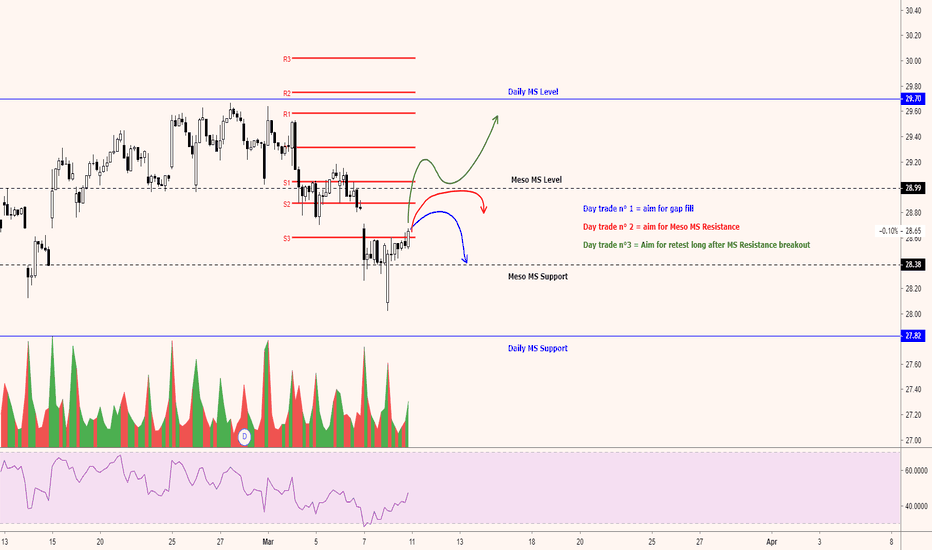

Thinking about shorting the golden ratio/200 MA for a day trade - medium/big size position, since SL is tight. Close above that will look for longs aiming for trendline resistance

Perfect retrace and bounce from golden ratio/weekly trendline support. Waiting now for gap fill (retrace), which is also .5 retrace of current wave up.

Sitting above weekly trendline support. Wait for trendline resistance breakout before going long.

Consolidating above Meso support, not many wicks below it, wait for close above 30 ish level before adding longs. wait for break and retest of meso support before shorting.

At support after Falling Wedge breakout, I would long now at support.

Looks like an ascending channel, and we got a higher low. So I assume we could go up again to test the upper channel resistance but volume is weak. A breakdown of both Meso & Trendline support could take us to 18 ish level.

Break and daily close above 22.3 i'm leaning bullish again on $AMD. Reection from that level could lead us to gap fill first.

$CVS heading towards Daily MS Support after huge gap downwards. If that level Is broken, I would short the retest and aim to 56 ish level. if that support helds and price action shows rejection off that zone, would be a good long opp.

Breakout upwards and retest could give us uptrend continuation. Wedge breakdown will lead us to meso ms support