomorrow waning moon in aries (diminished movement (of dump)) -> consolidation, bart up + continuation trend.

Close above $13k to get confirmation what is suspected. For ETHUSD is $450. At some point there will be a significant pullback, considering the world stage atm, this could happened when the 2nd wave hits the city of London, albeit I don't see it worse than the first manifested impact. Train of thought: It should be obvious now for even the skeptic that btc is a...

Short term play for bulls with very tight stop $6999.99 @ Bitfinex for an excellent RR to 8.2k/11k'ish white box vs longer term macro (unchanged bias since dec 2017).

Trend tracker with counts, htf (with 1 ltf weekly breaker) structures and key price pivotal points.

Gold printed same top as bitcoin, but there is some potential here for a breakout to the upside. The move down seems controlled, which can be seen by strong pushback real quick just 3 days in the new month, which can be seen in the monthly chart. I got a small bearish bias, as this can be a giant distribution trading range. On the other hand, I like gold, but I...

Well, you already know how I feel about all of this and how this has come about. If you read my other idea, tether has actually printed another billion fake dollars in the meantime and injected it into the system and actually are buying bitcoin with it... No bull was telling you that about that, right? There are major fundamental problems with the underlying price...

Following the waves in this larger cycle to see what's next

This is more of a FA rant than anything else, will be updated with TA later on. I can write entire episodes on the crypto cult, bitcoin ponzi, bsv alone, history of crypto and all experiences, but I will try to condense as much as possible, because I don't feel to write it all in one go, actually I didn't want to make this idea in the first place, but better now...

Why buy gold and silver at premium while them still being in a bear market, when you can buy uranium cheap at accumulation levels. Does it really make sense to buy silver > $10 and gold > $1000 at given prices vs the risk it carries for downside potential vs a strong base near bottom that has lots of upside potential at lower risk. Speaking common sense. Adding to...

Looking to add to portfolio with a long term outlook. Cyan line is average (time * price) of measured period. I'm looking to scale in (pyramiding) just below diagonal cyan line (i.e. buying the stops of prev swing low of cycle high). Lineair undervaluation at orange targets.

The grand exchanges exit pump is upon us. Talked about this in nov-dec '17 on tg and discord that this possibility was very present of how they did this in the past (especially with tethers at almost instantaneous access) and that sentiment can switch on a dime's notice, got the same feeling after the mysterious 100m buyer (i.e. exchanges in cahoot) as years gox...

And where is it likely to go? Watch in 2 years from here.

I've wanted to post this idea much earlier, but I didn't feel to write, although I got so many to write about with a constant flow of ideas and information that I could write volumes, I try to keep it short and expand it in updates. I do notice nobody gets my updates, you have to click the "Follow this idea" next to the like button, try if that helps... if not,...

Tesla is nearing a very long term weekly support with lots of fud last 2 weeks and last statement report didn't bode well. When putting trend, time * price in to consideration, from TA point of view believe it or not nearing undervaluation since IPO, but can be debated since the angle * is pretty steep while it was in distribution mode a long time, so top...

Waiting for manipulators to break the ath. From there on out, I'm looking to see if it's a fakeout to get one more corrective move before resumption of the bull for another 1 year and 3 quarters. Confirmation on a monthly close above previous ath. US market should have gone down a lot more given all the statistics, but it seems it got a huge injection in buybacks,...

Get ready for the big short to 2k, same actors in play that left the 3k liquidity pool untouched gonna liquidate shorters on okex and some degens at mex in weekend again before the mother of all barts (moab) to lower trading range at 1.8-2.4k before one more corrective bullrun to max 13-16k with avg at 8-10k. If that happens, cash out and come back at 3 digits....

Thanks to the PPT for the deadcat, first short filled last Tuesday, having more bigger size in case it wants to try another push. I'm not going to retype what I've did in the update earlier today, for some reason, almost none of you get the updates via notification. I'm adding the dxy below as a reference point where it might redistribute in case the indices...