Nasdaq turns, crypto follows. Eth,Solana and bitcoin ,also XRP temporarily changing their directions to follow tech hype, and Trump´s tariffs-announcments. There is no rational reason in behind of it: As traders we never care,what people say or do! We only follow the price,changes,and our trading rules.Only! What others say in the news or Social media, doesnt...

U.S. stocks ended higher on Tuesday on optimism that President Donald Trump’s reciprocal tariffs, which go into effect from April 2, will be less aggressive than previously expected Therefor as traders we are very flexible and have to react fast,because a lot of people say a lot of things, and that makes the markest move faster and turning back more...

Is it drill baby drill of President Trump? Or bearish profit taking before Oil season starts soon? Well I dont know! All I know is that the charts are communicating to me to sell oil for now. I am already short in this, 2 approches that I use for good, in case a short bullish pullback happens,I will add more to my selling positions(red arrows) 2 different...

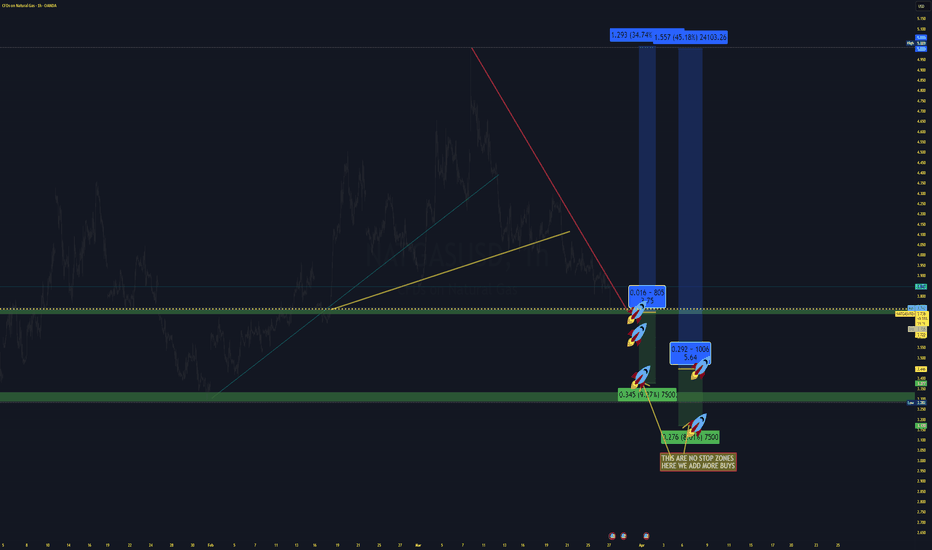

President Trump´s tariffs on Russia, energy crisis ,and natgas cycle starting to motivate more buyers accumulationg their positions,going for higher prices. Technically a profit taking time of the bulls is coming to an end. Rockets:Buy/add more buys 2 variants:For more conservative traders, and those who have higher risk appetite. Profit targets are the...

EU data going to be released: M3 Money Supply y/y Private Loans y/y EU Economic Forecasts Never the less,technically German 40 is providing very interesting oppurtunity where the bulls are accumulatiing their positions Chart: green arrows: More buys/add to more buying positions 1 profit target,but 7 different entries for aggressive and conservative...

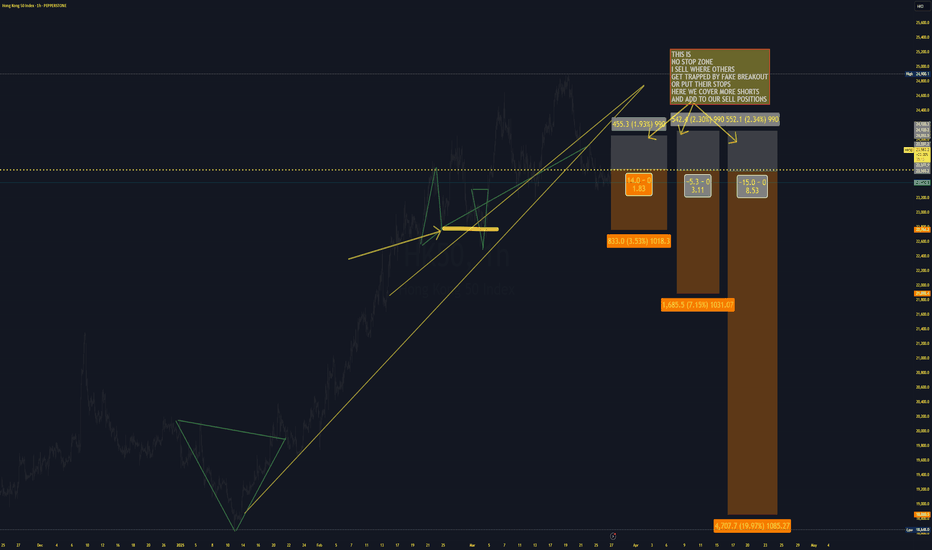

More pro-active policies in China More tariffs on Copper This will put the asian indices more under pressure 3 apporaoches and 3 different targets My entries are aggressive and conservative Where others use the stop zone,there I aggressively buy/sell into my targeted potential direction(cover more shorts in this case) More details: Please take a look at the chart above

Australianas inflation slowing down,before next interest rates decision .Possible rates cuts USA: Inflation up, FED no changes in interest rates,possible rate hikes 2 APPORACHES FOR TODAY;OR IF YOU WANNA WAIT ENTRY with more cautiios(Conservative entry) Yellow zones are areas where we can cover more shorts

This is reverse USDJPY trade....The oppositie of the long trade published. For example today it is not a good time to short the dollar,as technically the price caught in the middle of the range.....Better we wait to reach the higher zone.IF PRICE COMES DOWN to the lower range,then we can plan the long tradefirst(See my USDJPY long apporach!)

Singapore:Asia´s Switzerland getting stronger on China´s boosting industry and strong copper Canada weaker because of Trump´s tariffs and weaker economy Rockets: Entries Yellow zone is not stop zone.It is the zone where I sell more:i COVER MY SELLS in thise zone. Your stop should be based on your risk management decision taking

Strong EU Data weak Canada data,more tariffs on Canada Both approaches have same profit targets,but different entries,based on your risk appetite Risk management is essential, but can set based on your risk appetite

Australian Dollar weaker: Dispite of budegt defict forecast 2 apporaches:Conservative and aggressive entry Profit targets similar Risk management :Individual approach

USDJPY getting stronger, interest rates differences between 2 currencies, FED policy to hold the interest rates,and dilemma of BOJ.... 3 approches;" TAKE PROFIT TARGETS: extend the take profit target higher only, if signs of continuatioon.

wE CAN SIMPLY TELL THE SAME REASON trading stocks,indices! Simple: Economy under big inflation pressure. 2 approaches:Conservative and agressive entry. Where breakout traders enter,where others put their takeprofits,where others put stops: Thats my entry.Simple. Near details ,please take a look at the chart above

BTC trend is changing,seems temporarily (Until April2nd 2025) it is builidng a support. Intrady apporaches: CONSERVATIVE and aggressive I cover the stops of others intraday,also profit targets and sell positions of midterm bears,to re-enter long .Simple. The hiigh volatility guarantees fast moves,but also imbalances,and I take them as my advantage. Your...

BOJ interest rates hikes,Stock Market reacts. 2Approaches: Both selling the highs. Approch 1 is more aggressive, Approach2 :More conservative, higher reward-risk-ratio,but the irsk is,if the market falls in profit target zone and continues downard.Then we would miss the entry. I will chose approach1,if market temporarily at (stop.levels of other traders) I...

AUDCHF long trade:Buying stop,covering Buys where other set their stops. 2 approches, Proft targets are the same

I sell where others put profit targets,I cover sells where others set stop loss.

Tariffs, war, Inflation ,FED rule the markets Short term trend line broken Entry1: aggressive entry Entry2: waiting for pullback to enter Entry3: Entry aggressive (Buy1), if pullback we add 2nd position. If no pullback, no additional position. Profit targets are the same for both approaches