SPY has rallied sharply from its recent low, but it's now pressing into a critical resistance zone. Price is currently sitting just below a major unfilled gap between $539.54 and $548.94. Until this gap is filled and the market closes decisively above it, the broader downtrend remains intact and risk of a reversal is elevated. Current Price Action: SPY has...

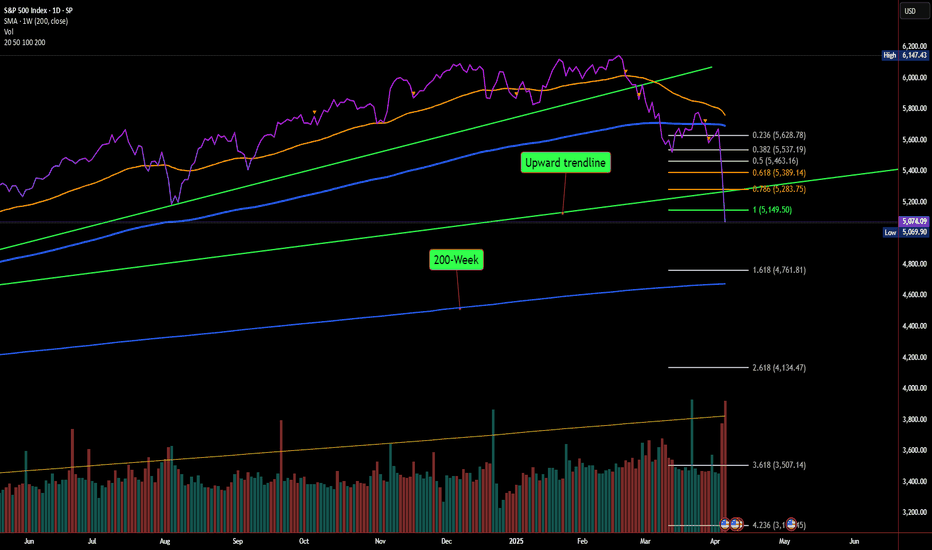

Last week, I warned in this post that if sentiment worsened, the S&P 500 could head toward 4,790 as a worst-case scenario. Fast forward to today, and the index has officially lost the 5,149 support level, opening the door for further downside. What Just Happened? 📉 Key Support Broken: The market just lost 5,149 (1.0 Fib retracement), which was a major line in...

The Volatility Index (VIX) just skyrocketed 50.90% to 45.30! This is one of the largest single-day spikes in recent history, signaling extreme fear in the markets. Historically, VIX levels this high have only occurred during major financial crises like: ✅ 2008 Financial Crisis ✅ COVID Crash (2020) So, what’s driving this surge in volatility? 📊 Understanding the...

The NASDAQ 100 (NDX) just took a huge dive, dropping 21.69% from its recent highs. That officially meets the definition of a bear market (a decline of 20% or more). The question is: Are we going lower, or is a reversal coming? Let’s analyze the moving averages, Fibonacci levels, and key market signals to figure out what’s next. 📊 Moving Averages Breakdown: A...

Looking at this SPX Daily Chart, we’re seeing some clear signs of weakness in the market. 🔹 Breakdown from the Rising Channel – After months of uptrend, SPX has broken below its previous rising channel, signaling potential downside ahead. 🔹 Failed Recovery Attempt – The recent bounce formed a bear flag (highlighted in brown), but today’s sharp drop indicates...

This daily BTC/USD chart is showing a potential Head & Shoulders pattern, which is a classic bearish reversal structure. But that’s not all Bitcoin is also at risk of forming a Death Cross, signaling deeper downside potential. Here’s what stands out: 🛑 Key Bearish Signals: 🔻 Head & Shoulders Formation: The pattern consists of a peak (head) with two lower...

Bitcoin is showing clear signs of a breakdown from a rising wedge pattern, a classic bearish reversal structure. The chart suggests that BTC failed to sustain momentum above key moving averages and is now heading toward critical support zones. Key Observations: 🔹 Rising Wedge Breakdown: BTC recently broke below a rising wedge, indicating potential further...

Bitcoin is currently trading at $87,201 on the 4-hour chart, consolidating within an ascending channel. Price action suggests that bulls are maintaining control, but a breakout in either direction could dictate the next major move. Key Observations Bitcoin remains in a short-term uptrend, forming higher highs and higher lows within the ascending...

Bitcoin is currently trading at $87,350, showing signs of recovery after a significant pullback. The weekly chart highlights a crucial battle between bulls and bears as price approaches key resistance levels. Key Levels to Watch Resistance Levels $89,067: Bitcoin needs to break above this level to regain bullish momentum. This has acted as both support and...

The S&P 500 is showing signs of weakness as it approaches a critical juncture ahead of tomorrow’s economic reports. After a sharp V-shaped recovery, the index is now facing resistance and struggling to maintain upward momentum. If key support levels fail to hold, we could see further downside in the coming sessions. Key Levels to Watch: 5,700 - 5,720: A...

The S&P 500 has broken down from a rising wedge pattern, triggering a sharp decline. Let’s break down why this is happening and what it could mean for the market. 🔍 Key Reasons for the Sell-Off 1️⃣ Rising Yields and Interest Rate Fears The Federal Reserve’s stance on interest rates remains a major driver of market movement. Recent economic data has delayed...

Bitcoin has officially broken down from its descending wedge pattern, slipping below key trendline support. This signals a potential continuation to lower levels unless bulls step in aggressively. Pattern Breakdown: 📉 Descending Wedge Breakdown – Bitcoin was consolidating within a wedge formation, but the lower trendline has now been breached, confirming a...

Months ago, I shared this Bitcoin (BTC/USDT) chart, outlining key levels, potential breakouts, and crucial support zones. Now that time has passed, it’s time to reflect on how the market has reacted and whether my predictions held up. Support & Resistance Levels Held Strong One of the most significant aspects of my analysis was the importance of the $100,000...

Bitcoin is at a critical decision point, and the next move could be massive. Let’s break it down: 📉 Bearish Scenario (Most Likely) BTC has been consolidating, but it's now breaking below key support and trading under the 21-day VWMA (red line)—a strong bearish signal. If sellers take control, we could see BTC drop to: 🔻 $88,000 (0.5 Fib level) – First major...

The S&P 500 (SPX) just closed with a strong bearish candle, dropping -104 points (-1.71%), signaling a possible shift in momentum. The index is now testing a key support level near 6,000, and if this level breaks, we could see a sharper pullback. 📉 What’s Happening in the Market? 1️⃣ Rising Interest Rate Concerns – The Federal Reserve remains cautious about...

📊 Chart Breakdown: AVGO is showing signs of a bullish pennant formation after a strong impulsive move up, followed by a period of consolidation. 🔹 Lower Highs & Trendline Resistance – The stock has been making lower highs, forming a downward sloping resistance. 🔹 Support at 9 EMA (Yellow Line) – The price has bounced off the 9 EMA, which suggests buyers...

AMD is forming a potential ascending triangle pattern on the daily chart, signaling a possible breakout if momentum continues. 🔍 Key Levels to Watch: ✅ Support Zone: The stock needs to hold above the $108-$109 range for the bullish setup to remain intact. ✅ Breakout Level: A push above $114 could confirm upside continuation. ✅ Target Levels: If AMD breaks...

Bitcoin is forming an ascending triangle on the 4-hour chart, signaling a potential breakout. The price is making higher lows, showing strong buying pressure, while resistance remains near $98,000. 🔍 Key Levels to Watch: 📈 Breakout Target : If BTC breaks above $98,000, we could see a move toward $100,763, with further upside potential toward $102,600. 📉 ...