What about the Gold and how to trade in this market? For me, the market stays interesting for shorting, if we talk about short and swing trading. The price is below the resistance zone formed by SMA20, the local downtrend line and resistance levels. It makes sense to search for trade opportunities for shorting in the hourly and minutes charts. What about buying?...

The daily chart of Ethereum offers the same structure as Bitcoin and the same setup for buying. The price bounced from SMA20 and moved downward. There is a support zone where we can expect the price reversal. It will allow us to open long trades. I show you an example of a possible long trade. It will be workable only if the price bounces from the support zone...

The buyers couldn't push the price above the resistance zone formed by SMA50 and 11 000$ resistance level. We got a reversal with a further downward movement. What's next? I think we should focus on 10 000$ support zone first of all. This support showed how it's important for the market and all parties. If we talk about possible trade opportunities, based on the...

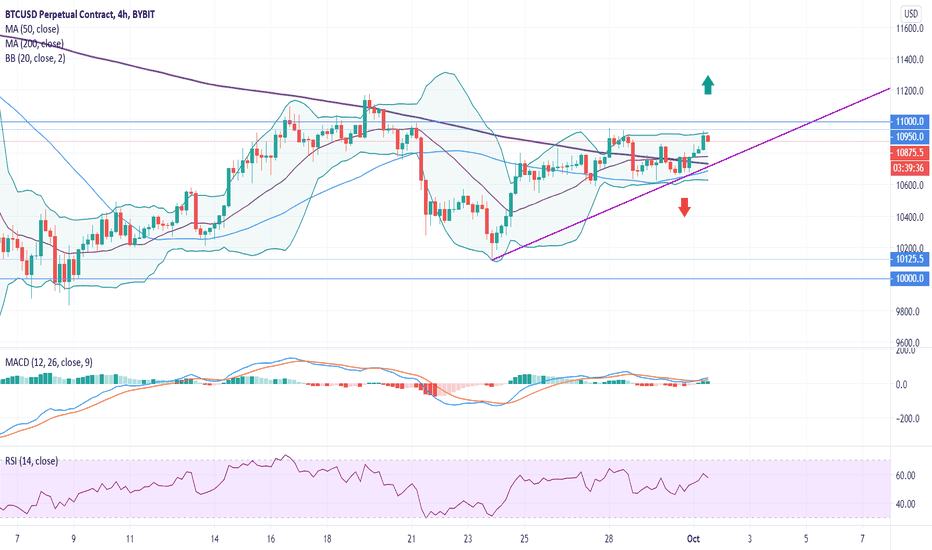

I draw your attention that the price tries to break 11 000$ resistance zone again and again. We will be able to see the 6th attempt. The price moved above SMA200 and it is a good bullish signal. Using the local swing low we can draw a new uptrend line which we will use as a signal line in combination with the price action. MACD is bullish and supports the upward...

What do we have? The price reached the resistance zone formed by SMA20 and SMA50. Also, there is 106.00 resistance level. If the resistance zone can hold the price, we should be ready to see a reversal. It will give short opportunities in the daily and lower timeframes. The main profit target will be 104.00 support. Stop orders must be placed based on the exact...

Here is an example of a possible long trade which is based on a reversal from SMA200. As you can see the price is moving sideways above SMA200. It is a consolidation period which will be changed into a new price movement up or down. Let's say that the price is going to move upward. How should we trade? We can buy using the reversal signal from SMA200. The 2nd...

How we can trade Gold using Ichimoku indicator? When the price moved below the cloud, the market became bearish. The breakout below the local uptrend line gave us a trading signal for shorting. As you can see, that trade could give a nice profit. What's next? The price is going to bounce from the cloud. If the price breaks the local uptrend line, it will give...

The price bounced from the support zone and move upward. Our long trades are in profit now and we can fix at least the part of it. The stop orders should be moved to the breakeven. What's next? The price reversal from the resistance zone formed by 1900.00$ and SMA50 will give us a new trade opportunity. Here is an example of a possible short trade: Short below...

There is a very interesting concept for traders and how they should trade. It is based on the possible results in every single trade. When we open a trade we should be ready to get one of the following results: - big profit - small profit - small loss - big loss From the list above, it is obvious that if we do the best to avoid big losses, our trading will be...

The price reached the strong resistance zone formed by SMA200 and 1.66000 resistance level in the daily chart. It means that in the hourly timeframes we should search for possible reversal signals for shoring. Here is the 1H chart we have a bearish divergence as a trend reversal signal. After a pullback to the resistance zone, we have a good entry point for...

Do you remember this post ? I wrote about a buying opportunity based on the price reversal from the support zone. If you could follow that post and apply the information from it with your own trading approach, you would have a profitable trade! For example, you could buy following the breakout above SMA20 in the 4H timeframe. Here is an example of such...

The price bounced from 1.16200 and the daily chart is going to give us a reversal signal. We can use the reversal from the support zone for buying. The profit targets are SMA200 and 1.17500 resistance. The price reversal from SMAs will give short opportunities in the direction of the main downtrend. We also can short following a breakout signal below the support...

The price reached 0.94000 support zone. It looks like we will get a reversal from this zone. MACD and RSI are going to support the price reversal. What does it mean for us? We can use the hourly and minutes timeframes and search for exact entry points for buying. We will need reversal signals from the support and trend reversal signals for opening long positions....

The price bounced from the support zone. We got a trend reversal signal based on a bullish divergence and a double bottom as a trend reversal pattern. RSI confirmed the price reversal not far from the oversold zone. MACD is bullish and supports a possible upward movement. We have a possible buying opportunity against the local downtrend. How to make a profit from...

Here is the market review based on the 4H timeframe. The price reached the resistance zone formed by SMA200 and 10 800.00$ resistance zone. The local swing low allows us to draw the uptrend line as well. So, we have a situation where a breakout will show us further market movement. If the price breaks the resistance zone, it will be a bullish signal. We will...

There are many indicators which traders can use, but probably one of the most interesting is Ichimoku indicator. It is very simple but at the same very powerful trend following indicator. If the price is above the cloud, we have a bullish market. If the price is below the cloud, we have a bearish market. Reversal and breakout signals at the lines give traders...

If we look at Gold through the signals of Ichimoku indicator, we will see a bearish market. The price could pass the cloud and now Senkou B is the 1st resistance line. The breakout below 1848.00$ will confirm the further downward movement. DMI is bearish and ADX line shows the strength of the bears. We can wait for the pullbacks toward the cloud, Tenkan, Kijun...

The price stays at the key support zone. We can use reversal signals in the hourly and minutes timeframes for buying. Probably during a new week, we will see an upward movement toward the resistance levels. MACD is bullish and supports an upward movement. RSI is not far from the oversold zone and it is going to confirm the price reversal. The alternative is a...