DatTong

PremiumMacro approach: - USDCAD edged higher this week amid softer Canadian labor data, boosting BoC cut odds and pre‑CPI caution that kept the USD supported as traders eyed key US inflation prints. - Canada shed 40.8k jobs in Jul while unemployment held at 6.9%, reinforcing expectations for a 17 Sep BoC cut and pressuring the loonie. With Canada's calendar light, focus...

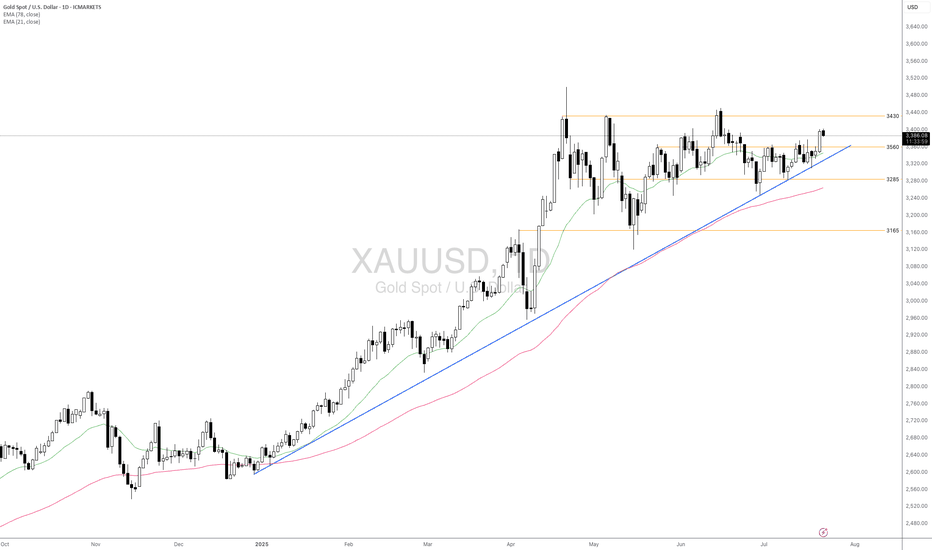

Fundamental approach: - Gold gained this week, supported by renewed trade tensions following new US tariffs on major partners and rising expectations of a Fed rate cut in Sep. - Safe-haven demand strengthened after weak US NFP data heightened concerns about economic growth and reinforced market bets on monetary easing, while US President Trump's tariff...

Macro approach: - The Dow Jones Industrial Average advanced this week, rebounding strongly as risk appetite improved following last week’s pullback, supported by a soft jobs report and easing global tariff concerns. - Sentiment was aided by the Fed’s increased hopes of a near-term rate cut after Non-farm Payrolls missed expectations, prompting a 1.3% surge on...

Fundamental approach: - USDCAD advanced this week, supported by broad US dollar strength and renewed trade tensions as the US announced higher tariffs on Canadian imports. - The pair was further buoyed after the BoC left rates unchanged and signaled caution amid persistent core inflation and ongoing trade negotiations. - Meanwhile, US labor data indicated that...

Macro approach: - Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision. - The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand. - Key drivers included robust...

Macro approach: - The US dollar index has traded mixed since last week, pressured by lingering trade uncertainty and cautious market sentiment ahead of major economic events. - Dovish Fed expectations and subdued US inflation continued to weigh on the greenback, while news of a fresh US-EU trade agreement and upcoming talks with China contributed to two-way...

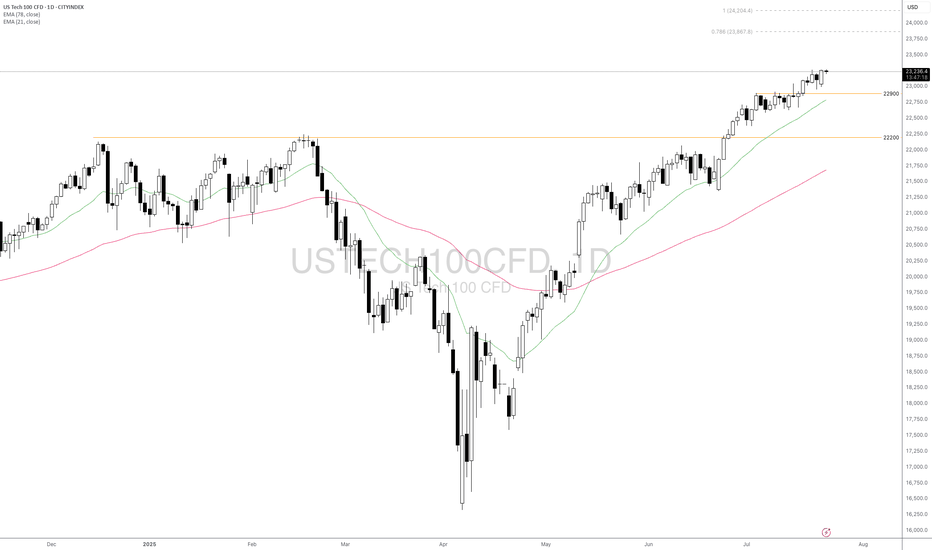

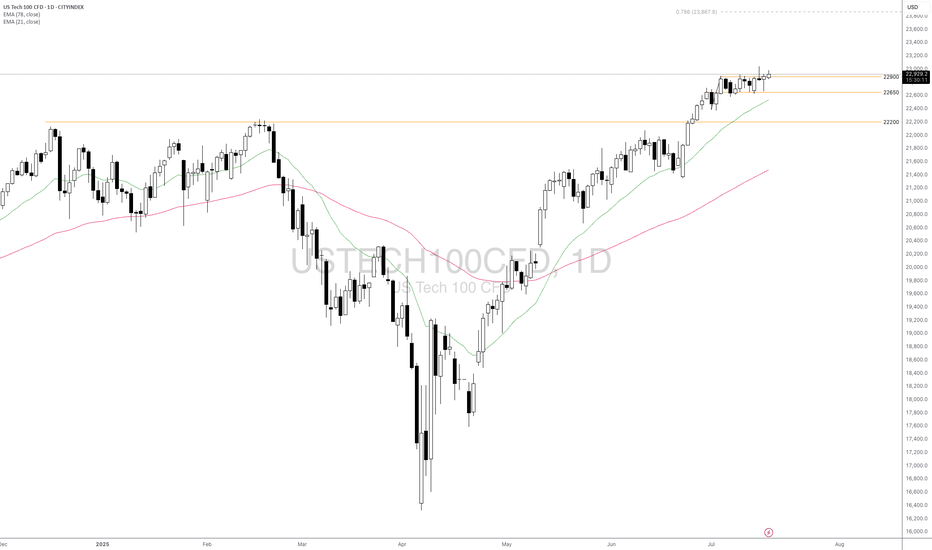

Macro approach: - USTEC advanced modestly this week, supported by upbeat corporate earnings and resilience in economic data amid ongoing policy uncertainty. - The index benefited from strong expected results in major tech firms such as Microsoft (MSFT) and Nvidia (NVDA), as top giant AI leadership, helping to bolster sentiment despite lingering concerns about...

Macro approach: - XAUUSD advanced this week, supported by broad-based US dollar weakness and reviving safe-haven demand amid rising global trade tensions. The yellow metal briefly reached a five-week high as investors sought safety following headlines of escalating US tariffs and uncertainty over the Fed’s policy direction. - Gold may remain well-supported if risk...

Fundamental approach: - USTEC climbed to fresh record highs this week, supported by positive investor sentiment amid consolidation ahead of key catalysts. - Sentiment was buoyed by expectations of continued AI and semiconductor strength, with Nvidia (NVDA) and Amazon (AMZN) registering gains, while Tesla (TSLA) rebounded on optimism despite recent...

Macro approach: - GBPUSD has weakened since last week, pressured by disappointing UK economic data and rising expectations of a BoE rate cut. Meanwhile, the US dollar found support amid cautious risk sentiment and anticipation of key US inflation data. - UK GDP contracted for a second consecutive month in May, and recent labor market surveys signaled further...

Macro approach: - Gold traded defensively this week, consolidating above the $3,300 level amid shifting risk sentiment and anticipation of significant trade policy developments. The yellow metal's performance was pressured by a firmer US dollar and easing geopolitical tensions, as optimism around potential trade deals and tariff suspensions reduced safe-haven...

Macro approach: - Gold prices have recently pulled back as investors took profits at elevated levels to offset losses elsewhere amid rising geopolitical tensions in the Middle East and steady Fed holding rates. - Speculation is mounting that the US may involve into the Middle East conflicts, raising fears of a broader regional tensions. - Meanwhile, a dovish Fed...

Macro approach: - The EIA’s latest short-term outlook projects weaker oil prices as rising global inventories weigh on the market. Sluggish demand growth and increased production are expected to push output above consumption, building stockpiles and adding pressure on prices. - Traders are also monitoring the ongoing US-China trade talks in London. Sentiment...

Macro approach: The Nasdaq 100 (USTEC) began Jun with strong momentum after its best monthly performance since 2023, fueled by robust tech earnings and a brief lull in tariff concerns. - However, renewed US-China trade tensions resurfaced early in the week, briefly weighing on sentiment before a market rebound restored cautious optimism. - Nvidia (NVDA) surged...

Macro approach: - Gold rebounded sharply from mid-May lows, fueled by renewed safe-haven demand following Moody’s downgrade of the US credit rating. - However, the rally lost momentum near a two-week high as profit-taking and easing US-EU trade tensions cooled demand. - Longer-term fundamentals remain supportive, with persistent central bank buying, particularly...

Fundamental approach - The US Senate has cleared the GENIUS Act, its long-awaited stablecoin framework, after marathon talks. A final vote is expected after the Memorial Day break (26 May). - JPMorgan Chase CEO Dimon says the bank will soon allow clients to trade bitcoin through third-party custody, adding fresh tailwinds to institutional demand. - Spot-bitcoin...

Macro theme: - Gold prices retreated from recent highs as improved risk sentiment following the US-China trade deal and a stronger US dollar weighed on safe-haven demand. - Gold ETFs recorded modest outflows in Apr, but the withdrawal slowdown suggests easing profit-taking pressure. - In the near term, trade optimism may keep gold under pressure, though central...

Macro approach: - DXY edged higher, recovering earlier losses as the Fed held rates and Powell was cautious. - Jun cut hopes faded, though markets expect three cuts this year, potentially lifting DXY short-term. - A potential US-UK trade deal also helps ease bearish sentiment on the dollar. Technical approach: - DXY is hovering around the key resistance at...