Crypto_robotics

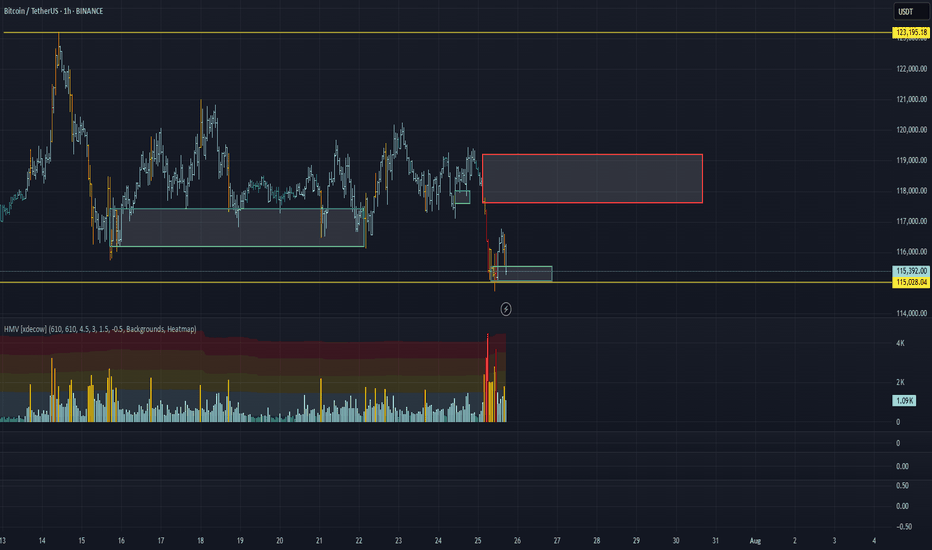

PremiumHello everyone! This is the daily analysis from a trader-analyst at CryptoRobotics. Yesterday, Bitcoin bounced off a local sell zone on the 15-minute timeframe (previously mentioned), but a full-fledged bullish move did not follow. Instead, the less likely scenario played out — we broke the range to the downside and tested an important buy zone around...

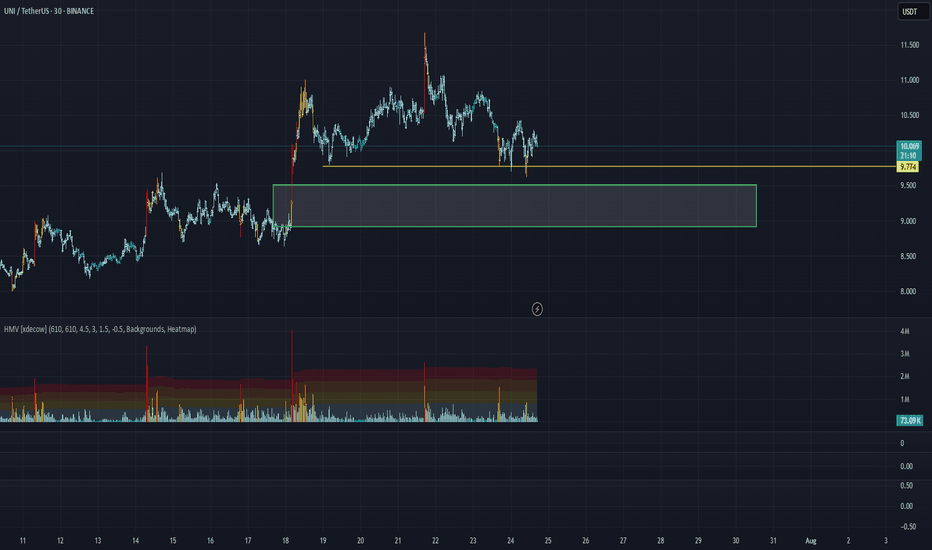

This pair has been in a downtrend since July 21st, but after approaching the important $9.8 level, the price has failed to break below it on three separate attempts. Below that, there is a very strong buyer zone between $9.5 and $8.9. If this zone is tested and we see a reaction from buyers, we will consider a long position. This publication is not financial advice.

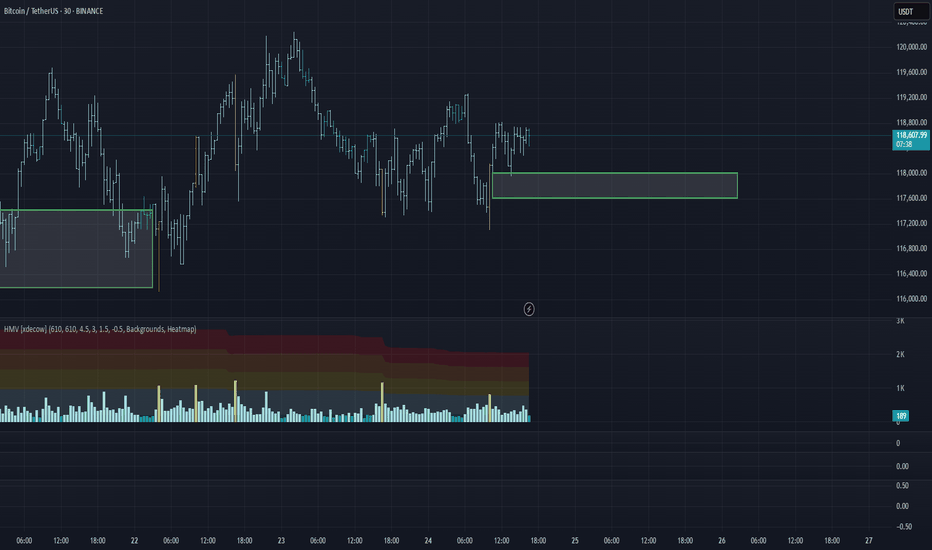

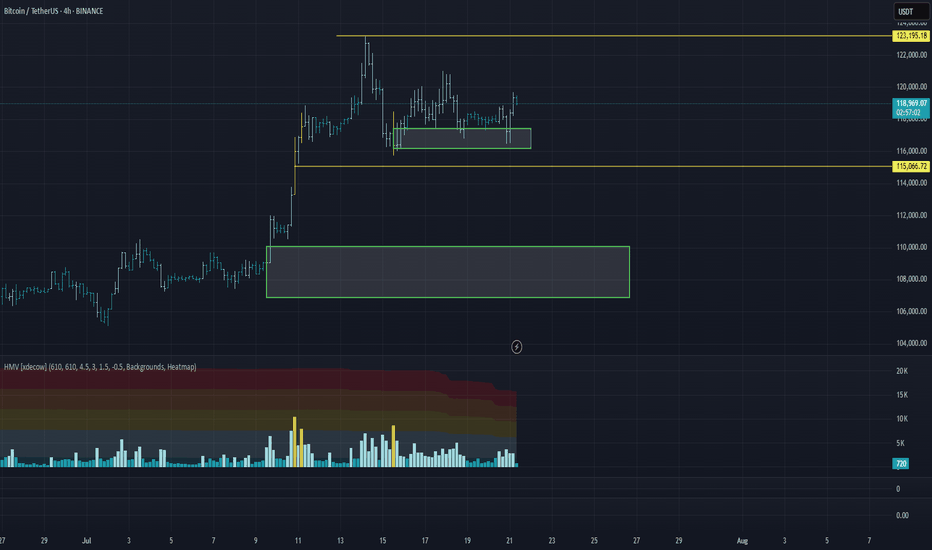

Hello everyone! This is the daily analysis from a trader-analyst at CryptoRobotics. Yesterday, Bitcoin tested the previously mentioned POC (the point of control — the area with the highest volume concentration within the range). A reaction followed: buyers prevented the price from falling below that level. At the moment, we still expect a breakout from the...

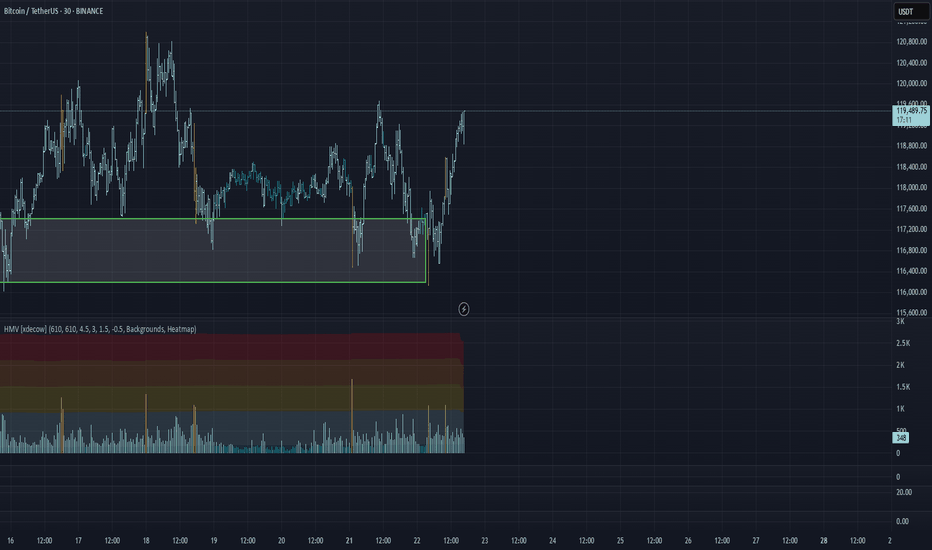

At the moment, we’ve been in an accumulation phase since yesterday. Within the current range, we’ve observed strong absorption of market selling based on cumulative delta (delta is falling while price remains stable). Additionally, earlier activity from a large player was noted near the lower boundary. The safest long entry appears to be a false breakout below...

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics. Yesterday, Bitcoin continued moving toward the upper boundary of the sideways range. Strong market buying emerged near that level, but unfortunately, it was absorbed by sellers. At the moment, we are testing the POC (Point of Control) of the current trading range. Buyer activity...

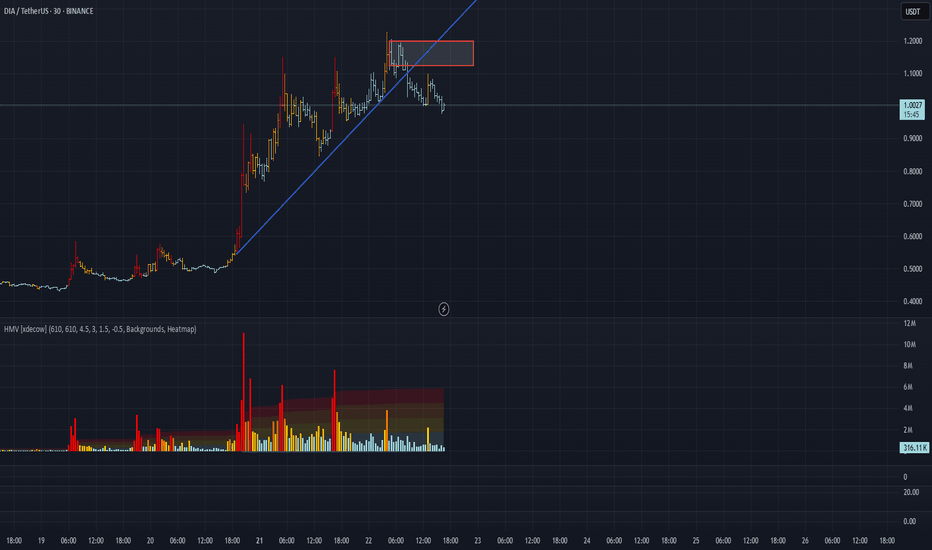

This asset has experienced a trend break and a breakdown of the ascending trendline. A volume cluster has formed above the current price, which triggered the current correction. If these levels are retested and met with a reaction, we consider a short position with a potential target of $0.9. Sell Zone: $1.125–$1.2 This publication is not financial advice.

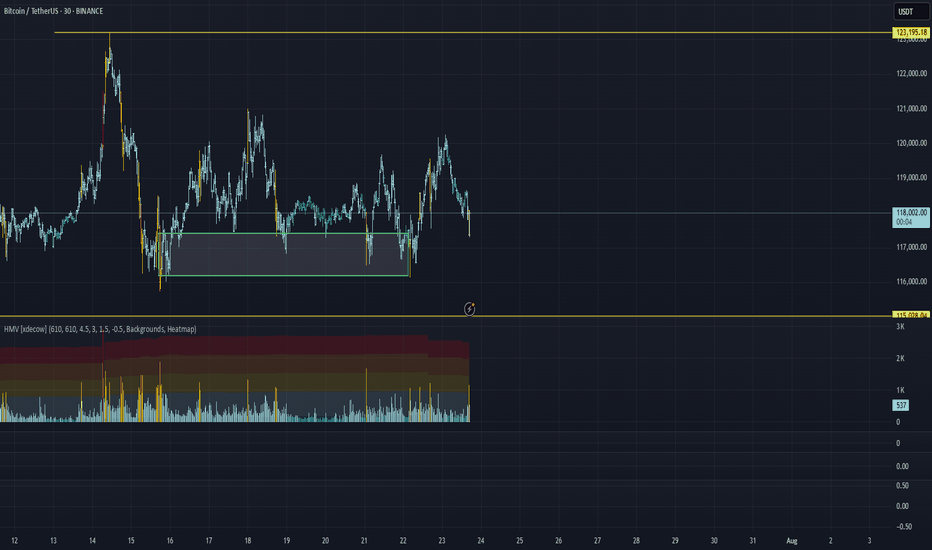

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics. Yesterday, Bitcoin continued to rotate within a narrow sideways range, and so far, there has been no breakout. We retested the lower boundary of the range and once again saw absorption of market selling at that level. At the moment, the scenario remains valid — we expect a...

WHAT HAPPENED? Last week, after updating the historical maximum, bitcoin went into correction for the first time, after which it went sideways. At the moment, the $117,300 – $116,300 zone has been retested (strong absorption of sales) and an active reaction from buyers has been received. Within the current flat, the cumulative delta supports buyers,...

WHAT HAPPENED? Strong sales resumed last week after a short period of growth. This was provoked by the escalation of the conflict in the Middle East. After testing and fixing the $105,800-$104,500 zone (accumulated volumes), strong volume deviations appeared, which should be perceived as protection on the part of the buyer. WHAT WILL HAPPEN: OR NOT? At...

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics. Yesterday, despite a positive chart structure, Bitcoin broke out of the accumulation zone to the downside. This move was influenced by the escalation of the conflict in the Middle East and extreme FOMO among retail traders. The main expectation is a decline toward the nearest...

For this token, abnormal buying by a large player has been visible for several days, followed by strong moves with very low volume. One of these zones is $2.77–$2.74. We consider buying from this zone if a reaction appears. This publication is not financial advice.

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics. Yesterday, Bitcoin once again tested the sell zone at $110,000–$110,600 (profit-taking by a large player) and moved into another correction. Looking at the current accumulation, we’ve noticed strong market selling pressure that so far hasn't led to any significant result. The...

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics. After a strong breakout through the high-volume zone of $104,500–$105,800 and a full trend reversal to the upside, Bitcoin has reached its resistance zone at $107,000–$109,800 (accumulated volumes). At the upper boundary of this range, strong volume anomalies and profit-taking...

WHAT HAPPENED? Last week, after fluctuating in a sideways range, bitcoin began to decline. Only $300 wasn’t enough to reach the level of $100,000 — there was a strong absorption of market sales, and a rebound occurred. WHAT WILL HAPPEN: OR NOT? We tested the $104,500–$105,800 zone (accumulated volumes). There is no abnormal activity or strong sales within...

We previously considered a short setup on this asset, and the trade performed well. After reaching key resistance levels, the coin showed strong selling activity. We’re now looking for another short opportunity on a retest of the high-volume anomaly zone at $51–$53 — provided there's a reaction within that zone. Our target remains the same: the POC of the...

Hello everyone! This is the trader-analyst from CryptoRobotics with your daily market update. As expected, Bitcoin dropped to the local low yesterday. At the time, there was no sign of buyer support, and the price moved down to the next support level. Just around $300 short of a round-number level, a strong absorption of market sell orders occurred, and we saw...

Hello everyone! This is a daily market analysis from a CryptoRobotics trader-analyst. Yesterday, after testing the local resistance at $105,400, Bitcoin shifted to a downward movement — but not for long. Selling pressure was very weak, and the initiative was quickly taken over by buyers. However, after a second test of that same level, selling resumed again,...

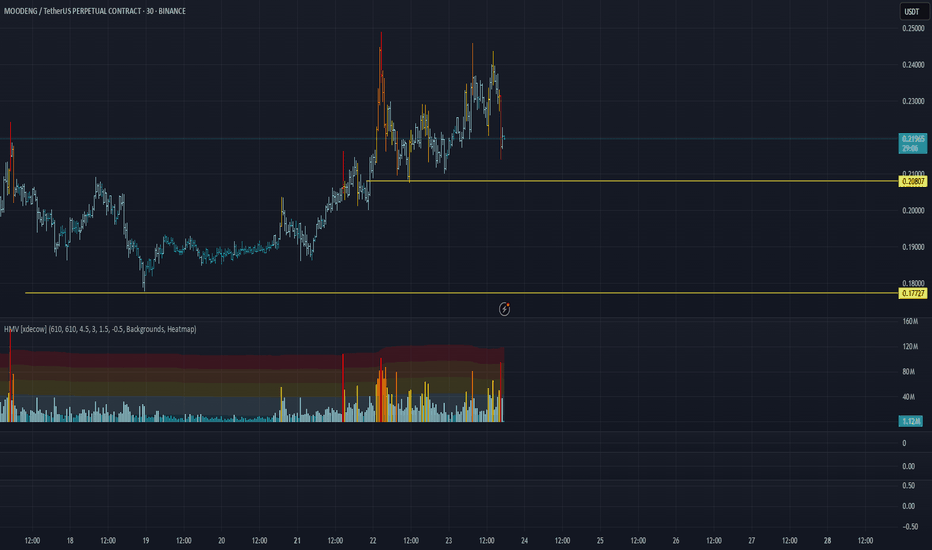

Following strong growth last month, a significant support zone has formed at $0.15–$0.11, which has not yet been tested. A false breakout below the $0.17 low is quite possible, followed by a quick move to the mentioned support zone and a return above $0.17. This publication is not financial advice.