Long term I'm definitely a gold bug but I have warned repeatedly about near term risk (which I don't think has completely resolved if I'm honest). The market is euphoric but channels are now becoming apparent and lines are being drawn. It's very possible we have a small bounce in miners with the upper channel limits identified as well as some other possible...

The market is too complacent. The call/put ratio is is where it was before the last crash. I'm not sure why the market is going up but wedges are appearing. Technology ETF TECL (inverse is TECS) is a short.

That market is absolutely littered with declining wedges (UGAZ, LABD, SOXS, TMF to name a few)!! I thought this was the tastiest and look like it will turn a corner early in trading and begin trading down. I hope everyone shorted gold miners and closed today because they're turning up tomorrow!

Interesting. When you look at the inverse of oil, symbol SCO, you can see support over a very long period of time. It's almost as if it is poised to start climbing again! This is something I'll be actively monitoring.

I was waiting for the end of the wave to occur, but with the appearance of a descending wedge I know a buy opportunity awaits us. My apologies, I was just a little early! What worries me though is that with a rise in the treasuries perhaps the wider market will sell off?

Large descending triangle emerging in semi-conductors (SOXS)/technology (TECS)/biotech (LABD) which is a very worrying development. I've shown my favourite one but please check out the others. News has emerged that Trump wants to blacklist Chinese businesses in response to the Hong Kong protests.

There's a wiff of deflation in the air and the market has broadly, although not chaotically, sold off. It appears like a massive ascending wedge is developing in Treasuries.

I don't know how other people are feeling but there are a lot of bearish declining wedges appearing in the leveraged ETFs and elsewhere. Makes me wonder what news we're getting between now and then.

Don't get me wrong, I love gold/precious metals and the miners but sometimes a little perspective is needed. The miners index is in nosebleed territory with 92% bullish and negative divergence on the RSI(5) and MACD. Then I started looking at DUST, an inverse ETF and a large bullish wedge is appearing.

I said silver (SLV) was going to rise but it honestly has shocked even me. Lately it had the momentum of a runaway train and even started going exponential with several gaps up it now has to fill, but when it blew past the second blue top line (a long term overhead resistance going back to 2015 if you can believe it) I was truly shocked. I sold a lot of positions...

I did not immediately appreciate the second overhead resistance (blue line). It starts back in 2015! It represents the last area of resistance to be targeted. I've tried to make the new channel lines thicker in appearance but right now SLV is filling up the gap from yesterday using the resistance line as support. Next target is the second blue line but I think we...

Todays action in Silver (SLV) was nothing short of earth-shattering. Several overhead resistances were smashed and this paves the way for some very bullish action for the shiny metal. The large ascending channel has now finally come into view with this move I hope everyone allocates as appropriate! I would recommend SLV for long-term holds as this ETF decays less...

One of my followers asked (and this has never happened before) for me to comment on LABU. I was touched by the request and so I have responded, and this after having a website which I shut down with 10,000 hits a month never once did anyone ask me to comment on a stock. My strength has always been analysis and dissection so I am happy to oblige. LABU isn't...

I've only just noticed this because I'm an idiot, but Silver broke out above a long-term overhead resistance! Of course it is getting a little over extended and a healthy correction is needed, but the subtext of this breakout means a lot for the long-term direction of this precious metal.

Even I have been shocked by SLV's moves lately. I was caught completely unprepared for it which is fine because it makes a signficant part of my portfolio anyway. Its both industrial and precious, but what is peaking my interest now is that SLV might be leading GLD which is bullish for precious metals anyway. In a bull market SLV will eventually take the lead. Is...

A lot of contact with the lower channel support lines, both here and in other crude instruments like USO, where crude should be going to $64. I've waited a few days now for a convincing rise before buying in but I just haven't seen the jump yet and if anything, it looks like its about to collapse. Not only is it struggling in its current channel but it has some...

It would be nice if the less valuable (retarded half-brother) of gold enjoyed some of his recent success, but for the last while Silver has always been playing catch up or stalled all-together. Right now both precious metals are caught in bull flags, and as always they can go either way but a clear close above the upper resistance would be a big move for silver.

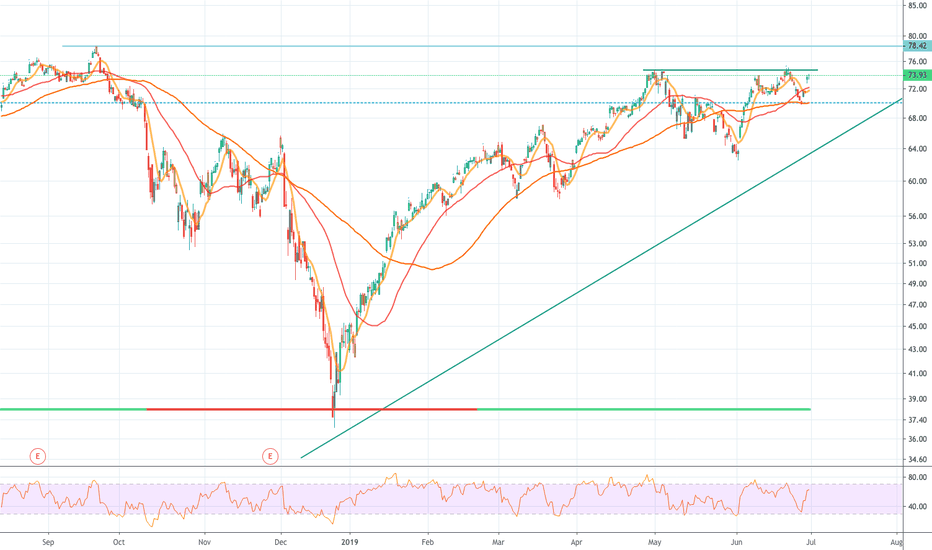

A very bullish sign for the Financial sector when FAS passed the double top overhead resistance at around $74.93 in premarker trading. New resistance is at $78.42 which is good for a further 3.5%. Given the events of Saturday I expect this to continue marching forward.