Crypto_Sniper_btc

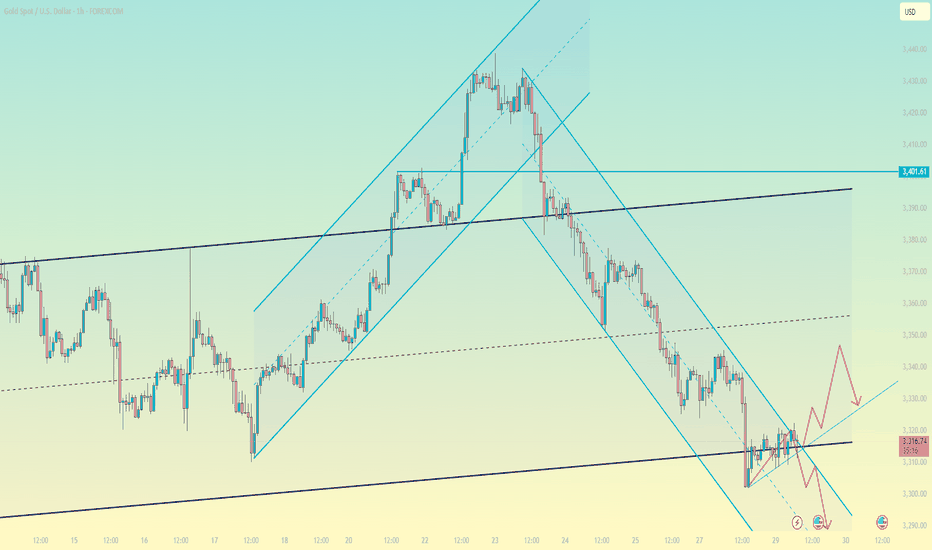

PremiumGold's final battle at the end of the week: Bulls face a do-or-die battle, awaiting the verdict of the non-farm payroll report! Key Points: Gold prices fell for three consecutive days this week, plummeting from a high of 3438 to 3268, a $170 drop that demonstrates the ferocity of the bears. While the trend reversed at the 3430 level, the sell-off below 3350 was...

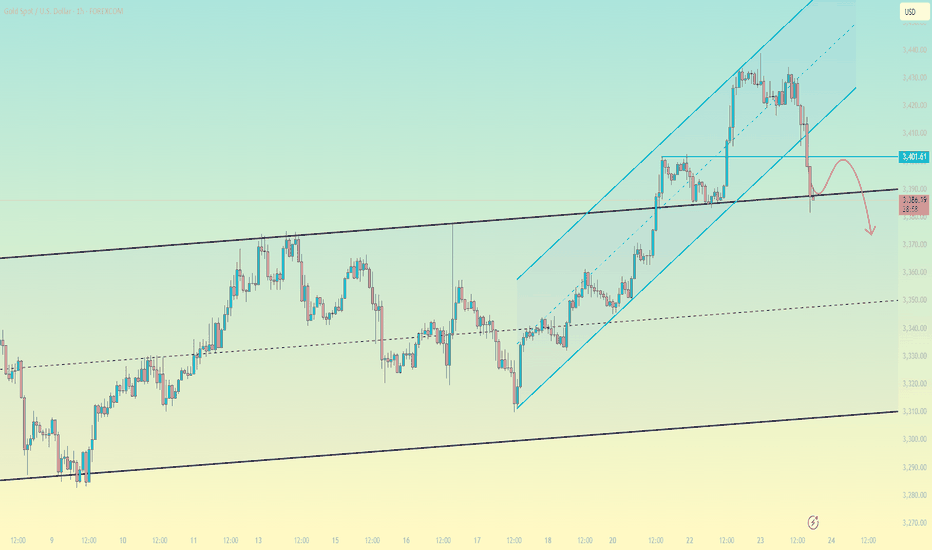

With the Fed's tariff decision approaching, can gold see a turnaround? Gold Outlook: The Current Bull-Bear Game Amid Three Major Storms Key Event Drivers Countdown to US-China Tariff Exemptions (August 1): The negotiation deadlock is difficult to break, but an "extension" could be a temporary respite for both sides. Be wary of Trump-style abrupt shifts that...

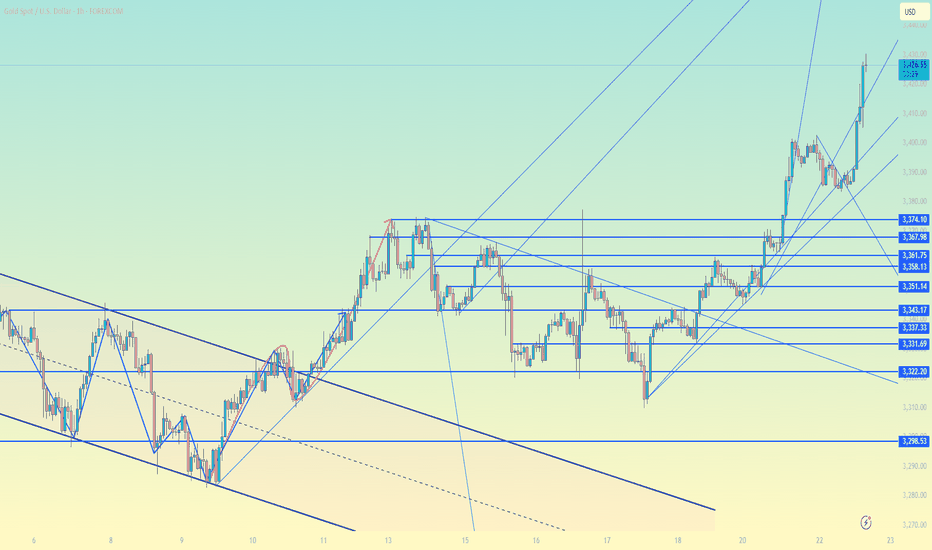

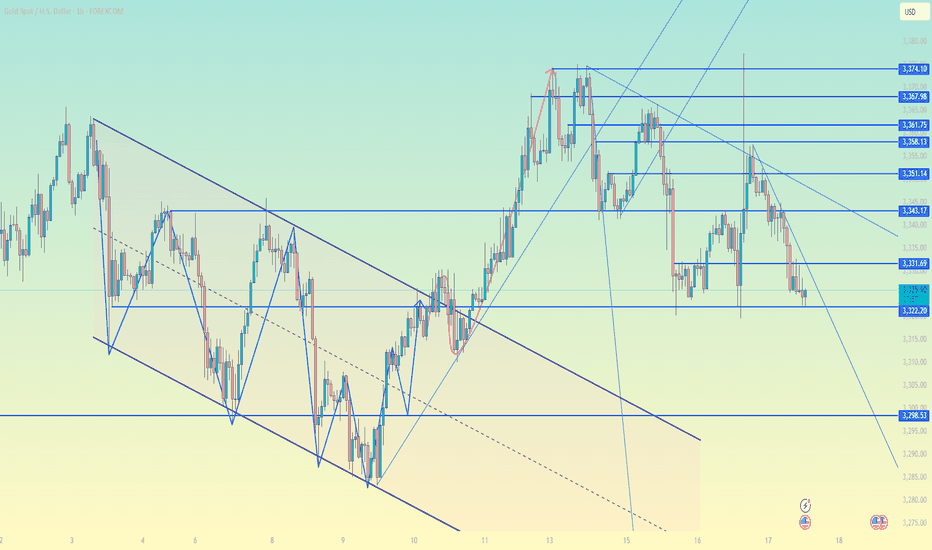

Gold Market Technical Analysis and Trading Strategies Current Trend Analysis Gold prices entered a technical rebound after testing key support at $3,300 and are currently trading in a narrow range between $3,315 and $3,320. This area constitutes a key bull-bear dividing line, acting as both upper resistance at the hourly chart's descending channel and technical...

Market Review Spot gold bottomed out and rebounded in the early Asian session. Affected by the US-EU trade agreement, the safe-haven demand weakened at the beginning of the session. The gold price once fell to the $3,320 mark, and then bargain hunting intervened to promote the rebound. It is now trading around $3,335/ounce. This week, the market focuses on risk...

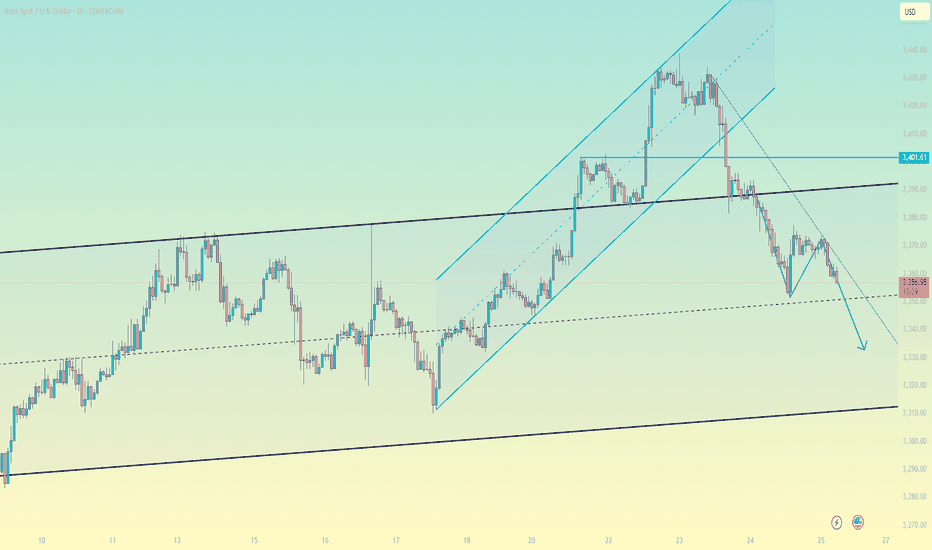

Gold prices are under pressure, focusing on the Fed storm Weekly gold price report: The rebound of the US dollar suppresses precious metals, and the market focuses on the Fed's policies and trade negotiations Market review On Friday (July 26), the international gold price was under pressure to fall, with spot gold falling 0.9% to $3,336.01/ounce, and COMEX gold...

Gold is under pressure, shorts aim at 3310 Gold technical analysis and trading strategy: key support faces test, weak rebound, beware of breakout risk Fundamental driving factors The stabilization of the US dollar index suppresses gold prices: recent US economic data (such as retail sales, initial jobless claims) show resilience, the market's expectations for the...

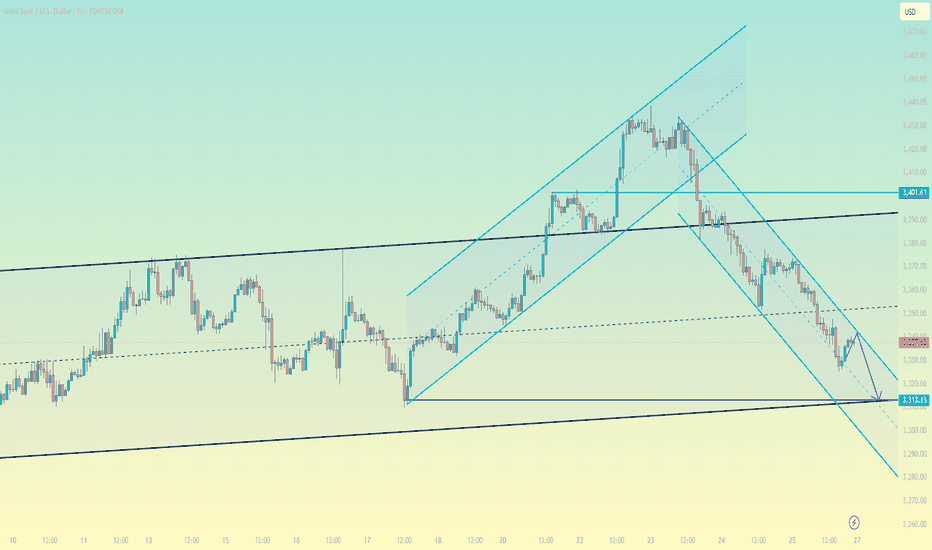

Gold fell from a high and may fall back to the range During the U.S. trading session on Wednesday (July 23), spot gold fell from a high and is now trading around $3,390/ounce. Previously, gold prices broke through the $3,400 mark on Tuesday, reaching a high of $3,433.37/ounce during the session, a new high since June 16, and finally closed up 1% at...

Gold technical analysis and operation strategy Market review and current trend Gold fell from $3402 as expected in the morning trading today. After the price rose in resonance in the evening, it chased more again at 3397.8. The current gold price has broken through the short-term acceleration line. The key resistance above is at $3420 (the pressure of the...

Gold bulls are accumulating momentum and are about to break Gold market analysis report: safe-haven demand supports gold prices, and the technical side maintains a bullish pattern I. Fundamental analysis 1. The weakening of the US dollar and risk aversion boost gold prices Spot gold closed up 0.35% last Friday (July 19), mainly affected by the decline of the US...

Gold Weekly Review: Risk aversion supports gold prices to remain stable, and the focus next week will be on the Fed and tariff trends This week, the gold market maintained a volatile trend under the dual support of a weaker dollar and geopolitical uncertainty. Spot gold finally closed at $3,353.25 per ounce, basically stabilizing around $3,350 during the week....

Gold short-term analysis: mainly long on pullback Core driving factors Fed policy suppression: Although officials have recently released dovish signals, strong US retail sales and employment data support the expectation of "higher interest rates for longer", limiting the upside of gold. Risk aversion support: Trump's tariff policy concerns are rising. If the...

Market review On Thursday (July 17) in the early Asian session, spot gold traded in a narrow range at $3346.50/ounce. The overnight market was dominated by news, and gold prices staged a "roller coaster" market: in the early New York market, it fell to an intraday low of $3319.58 due to the strengthening of the US dollar, and then soared by $50 to a three-week...

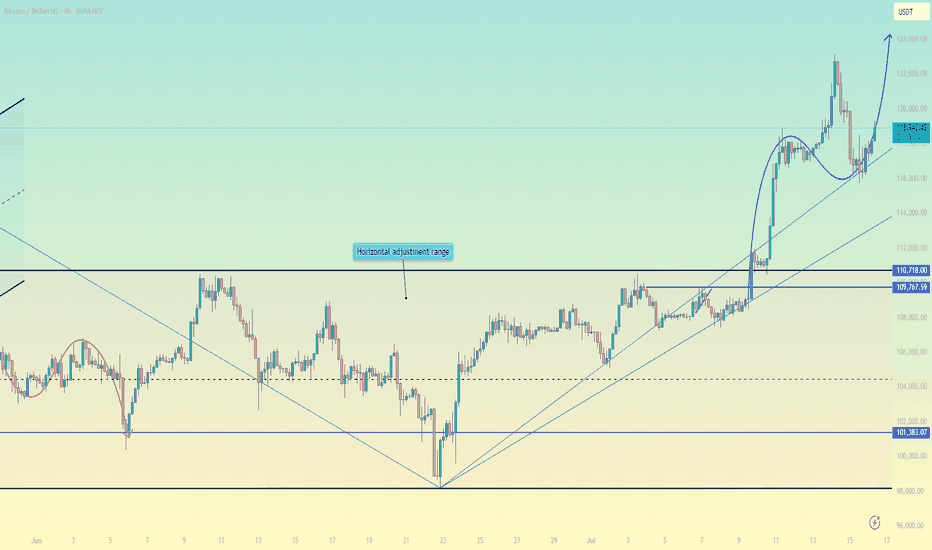

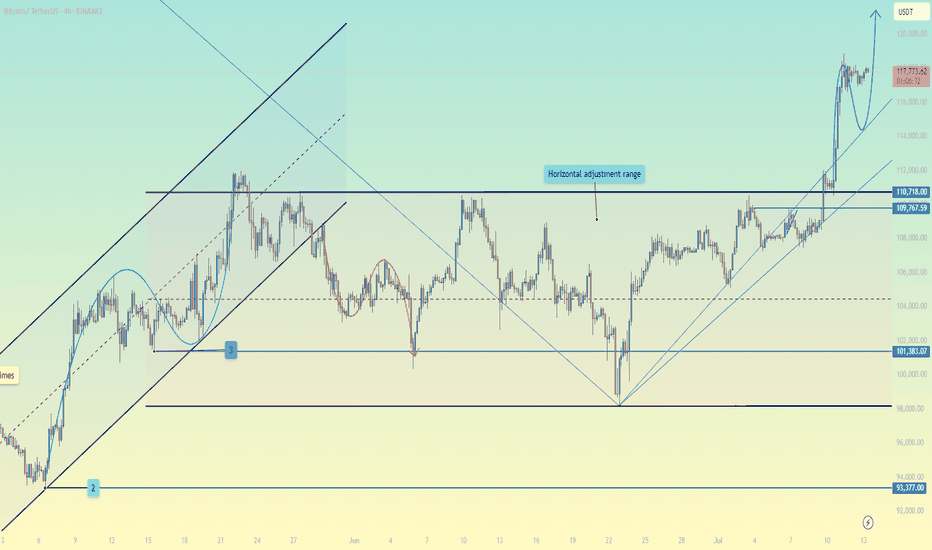

Bitcoin breaks through $120,000: long opportunities under the resonance of fundamentals and technical aspects I. Fundamentals: Multiple positive factors drive the bull market Institutional funds continue to pour in The net inflow of US spot Bitcoin ETFs reached US$2.7 billion in a single week (a single-week record in 2025), and BlackRock IBIT's management scale is...

Bitcoin Rush: The Carnival and Concerns Behind $120,000 The Bitcoin market is staging an epic rally - the price has broken through the $120,000 mark, setting a new record high. But behind this jubilation, the market has shown signs of overheating. Market Status: Risks Hidden in the Frenzy Price Performance: Hit a new high of $123,000 on July 15, up nearly 20% this...

Bitcoin hits a new high! Is this time really different? Bitcoin hits a new high! On July 11, BTC broke through $117,000 in one fell swoop, completely igniting market sentiment. Shorts were completely defeated, and 230,000 investors were liquidated within 24 hours, losing $541 million, of which 89% were short orders-this market is simply rubbing shorts on the...

Bitcoin breaks through a new high, aiming at 120,000! ——Trend analysis and operation strategy Bitcoin (BTC) finally broke through the shock range and broke through the 120,000 US dollar mark, setting a new record! The current market sentiment is high, and both technical and capital aspects show that bulls have an absolute advantage. Key data observation: Price...

In-depth analysis of the Bitcoin market: Breakthrough opportunities under the resonance of fundamentals and technical aspects I. Overview of the current market situation As of July 10, 2025, the price of Bitcoin is currently in a high consolidation stage after breaking through $112,000 to set a record high. The highest increase in 24 hours was 3%, and the...

Macroeconomic and policy impact Trump tariff policy: The United States announced that it would impose 25%-40% tariffs on Japan, South Korea and other countries (effective on August 1), triggering market risk aversion, and Bitcoin once fell to the support level of $107,5004. Federal Reserve policy: The market is concerned about the possibility of a rate cut in...