The price bounced from the resistance zone and broke the local uptrend line. We could open short trades following that signals. I wrote about such a trading plan in this post . What's next? If you missed reversal and breakout signals, it is better to wait for a short term upward movement. The reversal signal from 1900.00$ zone will give another trade opportunity...

The 4H timeframe gives us the exact zone for buying. If the price continues the downward movement, the main target for the bears will be at the support zone between 320$ and 300$ levels. The reversal signals from this zone will be good for buying. If the bears can't push the market down, we should be ready to see a breakout above the local swing highs and SMA200....

Here is another example of how we can trade in the BTCUSD market. The price has been moving in the borders of the triangle chart pattern. We can use a breakout signal in combination with signals from Ichimoku for trading. If the price breaks the upper line, it will be a bullish signal. The price will be above the cloud and we will have a bullish market. The 1st...

The price reached the resistance zone formed by a downtrend line and SMA50. If the bulls are strong, they will be able to break this zone. We will get a bullish signal in the direction of the main trend. MACD is going to support the further upward movement toward 126.500 resistance zone. It will give us new buying opportunities in the daily and hourly timeframes....

The price action in the weekly chart formed a bearish pennant. If the price breaks the bottom line, it will be a bearish signal. The breakout below 10 000$ will support the further downward movement and the strength of the bears. Targets will be 7000$ and 4000$ support levels. Looks crazy, right? But these zones come from the weekly chart and its market...

The daily chart tells us about a bearish market if we use the Ichimoku indicator. The price is moving sideways in the borders of the pennant chart pattern. This pattern belongs to a trend-continuation group of patterns. If the price breaks the bottom line of the pattern, the downtrend will be confirmed. It will be a good idea to wait for a breakout below 10 000$...

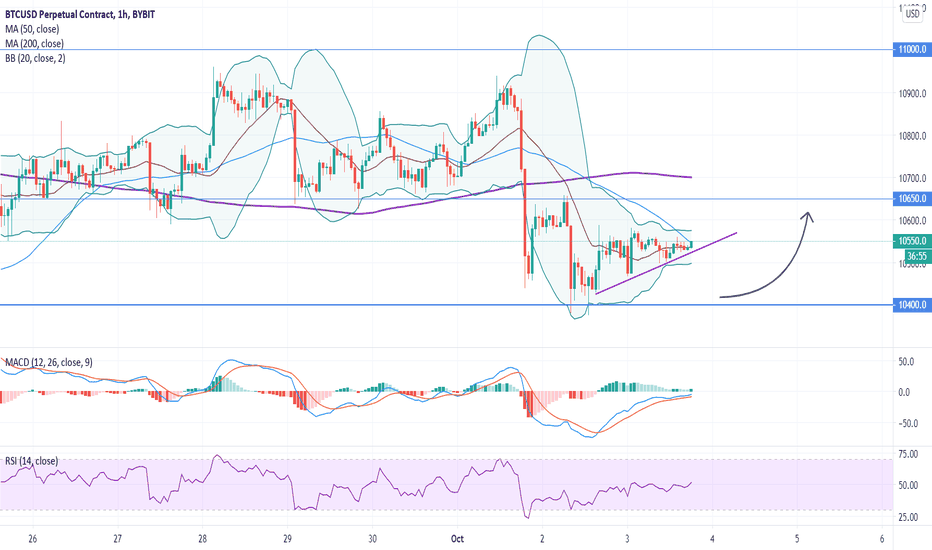

Let's look at the possible trade opportunities using the 1H chart. How can we trade and which levels and lines are important for traders? The price has been moving below SMA200. It tells us that we have a downtrend and we should search for trade opportunities for shorting. For this, any reversal signals from SMAs and resistance will be good for opening short...

We can see a clear trend reversal in the 1H chart. The price broke the main downtrend. After the retest, we could see an upward movement. Higher highs and higher lows confirmed a new uptrend. What does it mean? It means that we should search for buying opportunities as it will allow us to trade in the direction of the bullish trend. We have to use correction...

The pair looks interesting for buying. Why? The price broke the local downtrend line. It gave us a bullish signal. The price retested the broken downtrend line and bounced from 1.94575 support. It is another bullish signal. If the price can stay above 1.93850, we will be able to buy using reversal signals. The main profit target should be 1.97000 resistance....

In order to make a profit in the financial markets, we can use even the simplest technical analysis tools like support and resistance lines and zones. We don't need the complicated EWT, tens of indicators and the detailed fundamental analysis. We just need to look at the chart and draw 1-2 levels. Of course, we must have knowledge how to do it properly. Let's...

The price reached the support zone formed by SMA200 and 1.17000 support level. The price action at this zone will be able to give us interesting trade opportunities. If we talk about trading in the direction of the daily timeframe, it will be better to wait for a possible breakout below the support zone. It will give a trade opportunity for shorting. If the price...

The price bounced from the resistance zone formed by SMA20 and 124.350 resistance level. We should be ready to get interesting trade opportunities for shorting in the hourly and minutes timeframes. The main profit target will be the daily SMA200. Stop orders for all short trades must be placed above the local swing highs and the resistance levels. ...

The price reached the resistance zone formed by SMAs and 0.72000 resistance level. In spite of a bullish signal from MACD histogram, I would prefer to search for trade opportunities for shorting. During the next week the market will be able to give us interesting trading signals in the hourly and minutes charts. The main profit target for short trades will be...

If we look at the 1H chart, we will be able to plan possible long trades for short term trading. The market is bearish and the breakout below the local uptrend line will give a bearish signal. We will be able to see a new downward movement toward 10 400$ support zone. If the price bounces from the support, like it was in the previous time, it will be a new buying...

Here is a possible buying opportunity. The price bounced from SMA200 and continued the uptrend. RSI and MACD confirmed the price reversal. Now the indicators are supporting an upward movement. We have enough bullish signals which allow us to open long positions. Of course, we have to watch for Bitcoin markets and use the proper risk and money management. If you...

Yesterday I wrote about a possible buying opportunity based on the daily chart. Please, read this post for a better understanding of how we can trade and why we have reasons to buy. Today, let's look at the 4H chart. The price stays below SMA200 but the market stays bearish. We didn't need a strong downward movement toward the key support, it tells us about...

The price reached the support zone formed by SMA200 and 0.220$ support level. We have a bullish divergence that gives a solid bullish signal. MACD lines are supporting a possible upward movement. We can build a trading plan for this market based on the price reversal from the support zone. Entry points can as close to the support zone as possible as well as above...

Let's imagine that the price will bounce from 2.40$ support zone. If so, we will have a buying opportunity based on the price reversal signal from the bottom. We have enough space for the upward movement and it allows us to get an amazing long trade with a risk-reward ratio of 1:5, it is awesome! Will the market move like that? We don't know and nobody can say...